Wild forecast for Australian house prices

It wasn’t supposed to be like this. As interest rates rose all of the big banks predicted one thing – now the opposite is happening.

ANALYSIS

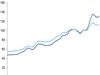

Well, the house price dip is well and truly history. Aussie home prices are on the brink of setting a new record. By the end of the year they will likely be more expensive than they have ever been before.

We set a house price record back in early 2022, then prices fell for a while, before bottoming out and starting their slow grind back up. The latest data shows, prices are set to tick back up over their 2021 highs at any moment.

Now national average prices are just 1.3 per cent below their record level, according to CoreLogic. And some cities are already back in record territory.

“We have already seen dwelling values reach new record highs in Perth and Adelaide,” said CoreLogic research director Tim Lawless. “Brisbane looks set to reach a new record high in October, with home values currently only 0.6 per cent below their previous peak.”

It wasn’t supposed to be like this. When official interest rates rose from 0 per cent to 4 per cent, it was fair to expect some relaxation in house prices. Certainly all the big banks were tipping huge house price falls. But they didn’t get what they expected.

What changed was Australia’s population. It grew massively as the backlog of Covid-era migrants arrived. It is kind of equivalent to what happened in the pandemic: we expected a major recession, and that’s what you would have got if the government hadn’t acted. Instead the government propped up the economy through a major spending program and we had a very healthy economy in 2021.

In 2023 government policy has again prevented the slump we might have predicted. The arrival of hundreds of thousands of people has helped prime the economy and also put a floor under the housing market.

This shows up most clearly on the rent side. Rental vacancy rates are still near their record lows, everywhere except Canberra, as the next chart shows.

And as the next chart shows, rents have been racing up.

In fact rents are now one of the most stubborn and painful elements of consumer price inflation. While petrol prices are flashy and noticeable, they’re also volatile. Petrol inflation has been up and down. A litre of petrol could fall back under $2 a litre at any time. But rents are just grinding upwards strongly and steadily, and literally nobody expects them to fall.

The way the Bureau of Statistics measures rents means rent inflation will be high for a long time. They don’t measure the asking prices of new properties. They measure the prices actually being paid on average. So that means that even when asking rents stop going up, rent inflation will still be rising. As long as people are breaking old leases at old prices and starting new leases at the new prices, the average rent paid will keep rising and rent inflation will stay high.

Asking rents are still rising though, especially for houses. House rents are up 3 per cent in the past three months, according to SQM Research, while unit rents are up much less at 1.2 per cent.

For renters who hope to buy a house the situation is a triple whammy:

It is getting harder to save a deposit thanks to rising rents

The interest rate they will have to pay on their loan is far higher than a couple of years ago.

The price of houses is soaring.

No wonder the proportion of first home buyers has been falling. It was down 12 per cent compared to a year in the most recent statistics. But those most recent statistics, came out back in June. But then the Bureau of Statistics stopped publishing the numbers, due to “data reporting issues” so we have no visibility of what has happened since. My guess would be that first home buyers are even rarer now, trapped in renting – or living in their parents home – for even longer.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.