The exact amount average Aussie will need to save for retirement is revealed

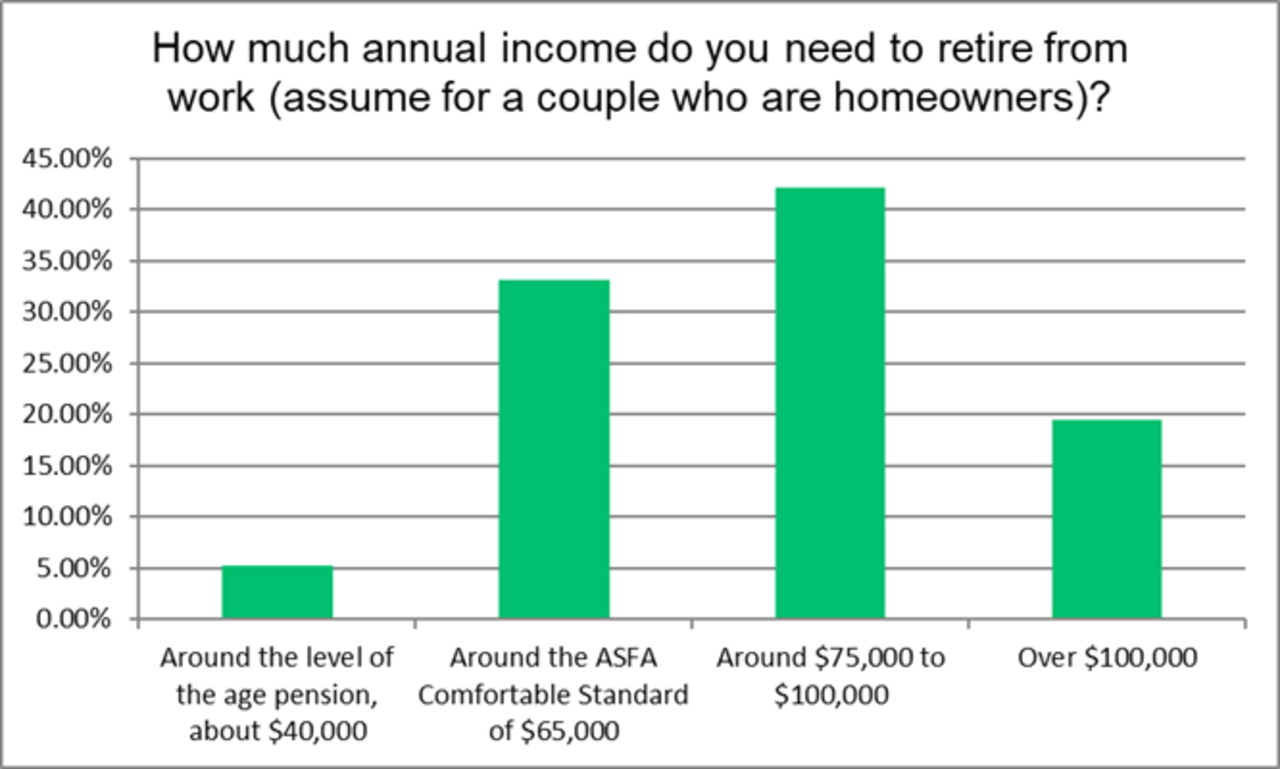

A graph shows just how big your nest egg should be to enjoy your golden years, but the path forward contains some obstacles.

The average Aussie may need to save around $75,000 to $100,000 per year just to retire comfortably, according to a new financial survey.

And while superannuation is a major asset on the path towards retirement, the fund you invest with may not be giving you the full picture of where your money is going.

New analysis by Market Forces reveals several super funds are potentially misleading consumers by “greenwashing”, with eight of the 11 super fund investment options labelled “sustainable” or “socially responsible”, choosing to invest in fossil fuel giants.

Both issues have cast light on major problems the average Aussie will face going forward as inflation and cost of living prices continue to surge.

A survey conducted by financial planner Merit Planning took hundreds of responses from retirees on their experiences, showing just how big their nest egg will need to be for the golden years ahead.

42 per cent of respondents answered between $75-100,000 was needed, while about 20 per cent said the average person needs over $100,000 a year.

Only 6 per cent of respondents said the age pension level of around $40,000 per year was enough with which to retire.

33 per cent said the Association of Superannuation Funds of Australia’s (ASFA) comfortable retirement standard – sitting around $65,000 a year – was enough.

Financial planner Darren Howard said the average couple in Sydney would need to earn about $85,000 per annum combined to retire comfortably.

“The full age pension provides approximately $25,000 for a single pensioner and $37,500 for a couple, so they will get this income if they retired with no money,” Mr Howard said.

“To extrapolate that out, just to receive the income you receive from the full age pension, you would require a lump sum returning 3 per cent interest of approximately $835,000 or at 5 per cent approximately $500,000.

