The products that make Shark Tank investors most willing to part with their money

FACING the Shark Tank panel is no easy feat but if you really want a chance at investment, these are the products that’ll get you there.

IF THE grumbling panel of investors are anything to go by, making a splash on Shark Tank isn’t an easy task.

But new data collated from close to 200 episodes of the US version of the investment show might just give future entrepreneurs the leg-up they need.

The show’s 10th season premiered earlier this month and over the past 10 years has seen Richard Branson, Ashton Kutcher and Steve Tisch on its panel.

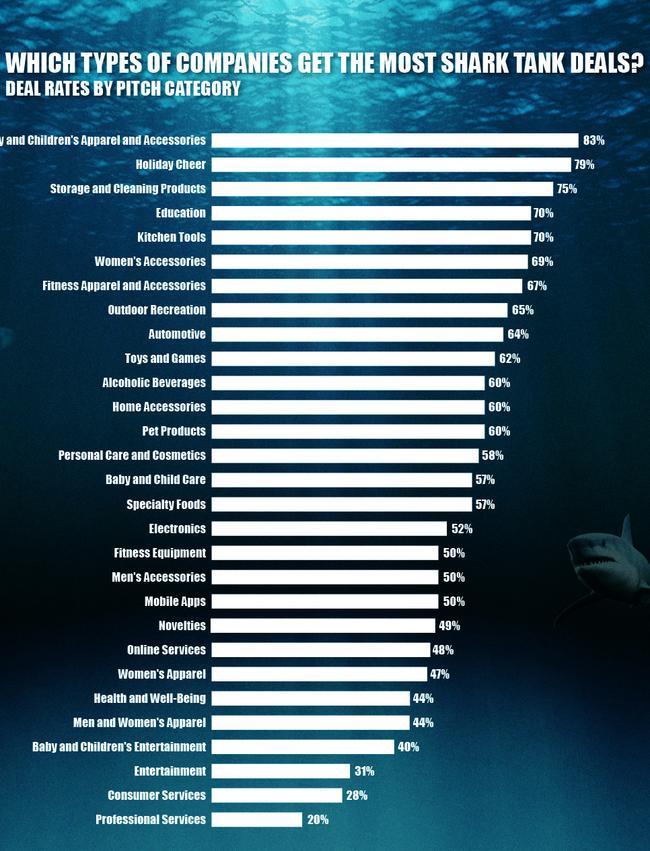

New data, compiled by SimpleTexting, found the business category with the best chance of earning a Shark Tank investment fell into the baby and children’s apparel genre.

If budding entrepreneurs pitched that category on the show, the idea had an 83 per cent success rate of getting picked up.

Holiday decor and products had a 79 per cent chance of earning Shark Tank investment followed by storage and cleaning products with a 75 per cent success rate.

Consumer and professional services fared the worst over the past nine seasons with only 20 per cent of investors willingly parting with their money.

The analysis also found 55 per cent of pitches received some sort of investment deal however women were 15 per cent less likely to get one over men.

The analysis comes weeks after the end of the fourth season of the Australian version of Shark Tank.

In May, the show’s sharks fought for a stake in Stand In Baby, a lifelike newborn baby mannequin originally designed to help photographers pose newborn babies during shoots.

Photographers Sandra and Brendon Moffatt entered the episode seeking $200,000 for a 20 per cent stake in their product.

Speaking to news.com.au, Ms Moffatt said the company was pushed through due diligence after the couple decided to go with an offer.

“We were a bit behind, it took us almost a month to get the information they needed, speaking without accountants,” she said.

She described the Shark Tank experience as “traumatic” but “awesome”. “It was wonderful to meet them all in person, we have been watching the show for a very long time, so it was very exciting to be on the other side of it,” she said.

Mr Moffatt said the company was on track to hit revenue of $450,000 this financial year with a goal of $1 million next year.

Speaking on The Project in May, Boost Juice founder and Shark Tank judge Janine Allis explained why most entrepreneurs don’t make the final cut.

“Look, not all of them get through due diligence. Sometimes when they actually get a big fright on [TV], they say things that probably aren’t true. And it’s confronting, so sometimes they pull out afterwards. But there’s a lot of people we don’t do deals with on the show, but we still work with them post-show,” she said.

Three of the sharks took news.com.au behind the scenes of the show earlier this year.

Internet investor Steve Baxter, Greencross founder Glen Richards and human resources pioneer Andrew Banks explained what turned them off budding entrepreneurs.

Richards said he was still “really pissed off” by the number of contestants who didn’t know their numbers.

“This is the fourth season of Shark Tank and they’re still turning up, they don’t know their numbers,” he said.

“We ask pretty similar questions for most businesses and they can’t tell us where they hope to be in the next two to three years.”

Banks added, “We ask them, have you seen this show before? ‘Yep.’ Did you actually listen to it? Because I’ll tell you, you haven’t prepared.”

Baxter, Banks, Simson, Allis and Dr Richards have so far forked out more than $9 million of their own cash on Aussie start-ups.

But just because the investors are putting up their own money doesn’t mean entrepreneurs are always willing to take it.

And five years ago, Shark Tank’s US judges made the costliest mistake in the show’s history by passing on Ring, a ‘smart’ doorbell which last week was purchased by Amazon for $1 billion.

At the time founder Jamie Siminoff was brutally rejected on the show. He was seeking $700,000 for a 10 per cent stake in his company, valuing it at just $7 million.

“It could be worth $7 million, $80 million, $90 million, [but] I just don’t see the progression, and for that reason, I’m out,” he was told by Mark Cuban.