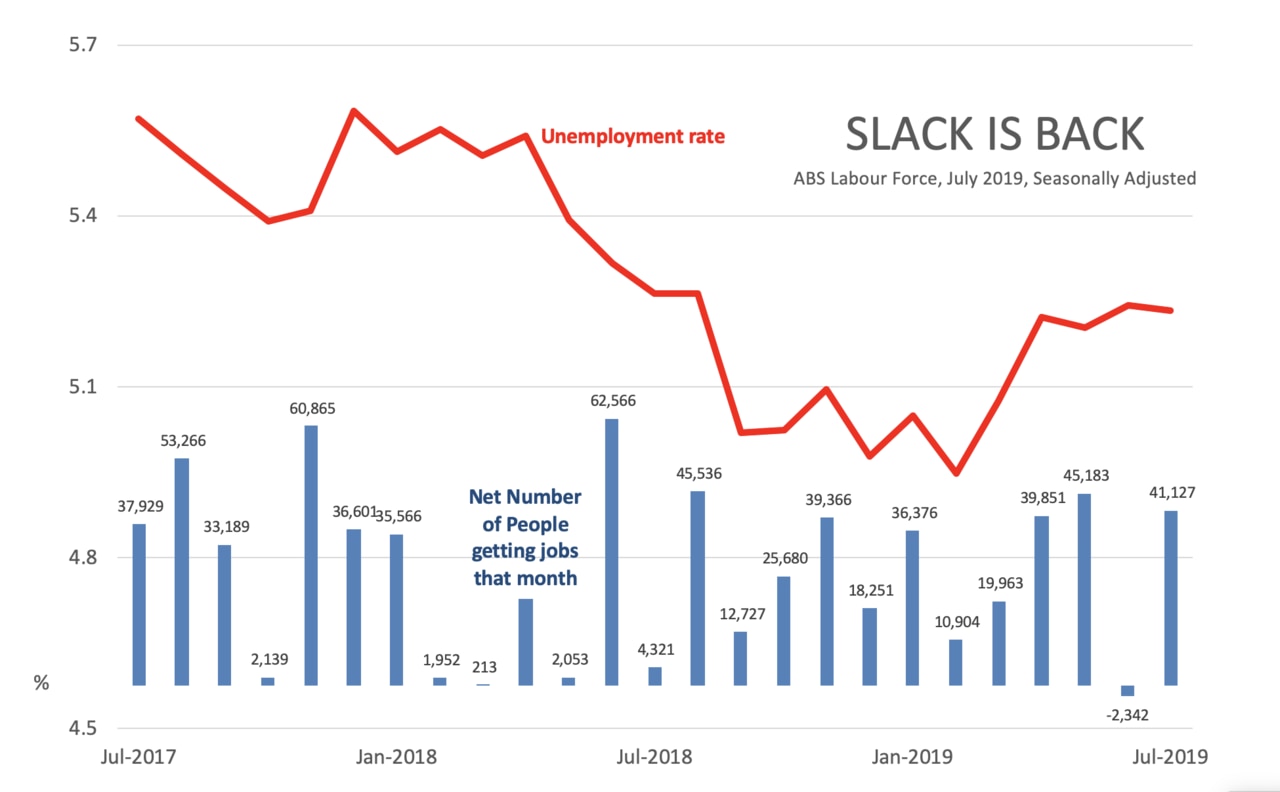

Australian unemployment rate is stuck at 5.2 per cent, keeping ‘slack’ in labour market

Australia’s unemployment rate is stuck. And while that’s good news for some people, it’s terrible for anyone wanting a bigger pay cheque.

Not good enough.

That was the verdict on Australia’s new unemployment data on Thursday that showed a lot of people moved into jobs but not enough for the unemployment rate to actually, you know, fall.

Unemployment is stuck at 5.2 per cent, and that means the RBA is set to reach for even more rate cuts.

Australia’s labour market has been a trouble spot for a while now. We need unemployment to go down so there’s not so much “slack” in the labour market and firms are forced to start offering higher wages.

On Thursday, we got evidence slack is still abundant. The ABS data for the month of July showed the economy actually did well in one sense — it moved 41,000 people into jobs, mostly full-time. But that big number wasn’t enough.

We have so many more people coming into the job market every month that we didn’t reduce the number of unemployed people. In fact, the ABS measure of the number of unemployed people went up by 800.

What’s more, the underemployment rate rose, meaning even more people would like to work more hours. It just goes to show how eager Australians are to work if the jobs are out there. We’re not slack, the economy is.

THE MONEY QUESTION

Sadly, wages growth in Australia remains weak. Average weekly earnings rose by just 2.5 per cent over the last year, only just keeping its nose ahead of inflation. Wages growth used to be substantially higher, averaging 4 per cent or more.

There are two big reasons weak wages growth matters so much:

1. The economy is a big cycle. One person’s spending is another person’s income, and weak wages growth slows down that cycle. If we think our wages aren’t going up, we spend less, making someone else’s wages fall.

They call this the “paradox of thrift”. One person trying to be frugal is fine, but if we all do it at once, the economy stumbles.

2. Australia has amazing, record high levels of household debt. Paying down a million-dollar mortgage is not so hard if you can rely on 4 per cent pay rises each year.

The magic of compounding means 4 per cent pay rises annually will turn an income of $70,000 a year into $179,000 a year in 25 years. More than double.

By contrast, annual 2 per cent pay rises lift wages much less, turning $70,000 a year into $113,000 a year in 25 years.

A mortgage holder counting on strong wages growth to pay off their loan might find it much harder than previous generations did.

And, of course, reasons one and two are linked. The more debt you have relative to your income, the more you spend on repaying the loans and less at the shops. This is why we need wages growth and why the RBA has promised to keep interest rates low until the wages situation is resolved.

INTEREST RATES

Interest rate cuts are the great pressure release valve from the situation described above.

The RBA hopes that if it cuts rates, life gets easier in the Australian economy.

The people who have to pay back their loans find their repayments are a bit lower. They have more spare money, and they spend more, and the cycle of the economy can run freely again. Cutting interest rates is like taking the brakes off the economy.

Yesterday’s ABS Labour Force data was enough to make the Commonwealth Bank change its predictions for interest rates.

They now predict two more rate cuts this year instead of just one — essentially saying we need to take the brakes off urgently.

More rate cuts would be unprecedented. It would take official interest rates from their current level of 1 per cent down to just 0.5 per cent.

(The official interest rate is the rate banks pay when they borrow from the central bank. The interest rates on the loans they sell are set a little higher than the official rate.)

The big risk in all this is that the lower interest rates don’t make the economy perform much better and they don’t do enough to solve the employment market.

The risk is they just blow up the housing market again. And god knows there’s not much slack in the housing market.