How to figure out if your superannuation fund is ripping you off

SUPERANNUATION can be complicated but here are some basic tips to help you figure out if you’re getting a good deal.

IF YOU don’t trust your super fund anymore, who could blame you?

This week, staggering stories about the superannuation industry emerged at the royal commission hearings into misconduct in the banking, superannuation and financial services industry.

It includes revelations that National Australia Bank charged more than 4000 dead customers $3 million in fees, for which it may be facing more than 100 criminal charges.

The royal commission also heard the bank spent five or six months in 2016 discussing ways to justify keeping fees wrongly charged to some superannuation members. It now says it will pay $87 million to more than 200,000 customers to refund them for fees charged even though no adviser was linked to their accounts.

The complaints are just part of a wider fees-for-no-service scandal that may result in more than $850 million in compensation across the financial services industry, including from the four big banks and Australia’s largest wealth manager AMP.

AMP’s first-half profit plunged 74 per cent this week to $115 million after the company set aside $290 million to refund and compensate customers it overcharged for financial advice.

The revelations have also claimed the jobs of former chief executive officer Craig Meller and chairman Catherine Brenner.

While trustees should be maintaining funds for the best interests of members, senior counsel assisting the commission Michael Hodge QC said they were surrounded by temptation, including to choose profit over the interests of members and to preference the interests of their sponsoring organisations.

While the royal commission has laid bare some of the practices that have seen consumers ripped off, there are many others that the Productivity Commission into the superannuation industry identified in its draft report released in April.

Differences in fees being charged and return rates are just some of the things that can have a big impact on how much people are left with in retirement.

Choice spokesman Xavier O’Halloran said the first thing people should do is log on to MyGov and see how many superannuation accounts they have.

“An average person has got a couple, some have got up to seven and this can be costly because you are paying two sets of fees or insurance,” he said.

“In some cases you can’t claim insurance of two sets of policies so it’s a waste of money.”

The government’s MoneySmart website recommends you look at six things when choosing a super fund. Just remember you cannot make your employer change your fund more than once a year.

1. CHECK YOUR FEES

If you ever bothered to skim the product disclosure statement of your super account you may have come across a warning that every fund is required by law to include.

It’s required by law because it’s that important.

This is the statement: “Small differences in both investment performance and fees and costs can have a substantial impact on your long-term returns.

“For example, total annual fees and costs of 2 per cent of your account balance rather than 1 per cent could reduce your financial return by up to 20 per cent over a 30-year period.”

So what does this mean?

Basically many people think paying 2 per cent instead of 1 per cent in fees is not a big deal but consider this: if you paid 2 per cent, your savings would be reduced from $100,000 to $80,000 over 30 years. That’s $20,000.

Former Labor spokesman on retirement savings, Nick Sherry, previously suggested a cap of 1 per cent on fees and many funds have reduced their fees to this level.

There are usually two fees charged: administration fees and investment fees.

Mr O’Halloran said administration fees can vary from as low as $70, up to $400 a year.

Investment fees can vary between 0.06 per cent and 2.5 per cent. If they are charged annually they should be on your end-of-financial-year statement.

Once you figure out how much you’re paying in fees as a dollar amount, convert this into a percentage of how much your super is worth. If it’s about 1 per cent then you’re doing pretty well.

You can also use this percentage figure to make it easier to compare the fees of other funds.

The government’s MoneySmart website also has some handy calculators to help you work out how fees will impact your retirement income.

2. COMPARE PERFORMANCE

Choosing a fund that gives you good returns is extremely important. The Productivity Commission figured out just how much.

