Former Westpac workers launch fintech solution to common office headache

Two former Westpac workers reckon they’ve solved one of the most annoying inconveniences — the dreaded expense form.

Daniel Kniaz and Russell Martin reckon they’ve solved one of the most annoying inconveniences — the dreaded expense form.

The 27-year-old former Westpac workers, who met in the bank’s innovation team, have launched a new fintech start-up they believe will solve what is a major issue, particularly for small businesses.

While banks offer large organisations corporate credit cards, small businesses are “greatly underserviced” in the sector, according to Mr Kniaz.

“You might be a fast-growing start-up with a couple of million in the bank but you’re not yet cashflow positive, so the bank doesn’t want to give you a credit card, or simply, you have a growing team and the bank will only give you 10 cards,” he said.

The pair left Westpac in 2017 and entered the H2 Accelerator program, where they initially began work on a consumer product.

Their company started as a sort of shared bank account for split payments that would allow groups access to a shared virtual card to make payments for things like rent or utilities.

“We had some good traction but essentially what we found was it was very difficult to get customers to actually activate,” Mr Kniaz said. “We saw lots of downloads but pretty slow activation.”

The second iteration of their virtual card was pitched as a security mechanism for online shoppers who didn’t want to use their real card details.

“We scaled that very quickly and got into a couple of online communities and forums where people liked how easy it was to create an instant virtual card,” Mr Kniaz said.

“But ultimately we found it very difficult to monetise consumers, particularly in the finance space — consumers want everything for free.”

Many of those customers said a similar product could be applicable to their business — it’s common practice for small businesses to share the owner’s credit card around or have employees cover expenses and claim them back.

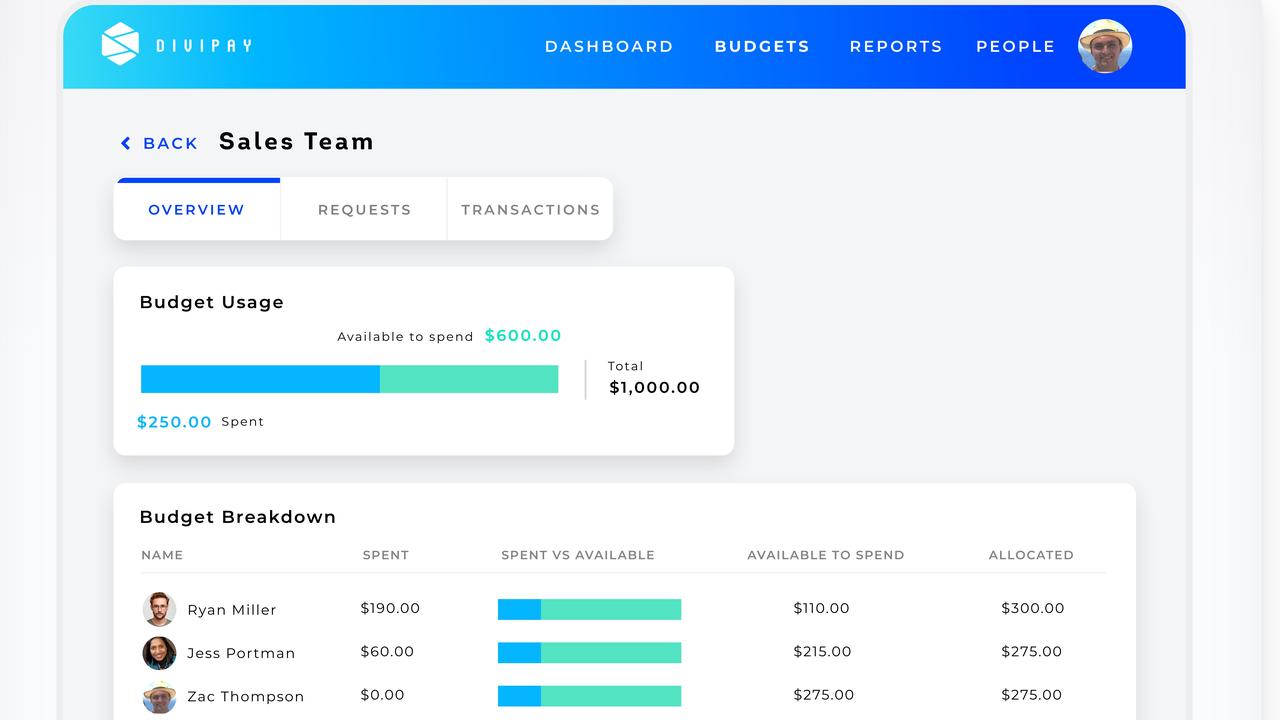

DiviPay, which launched in January and recently inked an integration deal with accounting software firm Xero, is a virtual credit card and automated expense reporting system for small businesses.

“It’s essentially a piece of software for financial managers and their teams to give every person in the organisation access to company money through a virtual card but within a very defined set of criteria,” Mr Kniaz said.

DiviPay has signed on 36 small business customers and is being used by nearly 300 individual staff members, with transaction volume of more than $800,000 and $1 million deposited on the platform.

The platform charges a monthly fee of $19 per user. Mr Kniaz said new customer growth was strong at 25 per cent week-on-week, and transactions were growing at 80 per cent week-on-week.

He has previously described the system as a win for employees who will no longer have to “waste time with expense reports, managing petty cash, chasing receipts and processing reimbursements”.

“Removing this issue can have a big impact on employee morale because it shows the business cares for the individuals who work there,” he said.