‘The horse has bolted’: The group of Australians at heightened risk of suicide amid rate rises

A widening gap in generational economic distress has raised alarms as Australia faces a sad surge amid a period of steep interest rate rises.

Warning: Distressing content

A bleak national suicide study highlights a threefold increase in the disparity of cost-of-living and personal debt distress between two key Australian demographics over the past 12 months.

This concerning data comes on the eve of the last Reserve Bank meeting of 2023, where economic decisions may further impact Australians grappling with financial challenges.

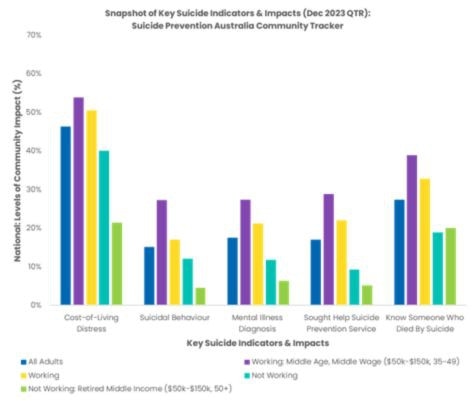

The Suicide Prevention Australia Community Tracker shows that suicidal tendencies are six times more common among “middle-age, middle-wage” workers, who are Australians aged between 35 and 49 years and earn an annual household income of $50,000 to $150,000.

This is in comparison to their “middle-income retiree” counterparts, who are over 50 years old and earn $50,000 to $150,000 annually.

According to the peak national body Suicide Prevention Australia, the alarming statistic underscores the heightened risk of suicide faced by individuals in the prime of their productivity.

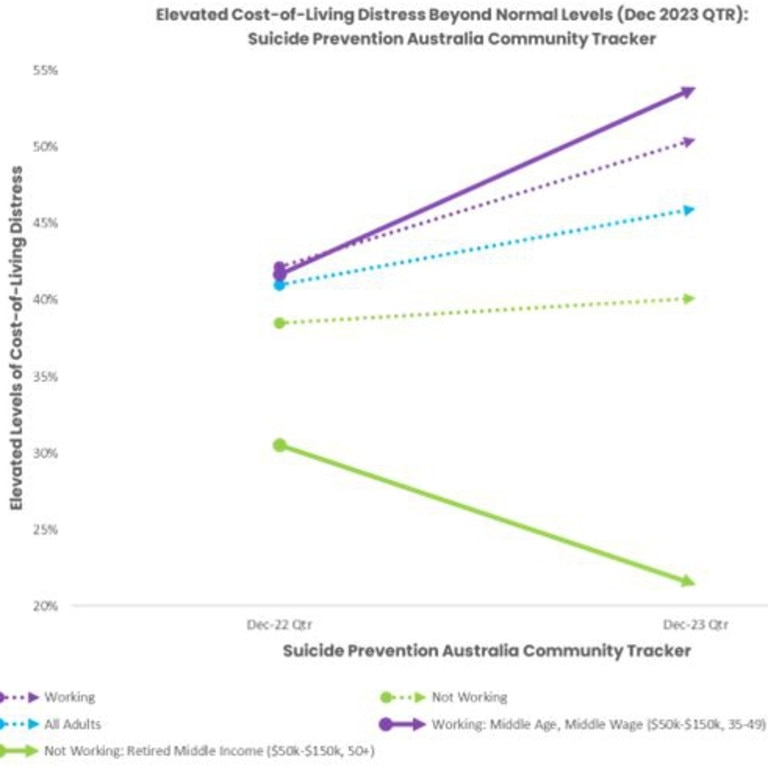

Roughly half (54 per cent) of Australia’s ‘middle-age, middle-wage’ workers reported elevated distress due to cost-of-living and personal debt in the December 2023 quarter, marking a significant increase of 42 per cent from a year ago.

In stark contrast, retirees experienced a sharp decline in distress, dropping from 30 per cent to 21 per cent over the same period.

On a national scale, elevated “cost-of-living and personal debt” distress for all Australians has surged from 41 per cent to 46 per cent in the past 12 months.

Nieves Murray, CEO of Suicide Prevention Australia, expressed deep concern over the findings. She said there is an urgent need for policymakers to address the economic burden disproportionately shouldered by middle-age, middle-wage workers.

Ms Murray urged the Federal Government to take immediate action, stating: “The horse has bolted, and there is no time to waste.”

“The Federal Government must introduce a national suicide prevention act now,” she said.

Ms Murray acknowledged the heightened stressors during the holiday season, citing financial pressures, family conflicts, loneliness, and grief as contributing factors.

She urged Australians to proactively plan for coping with challenges and reach out for support.

“Take some time to check in on friends, family, work colleagues; it might just make all the difference for some,” she advised.

As Australians grapple with these economic challenges, the Reserve Bank’s impending decision on the cash rate adds another layer of uncertainty.

Homeowners await the outcome of the final cash rate decision for the year.

Despite concerns, new consumer price index (CPI) figures offer a glimmer of hope, indicating that inflation is currently at 4.9 per cent, below expectations.

The inflation rate’s decline from last year’s peak of 8.4 per cent suggests a positive trajectory, and experts predict a pause in interest rate hikes during the upcoming Reserve Bank meeting on Tuesday.

Australia’s cash rate is currently at 4.35 per cent.

AMP’s deputy chief economist, Diana Mousina cited softer retail sales, falling home prices in key cities, and slowing auction clearance rates as reasons for an expected stall.

Ms Mousina’s outlook anticipates relief for mortgage holders in the form of rate cuts from mid-next year.

The Suicide Prevention Australia Community Tracker also revealed other concerning trends.

Over 92 per cent of Australians believe that social and economic circumstances will continue to pose a significant risk to suicide rates in the coming year.

It found over a quarter of Australians (27 per cent) have personal connections to someone who has died by or attempted suicide directly (17 per cent) or indirectly (13 per cent).

Get in touch – Jack.evans@news.com.au