“For couples it would be $1.25 million at 3 per cent, and at 5 per cent, $750,000.

Mr Howard said many retirees still retired with a goal of investing in assets that would provide a comfortable enough level of income to cover their lifestyle needs, leaving other assets untouched.

Some end up dipping into their capital to make up the shortfall of their capital base, he said.

“A vicious cycle takes place, where they now have a lower capital base to generate income, combined with ever lower interest rates over recent years,” Mr Howard said.

“Retirees need to understand they should be targeting a total return from their investments in retirement.”

Craig McDonald, owner of CBM Mortgages, said: “We speak to all our clients about their retirement and their superannuation position and how that will look when they enter in to retirement.

“We recommend they speak to a financial planner to ensure they are putting those steps in place early.”

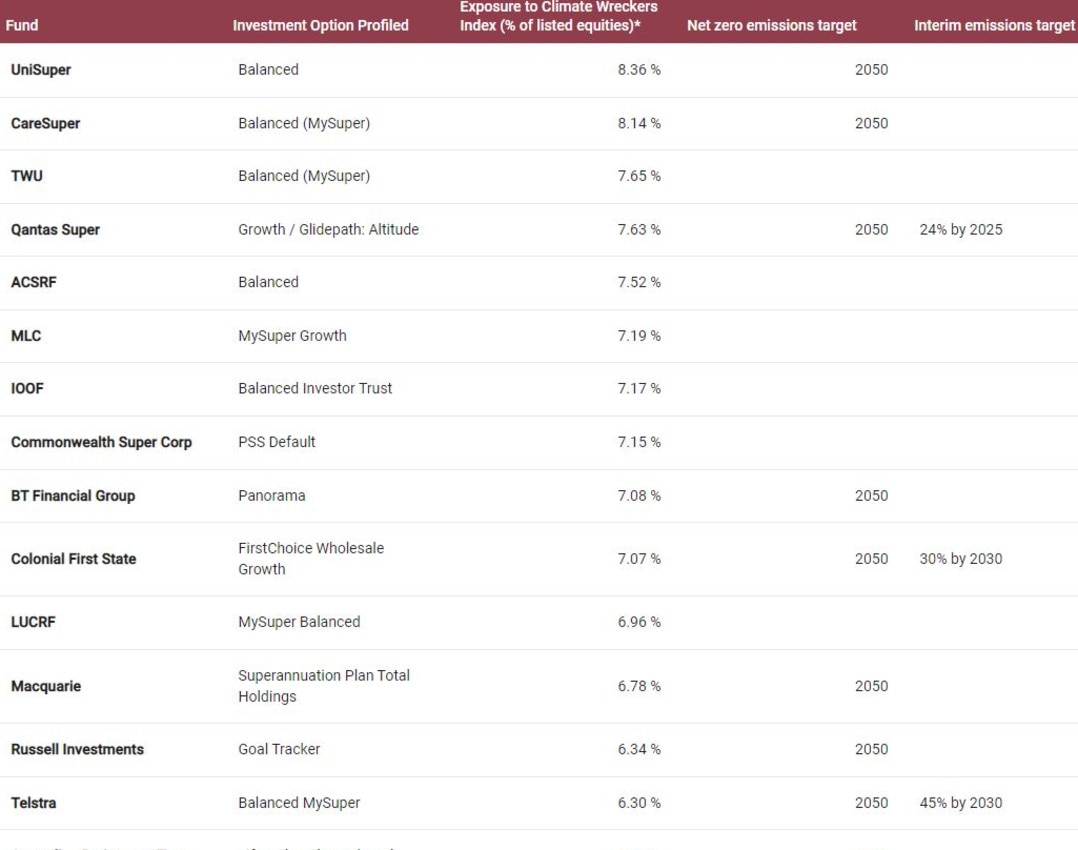

In a separate analysis conducted by campaign group Market Forces, many of the “sustainable” super funds tasked with managing superannuation weren’t living up to what they claimed to be.

It comes after the Australian Securities and Investments Commission’s (ASIC) recent warning that offering or promoting sustainability-related financial products which are not true to label or which use “vague terminology” could breach consumer laws around misleading and deceptive conduct.

“The very existence of a ‘sustainable’ investment option implies a super fund’s default option is somewhat ‘unsustainable’ which is a major problem,” Market Forces campaigner Brett Morgan said.

“Discovering your retirement savings are invested in companies opening up new coal, oil and gas mines would be a big blow to members of ‘sustainable’ super fund options.”

The company’s analysis examined super funds that had investments in fossil fuel companies which were major contributors to climate change – dubbed the “Climate Wreckers Index”.

UniSuper Balanced had the highest investment exposure to the Index on the list, due to its large stake in mining giant BHP.

CareSuper, TWU and Qantas Super also ranked in the top four, with an exposure rating of 8.14 per cent, 7.65 per cent and 7.63 per cent respectively.