Amount Aussies need for ‘comfortable’ retirement amid cost of living fears

The exact amount of money you need to have a “comfortable” retirement has been revealed amid the rising cost of living crisis.

All Australians want to be able to enjoy a comfortable retirement, with new recent figures showing exactly how much money you need to do that.

The Association of Super Funds Australia (ASFA) has claimed single Aussies need at least $545,000 to live a “comfortable lifestyle in their retirement”.

This bumps up to $640,000 for a couple.

Aussie investor Natasha Etschmann took to TikTok to share and explain the data to her followers.

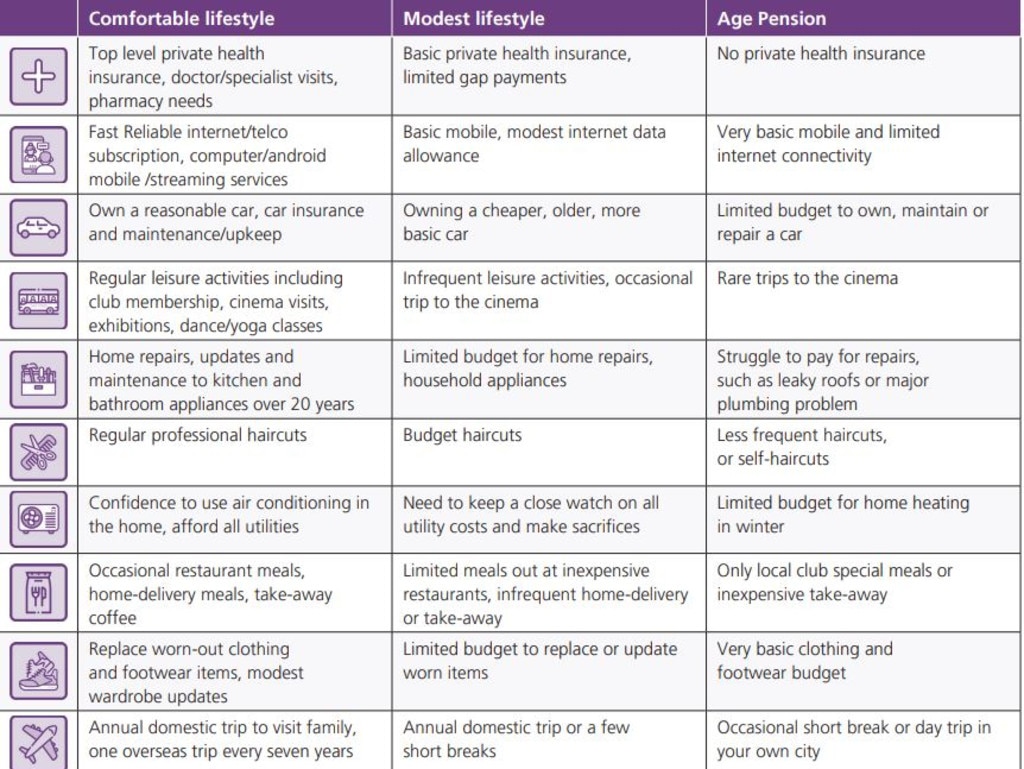

“How much super is needed for a comfortable retirement? The Association of Super Funds Australia has created this expense breakdown which shows what you can spend and how much super you are going to need to retire at this level, for example,” she said.

“It is pretty detailed, they even accounted for Netflix which is pretty cool.”

Ms Etschmann noted that the ASFA considers a comfortable retirement to include one domestic trip a year and an overseas trip every seven years.

Other aspects include regular haircuts, health insurance, owning a reliable car and occasional restaurant and takeaway meals.

“(This is) compared to a modest retirement, which is actually very basic and very budget,” she said.

A modest retirement lifestyle involves owning a cheaper, older car, having an annual domestic trip or a few short breaks, and a limited budget for home repairs and household appliances.

The savings required for a modest lifestyle in retirement is $70,000.

Ms Etschmann said the $545,000 figure for a single person to live a comfortable retirement was daunting.

“This is a pretty terrifying number for a single if your partner passes away and you don’t own your own home as well,” she said.

This becomes an even more daunting task when considering the rising cost of living and inflation.

AMP’s 2022 Financial Wellness report has found that many Australians are not feeling confident that they will be set up for retirement.

A survey found that the average working Australian is expecting to retire at age 65.4 years – a jump of more than six months since the 2020 report.

They are expecting to have $400,000 saved, which is a drop of $100,000 over the same two year period.

This is despite many respondents saying they expect to need $600,000 in retirement.

Only 41 per cent of people are expecting to enjoy a comfortable or lavish retirement, compared with 50 per cent in 2020.

The rising cost of livings has raised concerns for Australians about not having enough money for retirement and having to work later than expected as a result.

Cost of living crisis still out of control

Fresh data has revealed the rising cost of fruit and vegetables has help keep Australia’s inflation rate at a 30-year high.

The Australian Bureau of Statistics’ new monthly measure of inflation showed the pace of price rises hit 7.0 per cent in July before easing slightly in August, down to 6.8 per cent.

Soaring construction costs and fuel prices continue to be the key drivers, but the rapid uptick in the price of fruit and vegetables (up 18.6 per cent) added to the hip pocket pain.

“The largest contributors in the 12 months to August were new dwelling construction, up 20.7 per cent, and automotive fuel, up 15 per cent,” Australian statistician David Gruen said.

“The slight fall in the annual inflation rate from July to August was mainly due to a decrease in prices for automotive fuel.”

Overall, the cost of food and non-alcoholic beverages rose 9.3 per cent in the year to August.

The rising cost of key products and items is having a noticeable impact on the amount of money Aussie retirees will need to spend each year to live a comfortable lifestyle.

The ASFA Retirement Standard June quarter 2022 figures estimated couples aged around 65 living a comfortable retirement need to spend $66,725 per year, up two per cent from the previous quarter.

For singles it is $47,383 a year, up 1.9 per cent.

In the 12 months to June 2022, prices were up by around 6.2 per cent for the comfortable couple budget and by 6.7 per cent for the comfortable single budget.

ASFA Deputy CEO, Glen McCrea, also pointed to the rising cost of private health insurance as another major problem facing retirees.

“While there is considerable subsidisation of health costs and benefits being paid from private health insurance, out of pocket expenses remain substantial for items such as dental treatment, optical expenses, and gap payments for procedures in hospitals,” he said.

“Private health insurance premiums rose on average by 2.7 per cent from 1 April with some major insurers increasing premiums by more than 3 per cent.

“However, other insurers have postponed premium increases until later in the year.”

– with NCA NewsWire