The Instagram ad revealing a glimpse of Australia’s grim future

A seemingly innocent ad running on Instagram offers a stark look at the uncertain future facing millions of Aussies – and Millennials are right in the firing line.

An advertisement for a financial product running on social media offers a stark look at the uncertain future facing millions of Australians – some of whom have only just been born.

Mutual fund Australian Unity is running promoted posts across Instagram for its long-term investment bond, 10Invest, marketing it specifically towards parents.

The image shows a toddler leaning over to peer into a dresser drawer and carries the caption: “Because one day, Olivia will need a house deposit.”

On Australian Unity’s website, a range of case studies are provided to show how 10Invest can deliver healthy returns over time, with one example featuring a fictional dad and his son.

“Lewis recently inherited a sum of money from his grandmother. He values having his own ‘bricks and mortar’ home and understands that it could be tough for his son Zack to own his first home.

“At age 25 when Zack is ready to set out on his own, Lewis can provide the help he promised with $173,412. He contributed $100 a month to the policy after investing the $50K he inherited.

“And because he invested for over 10 years, Zack can withdraw his money as a lump sum, or a regular income stream, with no personal income tax to pay.”

The reality facing many young would-be first homebuyers right now is grim, with skyrocketing home prices, dwindling supply and intense competition combining to make the Great Australian Dream something of a nightmare.

For parents, imagining how things might deteriorate further for their kids over coming decades, Diaswati Mardiasmo, chief economist PRD Real Estate, conceded the future looks “scary”.

“A lot of parents are starting to have savings funds for their children, so things are a little less uncertain in decades to come,” Dr Mardiasmo said.

“I wouldn’t say the Great Australian Dream is a thing of the past, but it’s adjusted – and I think it will continue to do so.

“It’s hard to buy your first home now, and so looking 20 or 30 years down the track, it’s likely going to only get harder.”

Brenton Tong, managing director of the advisory Financial Spectrum, said the Australian Unity product and those like it are a “smart way of thinking” for people with young children.

“When I was a kid, my parents taught me that I had to get a job and work hard, and that was the formula for getting ahead financially and having a home one day,” Mr Tong said.

“That was it. And that’s how it was for generations, until all of sudden, boom, it’s shifted. These days, and in the future, you might work your ass off and do everything right, but still not be able to buy a home without your parents’ help.

“I like to think, I like to hope, that we’re not quickly getting to a point where the idea of owning your own home will only be possible if your parents are well off.

“But we’re in uncharted territory here.”

Housing will ‘never be cheap again’

Over the past 25 years, the median age for first-home buyers in Australia has leapt by 10 years, from 24 to 34.

Property market analyst John Lindeman, director of Property Power Partners, said that dramatic adjustment reflects an “increasing disparity between incomes and home prices”.

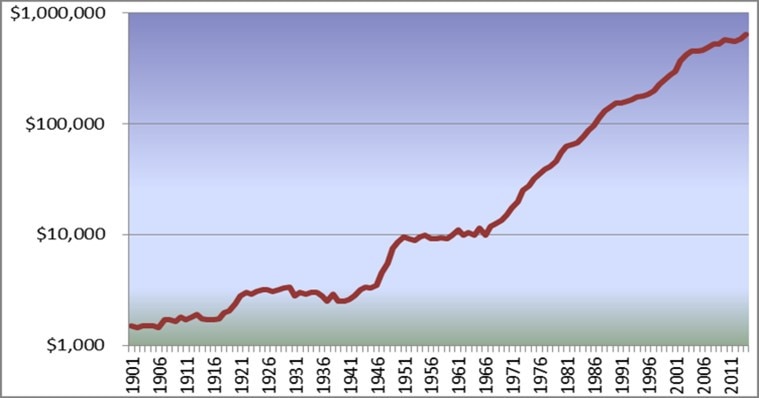

“Home prices have more or less been on a continual upwards trajectory since 1901, with only occasional temporary halts or downturns during wars and recessions,” Mr Lindeman explained.

“The rate of house price growth has averaged 10 per cent each year, far exceeding wage and salary increases, and as a result has continuously pushed up the median first-home buyer age.”

