Exactly how much super you need to retire revealed in new research

Extensive new research has revealed exactly how much Australians need to save for a comfortable retirement.

Extensive new research has revealed exactly how much Australians need to save for a comfortable retirement.

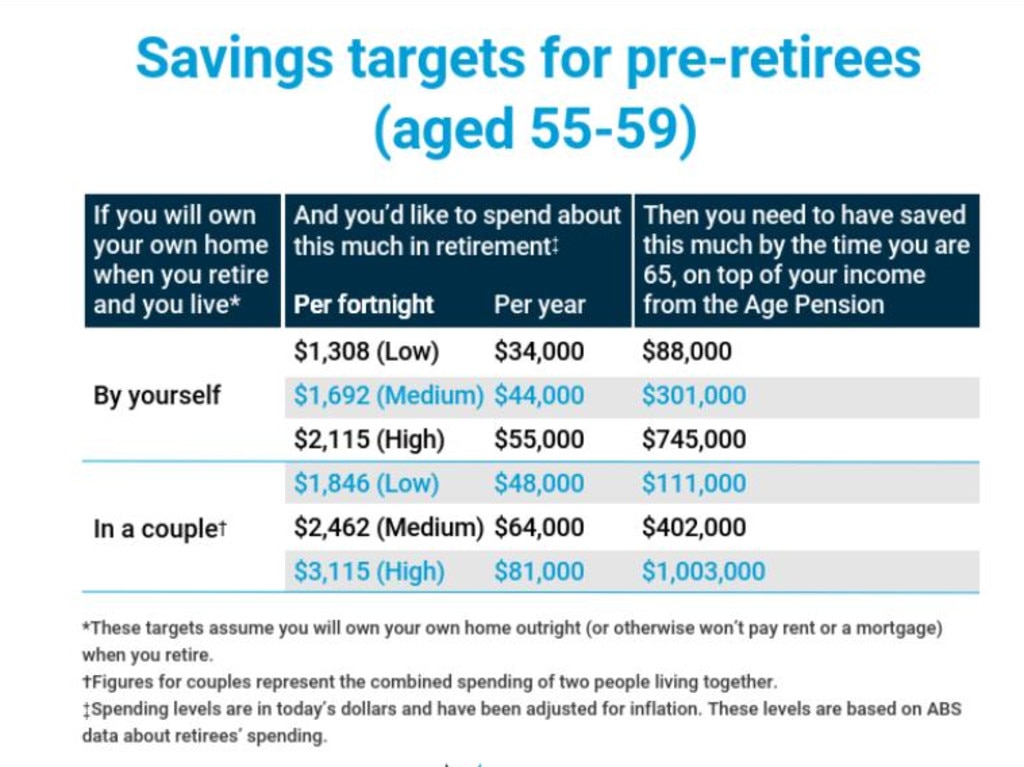

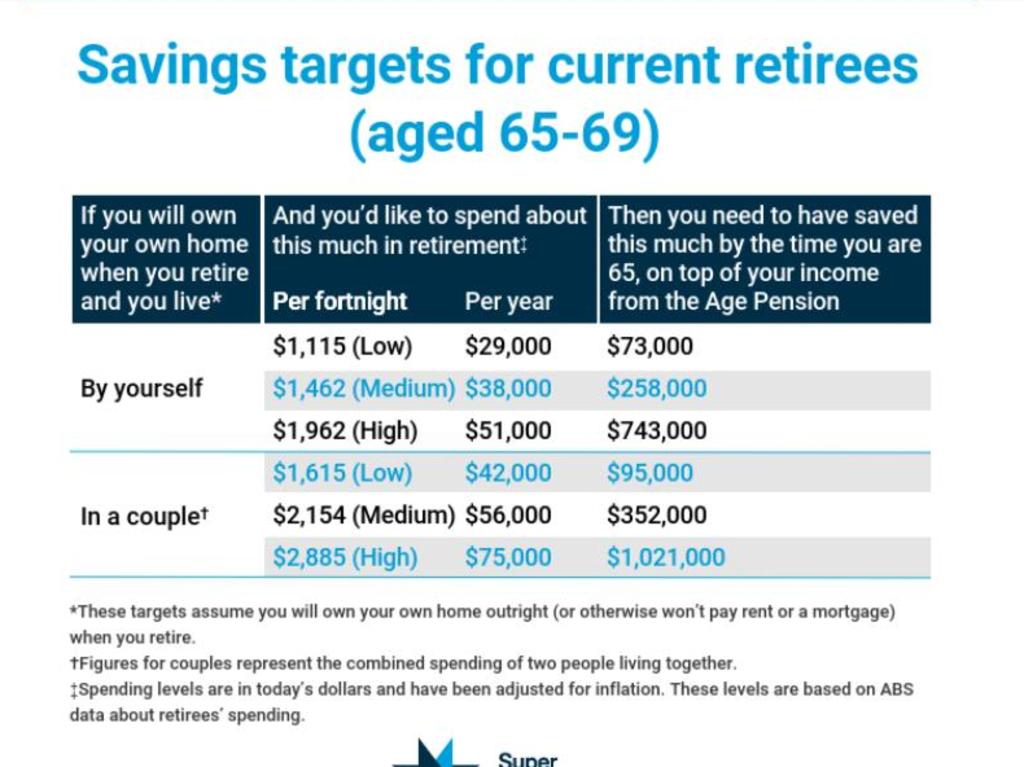

The targets – set out by superannuation advocacy group Super Consumers Australia – are designed to help Australians figure out how much they need to save and what income those savings will deliver in retirement.

Released this week, the research shows how much harder it is for single Australians to save for a secure retirement, when compared to the income and saving power of couples.

To sustain a “high” standard of living in retirement, Super Consumers Australia calculated a single person will need $745,000 in savings.

Meanwhile, couples can match that same standard of living by splitting savings of $1,003,000.

The figures also include how much people need to stow away for low, medium and high levels of spending during their retirement.

They are based on pre-retirees aged 55-59 who own their home outright, with no remaining mortgage payments.

A single retiree who spends $2115 each fortnight is deemed a “high” spender and will need $745,000 in the bank.

That’s more than eight times higher than the $88,000 required for a single “low” spender, who aims to live off $1308 every fortnight.

Meanwhile, “high” spending couples need just over $1 million in the bank in order to confidently spend $3115 every two weeks.

The “low” end for couples is $1846 every two weeks from a total savings of $111,000.

All groups in the research were assumed to also receive the age pension.

Super Consumers Australia director Xavier O’Halloran said the figures give Australians a “solid rule of thumb” for what they need to maintain living standards when they retire.

“Among the most important financial questions retirement-planning Australians face is how much they need to save and what income those savings will deliver in retirement,” he said. “These new retirement targets are designed to help people answer these questions.”

Super Consumers Australia’s consultation engaged consumers, academics, regulators, industry experts and superannuation funds.

“Our goal is to improve consumer and industry understanding of people’s retirement needs through industry wide adoption of the targets and the underlying assumptions and research,” he said.

“These savings targets are based on what people spend in retirement with a buffer built in to provide confidence that people’s savings can weather the type of market volatility we’re currently experiencing.

“Having credible targets, based on actual spending, means people can confidently spend and get on with enjoying their retirement.”