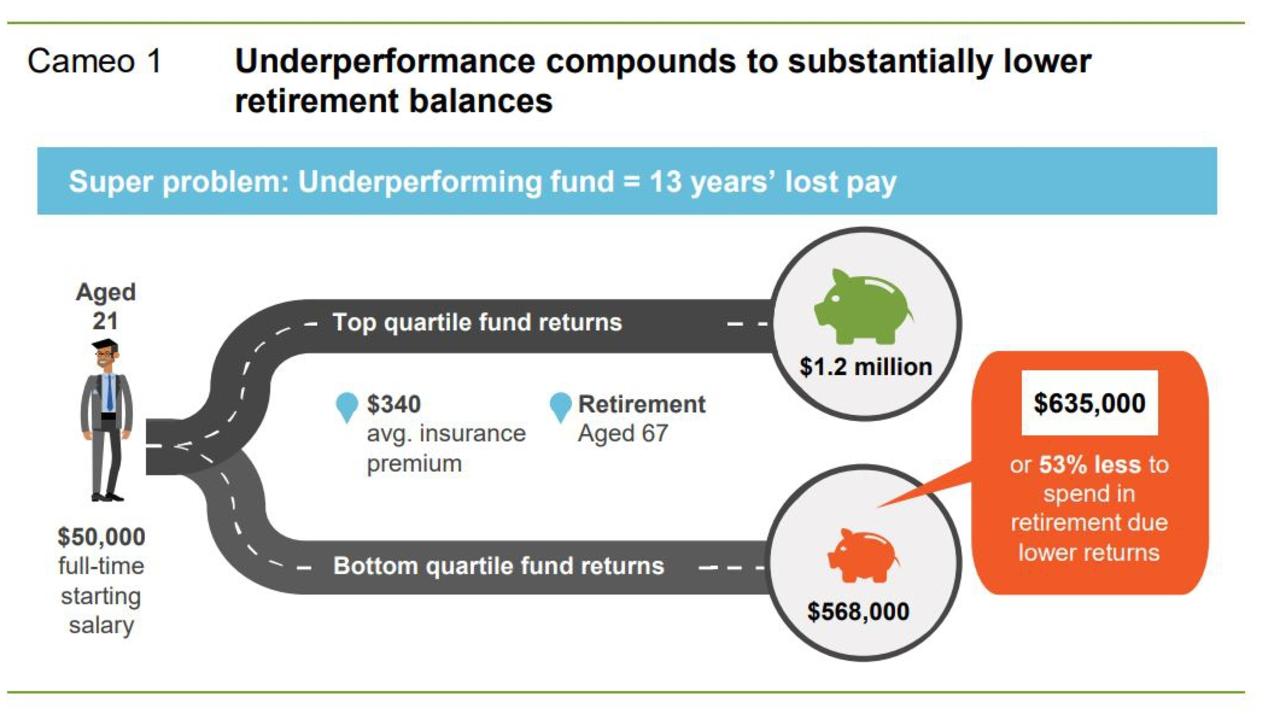

Its modelling showed that someone who put their money in a fund performing in the top 25 per cent of products, would have $635,000 more when they retired than someone in the bottom 25 per cent of funds.

It based its calculations on a 21-year-old starting work on a $50,000 full-time salary and found they would have $1.2 million when they retired aged 67 if they put their money in one of the top performing funds. This dropped to just $568,000 if they put it into one of the worst performing funds.

Basically those in the bottom performing funds lost about 13 years of pay.

Choosing a fund can be complex but one of the most important things is to look at returns over the last five to 10 years.

The Productivity Commission analysis found the top 10 MySuper products in 2017 had a median return of 5.7 per cent a year. So if your returns are higher than this, you’re on to a winner. Remember any fees you’ve paid should be subtracted first to get an accurate figure for your returns. The figure advertised by some companies don’t reflect this so may make returns look higher than they actually are.

Underperformers generated a median return of about 3.9 per cent. So if you’re getting less than this you’re definitely in trouble.

Interestingly, the Productivity Commission found as a ground, not-for-profit funds delivered returns above the benchmark for their average assets, but retail funds fell below.

Mr O’Halloran also warned about those who used super comparison sites.

“The way they are laid out can be confusing, with sponsored funds at the top, and they often don’t compare the full market,” he said.

They also calculate returns without taking into consideration the fees charged so some funds may look like they get high returns, but this drops once their high fees are taken out.

The Productivity Commission believes a list of the top 10 funds should be published so consumers can compare how their well their funds are performing in comparison.

3. DECIDE ON INVESTMENT OPTIONS

Another factor that can have a big impact on how much you’re left with is whether you chose to put your money into risky stocks.

“Usually the default option has a mix of high and low risk options, which is a good option for a lot of people,” Mr O’Halloran said.

“High risk options tend to have higher returns but when the market crashes they tend to drop more than other stocks.”

If you are close to retirement this is not recommended because you may lose a lot of your money just when you want to withdraw it.

But if you are young person this might be acceptable because you still have time to make that money back, and riskier options can help get you higher returns.

“Historically high-risk options have better returns on average compared to safe options like cash, which have low returns but are very safe,” Mr O’Halloran said.

4. CHECK FOR EXTRA BENEFITS

Some employers will may more than the required 9.5 per cent into your super account or you can benefit from making extra contributions yourself.

Mr O’Halloran said the main thing was to keep an eye on what your employer pays into your account.

“There’s been lots of reports now of employers not doing the right thing so it’s important to check your payslip and make sure you are being paid at least 9.5 per cent.”

5. DO YOU NEED INSURANCE?

Many super funds will provide default death insurance but this can leave people with multiple policies if they have many different funds and this could be costing them a lot of money.

It’s also worth considering whether you need the insurance on offer, especially if you are older and are no longer working, supporting a family or paying off a mortgage.

“It’s important to consider your needs, do you have people dependent on you who would need your income to survive?” Mr O’Halloran said. “If you become disabled, what are your needs going to be?”

Another pitfall to watch out for is whether the premiums increase dramatically in future years, many policies have cheap charges to begin with but then rise quite substantially.

But the good thing about getting insurance through your super is they often don’t require a medical check

6. ARE THERE EXTRA SERVICES?

It’s also worth calling the fund or browsing their website to see what other services they offer.

Many funds will offer financial advice and this can be helpful if you are have extra money and are unsure of how to invest it. They can also give you specific advice about your situation and how much money you need to retire and live on.

Their advice is usually cheaper than going to a financial adviser but you do have to be cautious about following what they suggest.

“No one cares more about your money than you,” Mr O’Halloran said.

“Back yourself, do your own research. If it’s too complex, get financial advice but be careful, make sure they are clear with you about what they’re proposing and you understand what that is.

“It’s not an easy market to navigate but there are good operators out there, it can just be difficult to find them.”