That trend will only change those hoping to one day own their own home buy in more affordable cities or regional towns, or if they opt for cheaper dwellings like units instead of houses, he said.

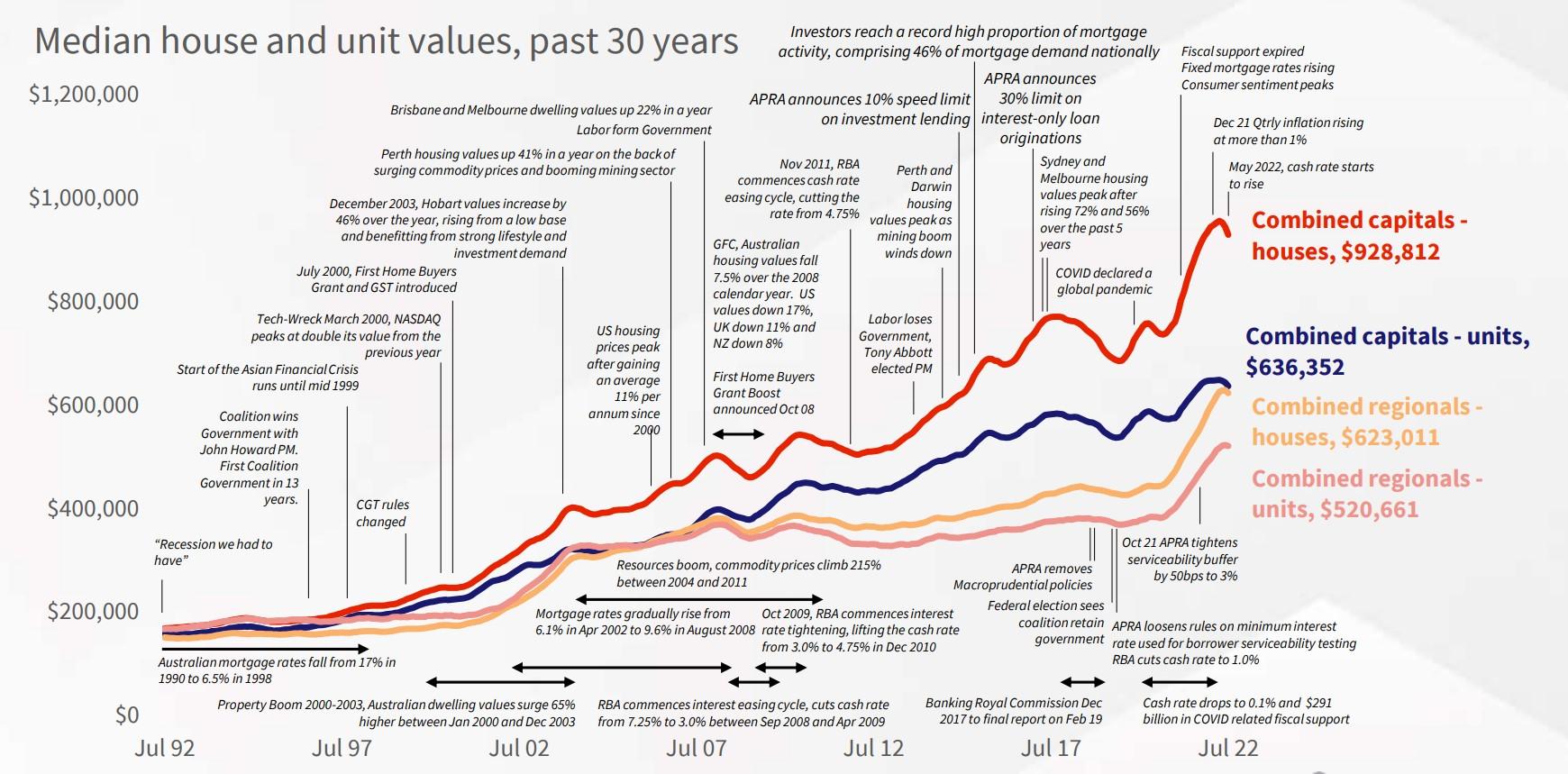

In Australia’s major cities, the price of housing has soared over the past three decades, CoreLogic research director Tim Lawless said.

