How two working mums got their money (and time) back

Two mums were sick of copping late fees on their bills for lack of time to pay them. Now they have a solution that’s saving Aussies hundreds.

Mireille Boutros has been starting businesses since she was 14 years old, in a race to build a career that would hold itself up when paired with her biggest dream of being a mum.

And her latest endeavour with fellow working mother Carolina Flores stems from the balancing act both women faced in managing life, their kids, and financial responsibilities shared with their partners.

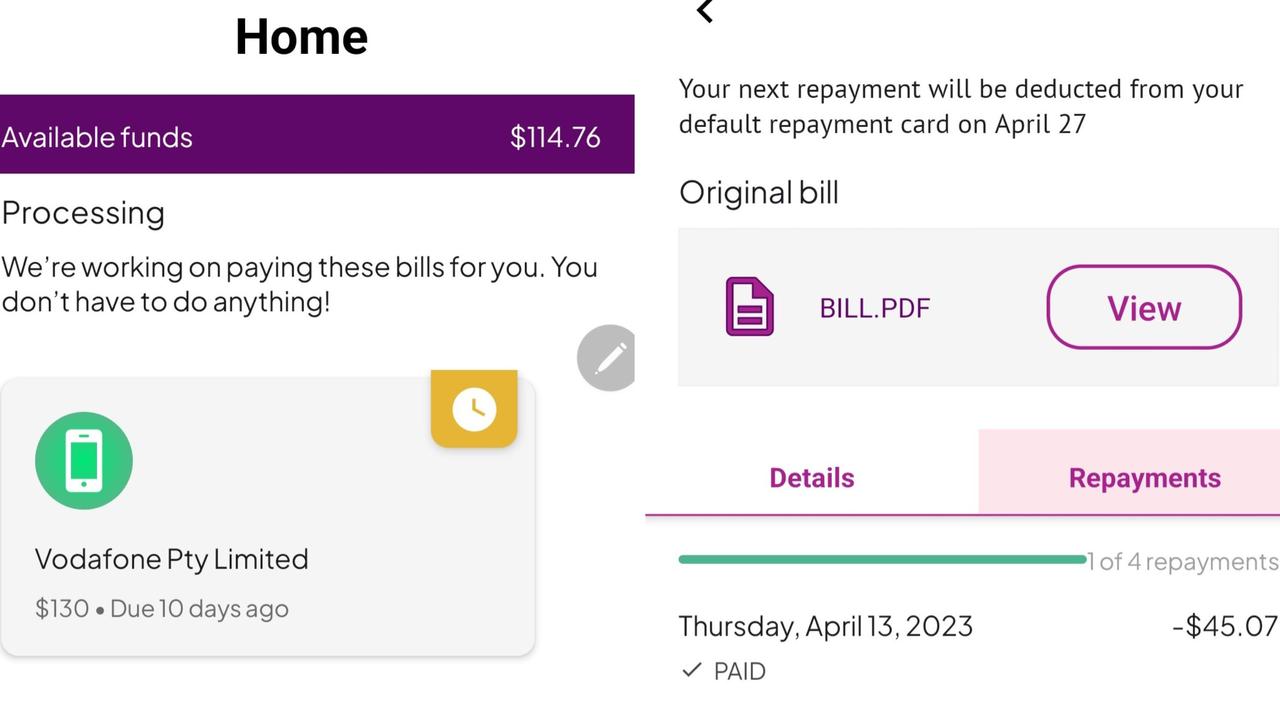

Their bill management app, Bree, costing $14.28 per month, is now used by Aussies with busy lives and tighter wallets, with users saving up to $950* per year- a small fortune as the cost of living continues to bite.

