Questions intensify over Dutton’s eligibility for Parliament

PETER Dutton is hoping to overthrow Malcolm Turnbull. But one problem could block his mission to become prime minister, and it just got worse.

ANALYSIS

MALCOLM Turnbull received yet another kick in the political soft tissue on Wednesday when his corporate tax cut plan was booted from the Senate and dropped from Liberal election plans.

And the disintegration of the government’s energy policy was highlighted by the Prime Minister’s confirmation the supplementary payments to pensioners, designed to compensate for a Labor carbon price, would continue.

They were to have been made redundant by a National Energy Guarantee, which no longer exists but which was aimed at cutting power bills.

In one bleak political day for the Prime Minister, he had to abandon his central fiscal policy, and further acknowledge he could not implement an energy policy that had the backing of the public, his party room, and business and industry.

The background to this humiliation — brought about by a lack of numbers in the Senate and within his own party — was the leadership challenge expected on Thursday from Peter Dutton.

There were only three good elements of the day for Malcolm Turnbull as he held a press conference to reveal news of fresh setbacks.

He was flanked by two of the government’s most important members — Treasurer Scott Morrison and Finance Minister and Senate leader Mathias Cormann. Another senior executive member, Foreign Minister Julie Bishop, had been spruiking for him earlier in the day.

For what it might be worth, they outranked the declared backers of former home affairs minister Peter Dutton.

The other good elements came from Mr Dutton himself.

The contender rushed out an energy plan, presumably to create the illusion he was a multidimensional policy practitioner.

Mr Dutton today proposed the GST be taken off electricity bills for an almost-immediate 10 per cent saving to households.

However, this would take close to $2 billion a year from the GST pool distributed among the states and territories — $7.5 billion over four years.

Treasurer Scott Morrison didn’t hesitate to attack the idea and hoist the perception Mr Dutton was out of his depth and would increase taxes.

Mr Morrison said the government had found about $1 billion a year from other taxes to make the GST allocation more equitable.

“So if one were to remove a big item like that from the GST pool, obviously it would have to … The states would expect to be reimbursed and that would have to come from other federal taxes.”

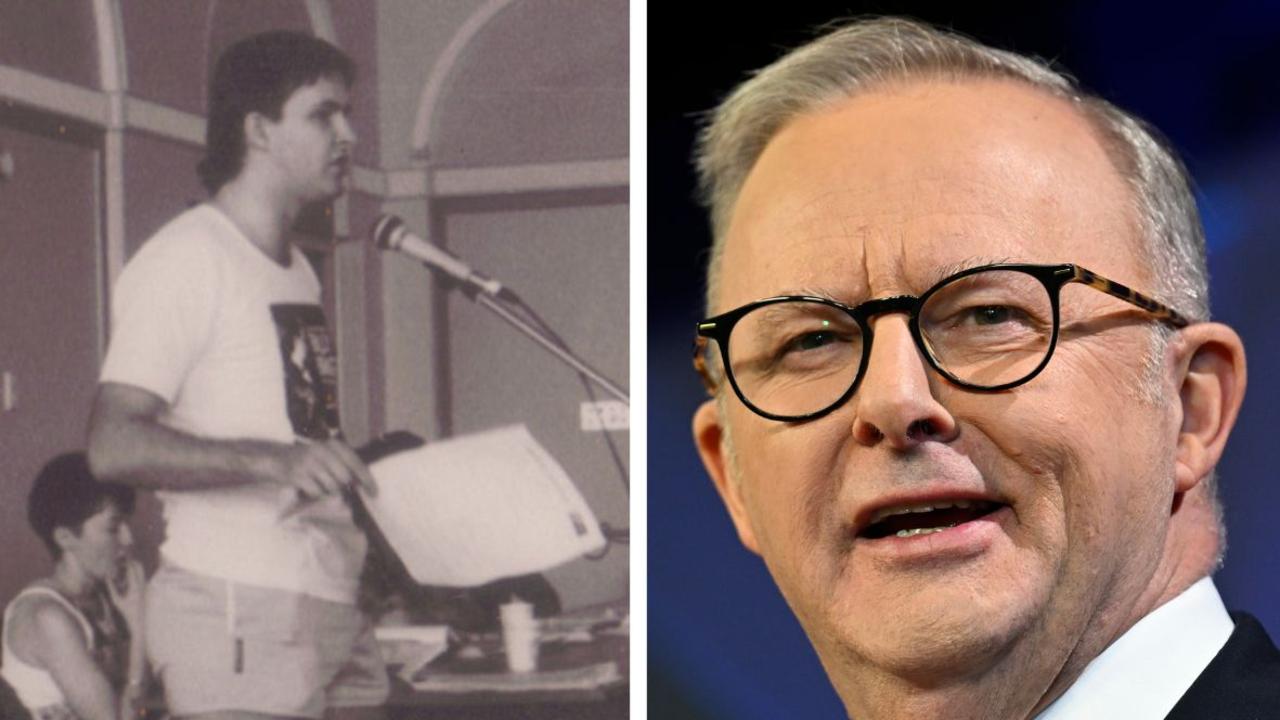

The other Dutton-linked issue was his operation of childcare centres, which received Commonwealth subsidies. Through his wife’s childcare business, he might have a direct or indirect pecuniary interest with the Commonwealth public service.

This could be a case of an office of profit under the Crown, and a disqualification from Parliament of Mr Dutton.

There is no evidence he has breached the Constitution on these grounds, and Mr Dutton has legal advice his business affairs were above board.

But Labor has also obtained advice, and it says there’s a problem.

In a letter obtained by News Corp Australia reporter Claire Bickers, Shadow Attorney-General Mark Dreyfus wrote to Attorney-General Christian Porter, citing advice from barrister Bret Walker declaring Mr Dutton ineligible.

“Mr Dutton was incapable of being chosen for the 45th Parliament and is not entitled to continue to sit,” the advice states.

Shadow AG @markdreyfusQCMP's letter to AG @cporterwa about Labor's legal advice on @PeterDutton_MP eligibility pic.twitter.com/zhC4UVmTuB

— Claire Bickers (@claire_bickers) August 22, 2018

Labor pelted the Prime Minister with questions about the arrangements in Question Time. The Prime Minister dealt with the questions in a businesslike manner.

But it would be tempting to imagine he enjoyed the prospect of his rival squirming under the attention.

That would not have been enough to balance out the tax defeat.

“Mathias skilfully negotiated the first part of the company tax plan through the Senate,” he said of the Finance Minister.

“And so, as a consequence, now, businesses with turnovers up to $50 million are paying less tax.

“There’s 3.3 million of them and they employ most of the private sector workforce.

“And that is one of the reasons, a big reason, why we’re seeing this strong jobs growth.

“Now, we sought to extend this tax cut to the rest of the corporate sector. And the goal was simply to ensure that Australia’s company tax rate is competitive.”

But it isn’t, according to the government, and the Prime Minister is powerless to fix that.