Take Sydney, where dwelling values skyrocketed by 449 per cent in the 30 years to 2022, or Melbourne, where home prices rose by 459 per cent in the same time period.

Even smaller capitals have seen exponential long-term growth, with Brisbane prices up 340 per cent in that three-decade window, Adelaide up 357 per cent, and Perth some 303 per cent higher.

And those figures don’t factor in the strong performance of property markets across much of Australia last year.

Mr Wong believes the level of price growth Australia has seen in recent decades is “unsustainable” and unlikely to continue.

“I don’t see home prices doubling in the next decade because I just can’t picture how people can afford that.

“But I also don’t see housing becoming ‘affordable’ again. I think buying your first home will remain stuck somewhere between difficult and impossible. Family help is here to stay.”

Mr Lawless said forecasting where housing trends are going is “hard enough over the short-term, let alone over the next 10, 20 or 30 years”.

“Short-term trends may be the talk at a weekend barbecue and in the media, but Australians tend to hold their homes a lot longer than a typical market cycle.”

The average hold time of a property is about a decade, meaning that “time in the market” is more important than “timing the market”, he said.

New way of thinking

The mechanism behind Australian Unity’s product isn’t new. In fact, it’s existed in the market for decades, Mr Tang explained, often used for tax minimisation purposes.

What is new is the ease of access, going direct to consumers instead of via financial planners, and how the product is being framed – as a way for worried parents to give their babies and young children the best shot at buying a home in the future.

News.com.au spoke to Adnan Glinac, general manager of life and super at Australian Unity, who said more than 6000 account holders have generated $110 million in just a couple of years.

“This sort of investment bond was something of a hidden treasure, used by advisers or more affluent investors, and we asked ourselves, why wouldn’t we make it broader?”

“We’ve designed it specifically for Millennials – this is who we’re seeing go into this product. They’re the cohort between 34 to 42, effectively setting up their future. They’ve bought a home, they have a child, but they’re thinking about the future of the little one.

“Their primary investment driver is being able to provide for the future generation, for homeownership.”

Right now, young Australians in the market for a home could spend more than a decade scraping together the required 20 per cent deposit, which could be $150,000 or more.

“To be honest, the bank of mum and dad is going to be essential [for many], it doesn’t matter what you do,” Mr Glinac said.

Millennials with kids are grappling with the realisation that unlike their parents, they might not be in a position to act as the bank of mum and dad for their own kids

“So, this is a long-term play. We’re not talking huge initial sums [being invested], but it’s the discipline of saving and investing, and building for the next generation.”

Changing attitudes are inevitable

While it might be that future generations don’t achieve the Great Australian Dream, it could be the case that many don’t mind, Dr Mardiasmo said.

“I teach at a university, so I talk to a lot of young people about the idea of buying a home,” she said.

“A lot of them don’t mind the idea of renting so they can use their money to travel, to have a nice lifestyle, to invest elsewhere.

“Many tell me that instead of worrying about a mortgage, council rates, insurance, all of the other things like maintenance, they’ll live the life they want.

“I think we’ll see more and more people renting, and that’s not a bad thing. There’s no shame in renting. It doesn’t mean you’ve somehow failed at life because you don’t own your home.”

Mr Lindeman agreed and said he sees renting becoming “the lifestyle choice of future families” who value the ability to “live where they want, rather than where they can afford to buy”.

“Wealthy countries with high per-capita incomes such as Switzerland, Hong Kong, Germany and South Korea also have the highest percentages of renters,” he said.

“In some countries such as Switzerland, the number of renting households even outnumbers those of owner-occupiers.”

In Australia, many young professionals on high incomes choose to rent in inner-city suburbs with high densities because they offer a “wealth of lifestyle, employment, education and entertainment options”.

“The future could see more families choosing to rent rather than buy, so that they can live in desirable locations where they could never afford to purchase.”

Regardless of how future generations feel about homeownership, Mr Tang said it’s crucial for parents with young children to think about preparing them for the economic realities they’ll face.

“Families don’t want their kids to miss out, or to struggle, and they’re looking at their children and wondering: ‘How the hell is this going to go? The world looks like it’ll be tough’,” he said.

“I think it’s us as parents who have to upskill really, really quickly so we can teach our kids about money, teach them financial literacy.”