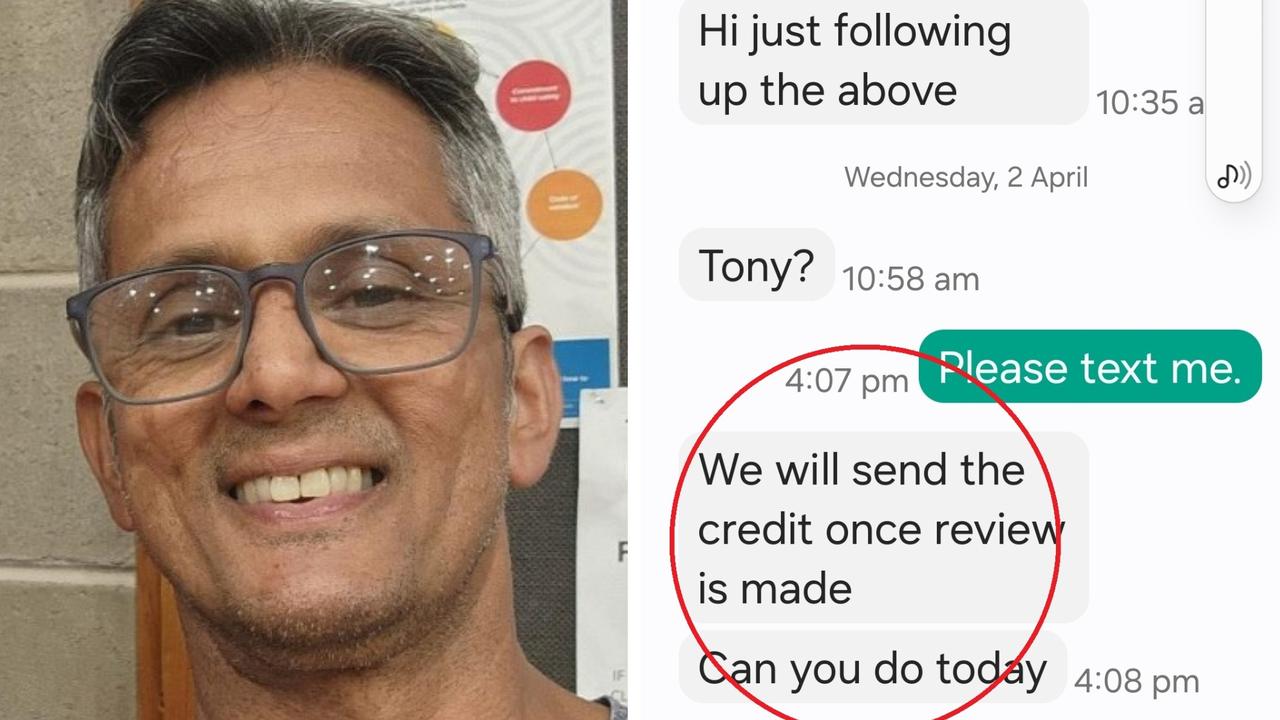

Championed by transformational speaker Alice Crawley, the Bree app automates the paying of your bills, allowing you to repay the app in fortnightly instalments. But what’s more, artificial intelligence within the app is constantly on the hunt for better deals and cheaper providers, saving Aussies on late fees and unnecessarily expensive rates.

“After I had my kids … I just wanted to be with them, I actually didn’t want to work for the first time in my life,” says Ms Boutros.

“But finance wise, I didn’t have a choice … you have to make it work and keep at it.”

While the percentage of fathers employed was higher than that of mothers in Australia as of June 2022, 71.4 per cent of families with dependants had both parents employed. The women behind Bree believe that when parents are raising kids in a climate where work and savvy spending are vital to survive, they are constantly at a loss for one asset: time.

Mum-of-two and Bree CEO Ms Boutros says her new app aims to give parents and especially mothers their time back.

“(For) whatever they want. It could be the shower you just didn’t have because you are multi-tasking.

“Whatever your priorities, spend it on your career, you spend it on your family, your connection.”

Research in 2022 revealed that over half of women (59 per cent) take primary responsibility in managing their household’s finances, and Bree Chief Marketing Officer Ms Flores says having the app automate the paying of her bills is “a relief having something that’s just being taken care of”.

“Because everyone knows what needs to be done, right? Everyone knows that if you call your provider, you get a better deal. But you have to carve time out of your schedule. And when is that going to happen? On the weekend? I’d much rather spend that with my child.”

The app’s Chief Expansion Officer, Alice Crawley, who worked her way out of $180,000 in credit card debt at just 33 years old says that it’s “the right time” to be introducing an app like Bree.

“There’s a lot of people experiencing very high degrees of stress around their finances and around coping financially.”

“A lot of people are feeling like something’s got to give, the prices are going up, organisations are getting squeezed for people.

“It’s the right time to be having the conversation around, ‘how are we?’ ‘What can we really offer to help alleviate some of the financial stress for people?’ Because a lot of people are overwhelmed. Whether they’re busy mums, or they’re busy students, or people like me that have three jobs.”

The 52-year-old says she hopes the Bree app helps Aussies who are “simply feeling overwhelmed with financial tasks and budgeting,”

“(Bree) very simply helps to streamline your bills and offers you some breathing room.”

Ms Boutros says she hopes for the Bree app to simply give women; parents and Aussies back the “utility of money and time,” along with sanity.

“It makes you more chill, more relaxed, a better person to be around; a better mum with better energy around your kids. I think that’s immeasurable.”

*During a pilot of Bree’s bill comparison service, participants saved on average between $320 and $950 per year on their bills by switching to a more cost-effective provider.