Young Aussies will have $3 million by the time they retire according to new modelling

New modelling paints a crazy picture of what retirement will look like for someone who is 22 right now.

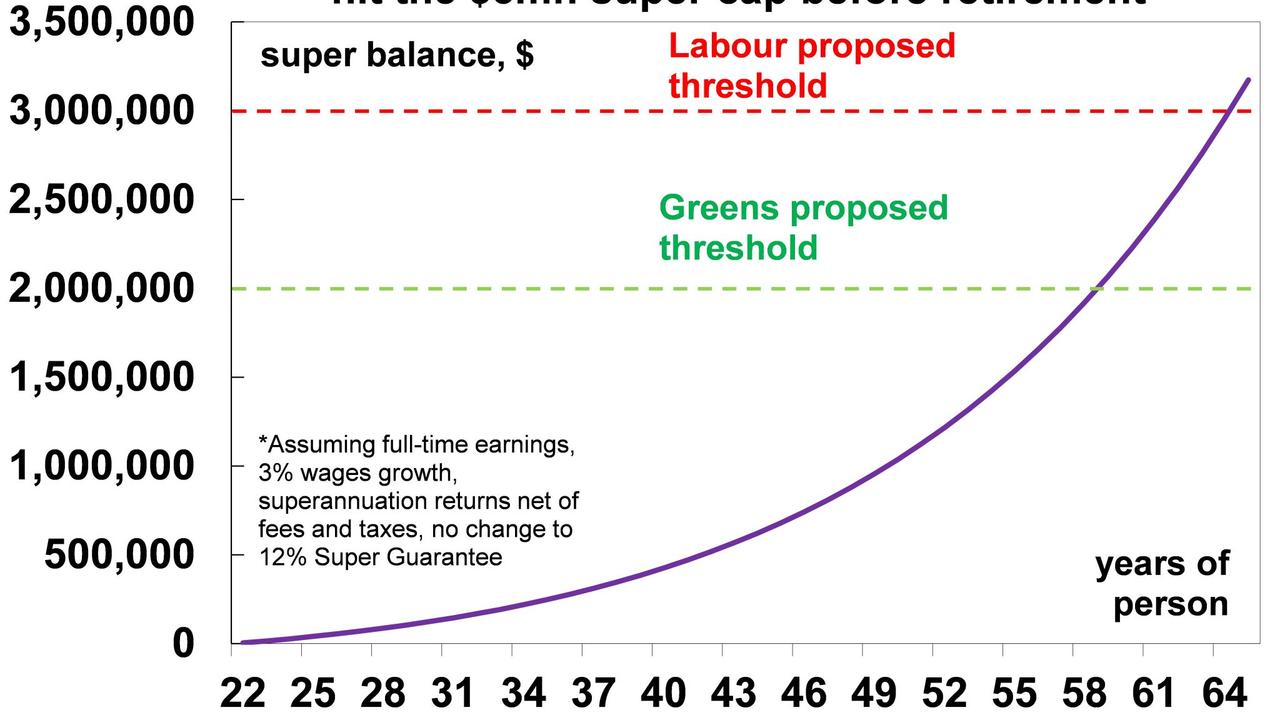

Most young Aussies are set to retire with a whopping $3 million in their superannuation accounts.

That’s according to the latest modelling from an economist in the wake of Labor winning the election and committing to plans to double the tax on super balances that come in at over $3 million.

Only a tiny portion of the nation currently can boast having that much money in their superannuation accounts - 0.5 per cent of Australia’s population or around $80,000 people.

But it might actually be the norm in 40 years’ time, according to new analysis.

AMP deputy chief economist Diana Mousina said earlier week that with inflation and wage growth, most young Aussies will have that much by the time they retire.

“An average 22 year old today earning average wages for the rest of their life will breach the $3 million limit unless the government indexes the threshold,” Ms Mousina wrote in her note.

“Do you think that the proposed $3 million superannuation cap tax won’t impact you because the Labor government said it only impacts 0.5% of people now? Think again!” Ms Mousina wrote.

She said savvy workers who made additional contributions to their super would end up with more.

Overall, she called the $3 million figure “conservative” and said the final amount was likely to be higher.

The modelling was done under the assumption that wages would grow at three per cent a year and that super contributions sits at 12 per cent, leading to substantial compound interest.

She based the figures off an average income of $98,000.

Ms Mousina came to those figures through her own analysis and was not using various superannuation calculators, including that she hadn’t relied on AMP’s own calculator.

She said these calculators used today’s dollars and didn’t factor in future inflation so she had adjusted for that.

If the government indexed the $3 million super amount to inflation, most of today’s younger generation wouldn’t be hit with the higher tax rates because they would be under the ultra rich threshold.

However, that’s not the government’s plan.

When Labor first announced the policy in 2023, Federal Treasurer Jim Chalmers said the government didn’t intend to index the threshold.

Meanwhile, the Greens want the threshold to be lowered to $2 million and for this to then be indexed in line with inflation.

Superannuation is currently taxed at 15 per cent but it would be 30 per cent for those with more than $3 million under the plan.

“The policy, as it stands, is trying to target wealth, and I’m not necessarily against that … but it just doesn’t make sense not to index the brackets,” Ms Mousina told The Australian Financial Review.

“A $3 million balance in 40 years’ time is not the same $3 million balance that you have today. It doesn’t affect 0.5 per cent of the population, it impacts a much higher share.”

Ms Mousina said she was surprised by the results of her analysis.

“I knew that for a high-income earner, $3 million by retirement was something that they would easily hit by retirement because people often forget the impact of compound interest,” she explained to the publication.

“What did surprise me was that even for an average income earner who is saving right now, they will hit the cap before retirement.”

Super Consumers Australia released research in January which found that Australians need a lot less than $3 million in their superannuation to enjoy their retirement.

A single person needs around $310,000 in superannuation while a couple needs around $420,000 to have enough to live a “medium spending” lifestyle in retirement, according to the body.

Super Consumers Australia say these figures are based on what Aussies are actually spending in retirement, not what they aspire to spend.

These figures rely on Australians owning their own home and going on the aged pension at some point throughout their retirement.

Super Consumer Australia chief executive Xavier O’Halloran said combining the income of an aged pension, home ownership with these super figures, Aussies could reliably spend between $43,000 to $62,000 a year until they reach 90.