UK’s interest rates predicted to stay high for five years

Mortgages are to remain unaffordable for years in the UK with a prediction about sky-high interest rates leaving many reeling.

Would-be first time buyers and homeowners looking to remortgage have been dealt a devastating blow in the UK after the latest forecasts predicted that mortgage rates will remain high for at least five years.

The UK’s base interest rate is currently 5 per cent but many experts predicted that would come down next year allowing many first time buyers to finally get on the housing ladder.

Some lenders had already lowered their rates in anticipation for the expected cut by the Bank of England later this year.

However following Wednesday’s Budget, the Office for Budget Responsibility has now predicted that average mortgage rates will rise from about 3.7 per cent this year to 4.5 per cent in 2027 and stay there until the end of 2029.

The OBR analysis said: “Average interest rates on the stock of mortgages are expected to rise from around 3.7 per cent in 2024 to a peak of 4.5 per cent in 2027, then remain around that level until the end of the forecast.”

The government’s spending watchdog said mortgage rates would be driven by higher than expected base rates issued by the Bank of England.

Forecasters now believe that the Bank of England will lower the base rate from 5 per cent this year to 3.5 per cent in 2029.

The high interest rates will come as a blow to around 1.5 million people whose fixed mortgage deals will come to an end this year.

Many experts have warned that “it’s going to hurt’.

When many of these mortgage deals were secured the interest rate will have been 1 per cent meaning that homeowners are now facing having to pay hundreds of pounds more each month.

Those with a mortgage or around £360,000 (AUD$700,000) would be forced to pay £500 (AUD$980) a month more each month.

More Coverage

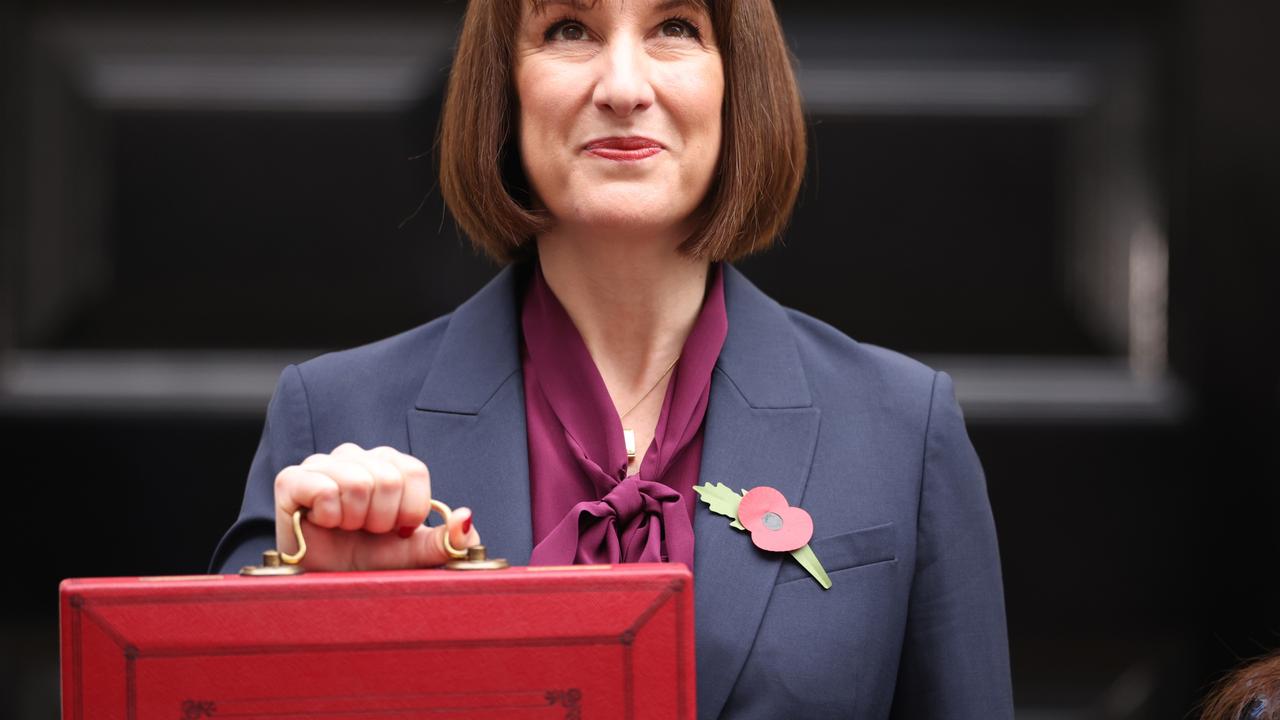

It comes as the UK Labour government’s Chancellor Rachel Reeves put up stamp duty for landlords and second home buyers in Wednesday’s budget meaning that renting is likely to become even more unaffordable as landlords pass on costs to renters.

Those hoping to buy may be stuck in the rental trap even longer due to expensive borrowing.

Ms Reeves announced £40 billion (AUD$78 billion) in tax rises in order to address a £22 billion (AUD$43 billion) deficit in public finances.