What the child care changes mean for you

MANY working parents will soon be able to get more subsidised child care after a major overhaul of the system passed the Senate last night.

MANY working parents will soon be able to get more subsidised child care after a major overhaul of the system passed the Senate last night.

The Turnbull Government managed to get its $1.6 billion package passed in the upper house after coming to an agreement with crossbench senator Derryn Hinch to cut subsidies for those earning more than $350,000.

Family tax benefit rates will be frozen for at least two years to help pay for childcare under the new plan. The government also wants to abolish the end-of-year supplements but has not been able to find support for this yet.

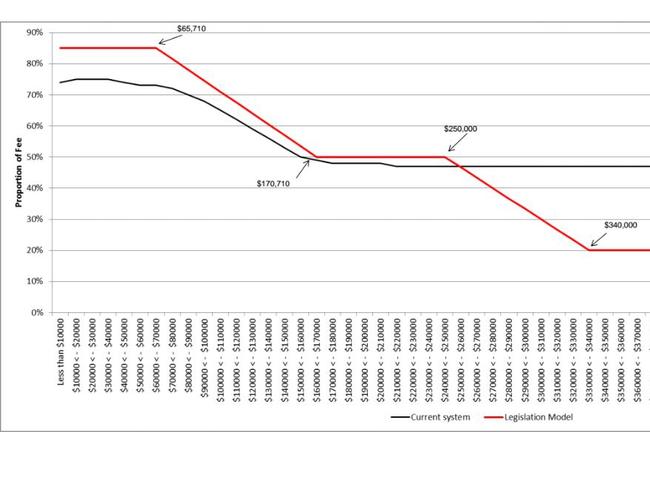

The childcare package will allow a family earning less than $65,000 a year to have 85 per cent of their child care bills paid for by taxpayers.

But parents will have to work, study or volunteer for at least eight hours a fortnight to get the maximum benefit.

The amended legislation will go back to the lower house for approval before it is officially passed.

Government figures say almost 816,000 families will be better off. On average, those earning between $65,710 to $170,710 will be $1500 better off.

But about 128,000 families will get reduced subsidies, including 52,100 earning less than $65,710 a year (mainly because they don’t work enough to be eligible).

The package sparked heated debate in the upper house on Thursday night.

Labor and the Greens opposed the package, arguing it hurt the most vulnerable and disadvantaged by halving the hours of subsidised care available for families earning less than $65,000 a year who don’t meet the activity test.

Families currently get 24 hours of subsidised care regardless of whether they work but this will be cut to 12 hours, and will only be available to those earning less than $65,710 a year.

Greens and Labor wanted the 12 hours-a-week entitlement boosted to 15 hours, with Greens senator Sarah Hanson-Young describing the move as a “kick in the guts” for vulnerable children who had been put in the “dustbin”.

“Unless both your parents are working ... you’re not as valuable to this government,” she said.

Education Minister Simon Birmingham said 12 hours allowed two six-hour sessions per week, equivalent to normal school hours.

There were also safeguards allowing children from disadvantaged homes to be eligible for fully subsidised full-time attendance of 50 hours per week, he said.

“Hardworking Australian families should be swinging from the rafters tonight,” he said.

The legislation passed with the support of crossbenchers including Senator Hinch, One Nation and the Nick Xenophon Party, while David Leyonhjelm and Cory Bernardi abstained from voting.

This is what has changed:

CURRENT PAYMENTS WILL BE SCRAPPED

The Child Care Rebate (which covers 50 per cent of child care fees up to an annual cap of $7500) and the means-tested Child Care Benefit will be replaced with the new subsidy.

WHAT DO YOU HAVE TO DO TO GET THE NEW SUBSIDY?

Both parents have to work to satisfy the activity test for the new subsidy. Both have to work, study or volunteer for at least eight hours a fortnight.

If you don’t work enough, you will still get 12 hours of child care if you earn less than $65,710.

If your family’s income is more than $65,710 but you don’t meet the activity test, you don’t get any child care subsidy.

HOW MUCH DO I GET?

For families earning $65,710 or less, you will have 85 per cent of your child care fees covered by the government.

The subsidy gradually tapers down to 50 per cent once you are earning $170,710.

According to the graph below, those on about $100,000 will get about 70 per cent of their fees covered.

For those earning between $170,710-$250,000, you will get 50 per cent of your child care fees covered by the government.

For those earning between $250,000-$340,000, the subsidy will taper down to about 20 per cent.

Anyone on more than $350,000 will not get any subsidies.

HOW IS IT CALCULATED?

Fee subsidies are based on a set hourly rate ($11.55 centre-based day care, $10.70 family day care, $10.10 outside school hours care).

If you pay more than this, you will have to cover the difference.

IS THERE A CAP ON HOW MUCH YOU CAN CLAIM?

There is no annual cap on subsidies for families on $185,710 and under.

Those earning more than $185,710 will only be able to claim $10,000 per child.

There will be a bonus subsidy for disadvantaged families, such as those with children at risk of abuse or neglect; those experiencing temporary financial hardship; and grandparent carers on welfare.

WHEN DOES IT START?

The new scheme will begin on July 2, 2018.