Why Australia’s housing crisis is going to last a very long time - and it doesn’t matter where you are on the ladder

If you’re one of the many hoping to crack into the housing market, a grim forecast reveals why you’ll be waiting a very long time.

Waiting for a house? I’ve got bad news. The housing shortage is going to last a really long

time, official agencies are warning. A really long time.

There’s already a shortage. Vacant rentals are almost impossible to find and the number of

sleeping bags in doorways in the CBD tells you homelessness is rife.

But the even worse news is the shortage is forecast to get worse over the next six years.

We may need to bunk up. The RBA itself has said putting more Australians into each house

would help avoid a total disaster.

“If for some reason average household size rose back to 2.8 (from its level of 2.5), we would

need 1.2 million fewer dwellings to house our current population – no small difference,”

the Assistant Governor, Sarah Hunter, said last week.

How do you raise the number of people per house? One thing that helps is if young people

don’t move out of home.

So parents can expect their kids to be around a lot more. And if they do move out, they’ll be sharing. But ultimately the solution is going to be building more homes to accommodate the hundreds of thousands of Australians who want one.

Australia’s population boomed in 2022 and 2023 and while the pace of growth is slowing now, houses take time to build and that mean Australia’s ultra-tight housing market is

going to remain a problem for years.

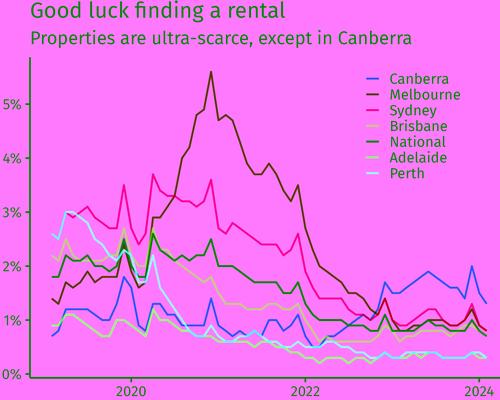

Rental vacancy rates are really low, as the next chart shows. If you’ve seen a massive crowd

on a suburban street recently, it was probably people showing up for a rental inspection.

Every time a property is advertised a horde descends to apply for the right to live in it.

Buying a house? Even harder.

The price of homes is up 8.7 per cent on average over the last 12 months, and more in the capital cities.

This means the deposit a person needs is sky-high, and saving it is harder than ever given the cost of living has been rising faster than wages.

The crazy thing is that house prices are rising even though interest rates are rising.

Normally the higher cost of getting a mortgage would make house prices go down or at least stay flat.

But nope, the market is in such a state of shortage that even when official interest rates rise

from zero to four-and-a bit percent, house prices still rise.

Is it too much population (demand) or not enough building (supply) to blame?

Choosing just one reason is simplistic.

You need oxygen and a spark for a fire; sometimes things have two causes. In the case of housing, high demand and low supply are both

relevant. A better argument is which one is more likely to be solved quickly.

It’s going to get better, right?

Nope. It’s going to get worse. The National Housing Supply and Affordability Council says

the shortfall will get deeper in the future.

“The council’s projections indicate that new market supply will fall short of new demand

over the next six years,” it said in a report released this month.

“Shortfalls in new supply relative to new demand will add to the already significant

undersupply of housing in the system.”

That is, unless we do something drastically different, which the report said would need to be a “significant change in housing policy or the capacity of the housing sector to supply new dwellings”.

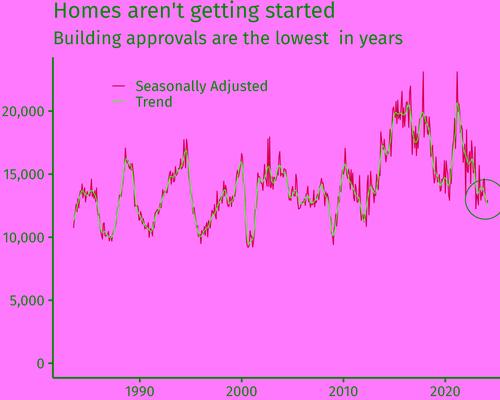

Can we expect Australia’s tradies to get cracking? To just suddenly start building more? At

the moment, the number of dwellings getting approved is low, as the next chart shows.

There were moments way back in the 1980s where we were approving more new places to

live than we are now. Building approvals turn into new homes slowly. So the low rate of new

building approvals now means fewer homes with that fresh-paint smell to move into in a

couple of years.

The cost problem

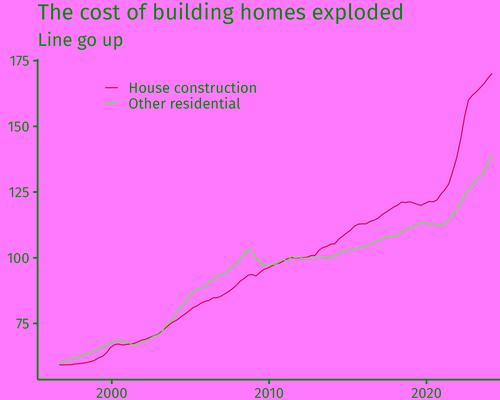

You’ve been to the shops so you know what it’s like: the cost of everything is up. Things

that go into a house are no different; hammers and nails, plaster and Colorbond, pies and Solo

for the tradies, all are more expensive than they were.

Back in 2021, lets say you could build a house for $400,000 and sell it for $500,000. Now it’s

costing, say, $480,000 to build and the price of the finished product is up to maybe $550,000.

The profit margin is less and if something goes wrong during the build the builder could lose

money.

Builders are going broke left and right, so the remaining ones want to be cautious.

The next chart shows the producer price indexes for residential construction.

It shows the

price of building homes has gone through the roof recently, with the price of houses going up

more than apartments.

What’s the solution? Perhaps the cost of inputs goes down? That doesn’t seem likely.

More likely the price of housing goes up until the profit margins are restored.

A third option is that governments streamline all their costs and reduce the administrative cost of building a house, as there are often huge fees, charges and delays in the planning system. That’s certainly a helpful idea.

“An easing in zoning and planning restrictions and a streamlining of the approval process

can reduce these costs,” the RBA helpfully points out.

While most experts agree they should reduce pointless rules, some of those rules exist for a reason and if you get rid of them other problems emerge.

A fourth option is organisations who don’t care about profit start building houses.

The federal government pledged to help get 40,000 social and affordable homes built in the recent budget by giving up to $1.9 billion in concessional finance for community house builders and other charities.

But there are already 169,000 families on the waiting list, meaning it won’t be nearly enough to solve the shortfall.

The horrible irony is builders need house prices to go up before they start building again in

massive volumes, and that doesn’t solve the affordability problem.

This is the classic

problem with free markets: low prices and high supply do not both happen at once. It’s going

to be an awfully long wait until housing shortages are resolved.

I hope you can find a housemate you get on with.