Commonwealth Bank named one of seven winners of the annual Choice Shonky Awards

IT IS one of the country’s biggest banks and chances are you’re a customer. But there’s one award this business can bank on — and it’s not customer service.

IT IS one of the country’s biggest financial institutions and chances are you’re a customer.

But there’s one award the CBA can now bank on — and it’s not customer service.

The bank was among seven companies which received an annual Choice Shonky award for the “slick PR campaign it served up to apologise for nearly a decade of dodgy financial advice.”

But according to Choice, the bank’s response to one of the Australia’s biggest financial planning failures was “questionable at best”.

“After a long delay in acknowledging fault, they lobbied to remove financial advice protections while offering up a slick PR campaign in an attempt to apologise for losing consumers’ life savings,” Choice said.

RELATED: COMM BANK RELEASES $2.2M ON TRAVEL CARDS

RELATED: THERMOMIX WINS SHONKY FOR ‘SHREDDING TRUST’

YOUR VOTE: WHO DO YOU THINK DESERVES PEOPLE’S CHOICE?

In July this year the bank faced a Senate inquiry over fraud and misconduct by some of its own financial planners.

Customers lost large amounts of their life savings after being switched into high risk investment products without their consent.

In some cases financial planners even forged client signatures to allow profit-producing product switches.

The Senate report blasted CBA and the corporate regulator over their lack of response to fraud and misconduct by some of the bank’s financial planners.

The CBA paid around $52 million in compensation to 1100 people as a result of scandal. CBA boss Ian Narev later apologised to customers hurt by misconduct in its financial planning business and announced a review process covering a decade of activities within its financial planning businesses, from 2003 to 2012.

who wins the shonkiest shonky? My vote goes to conbank #shonkys pic.twitter.com/P1G7mmfQh9

— Erin Turner (@ErinLTurner) October 14, 2014This years' #shonkys winners @choiceaustralia pic.twitter.com/toECh9xvam

— ACCAN (@ACCAN_AU) October 14, 2014Congrats to @CommBank the final #Shonkys winner for 2014 #ConBank #sorrynotsorry pic.twitter.com/5BRdCjwPZF

— CHOICE (@choiceaustralia) October 14, 2014But Choice chief executive Alan Kirkland said consumers expected a lot more from a big four bank than a sick YouTube video.

“CBA presided over one of the worst financial advice disasters in Australian history,” he said.

“While this stretched from at least 2003 to 2012, it was not until July 2014 that the CBA bothered to make any apology.

“And at the very same time as making that apology, the CBA was actively lobbying the parliament to remove financial advice protections for consumers. This twisted corporate logic defines what the Shonkys is all about. Saying one thing to the public and doing the opposite when they think no one is looking.”

The Shonky Awards put the spotlight on products and services that consumers consider to be sneaky, slippery, unscrupulous and even unsafe.

Choice receives hundreds of nominations for Shonky products from members and staff.

They said the risk of receiving a Shonky should be enough to encourage businesses to “sharpen up their act and put consumers first.”

“This year we had a record 1041 Shonky nominations from across Australia, which highlights the level of consumer concern about shonky products and services,” Mr Kirkland said.

The CBA award comes as Choice today told a Government Committee that key protections for consumers seeking financial advice must be reinstated after the wind back of the Future of Financial Advice (FoFA) protections earlier this year.

The Committee is looking at proposals to increase education standards for advisers but according to Choice it is nowhere near enough.

Mr Kirkland said raising education standards in the financial advice industry without addressing conflicts of interest would only “lead to better educated advisers taking advantage of consumers.”

“FoFA regulation and legislation must be amended to establish a clear, professional obligation for advisers to act in their clients’ best interests with no exceptions.

“We also need to rule out all kinds of conflicted payments like commissions for insurance products and bonuses for bank staff.

“Until we fix FoFA, the CBA’s of the world will be able to continue their shonky behaviour.”

Mr Kirkland said he believed customers deserved a lot better from the CBA.

While not every Shonky Award winner may be necessarily be breaking laws or breaching regulations, Choice said it believed consumers deserved better products and services.

“We hope the Shonkys encourage consumers to look critically at the goods and services they use, and question poor service, hidden costs and the fine print beneath claims that seem too good to be true,” Mr Kirkland said.

But it wasn’t just the CBA which came under the spotlight, with six other companies also named and shamed in the annual awards.

Arnott’s Tim Tam (Peanut Butter Flavour)

Australia’s favourite biscuit left a crumby taste in some consumers mouths over its peanut butter variety. Not only did the biscuit fail to contain any actual peanuts (although it did include paprika), but Arnott’s also cut the size of the pack by two biscuits (35g from the pack) “while maintaining the same price and package size.”

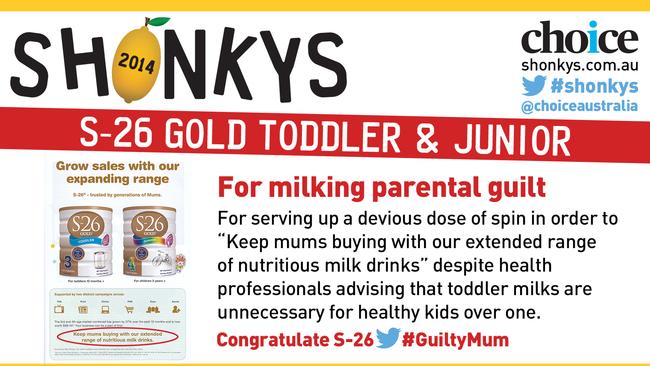

S26 Gold Toddler and Junior

The formula left a few consumers chucking a dummy spit over its marketing spin in an industry trade magazine, with the sell: “Keep mums buying with our extended range of nutritious milk drinks”. But according to Choice, most health professionals agree the powdered formula mix isn’t needed for healthy babies over one who instead should be having solids and developing better eating habits. “So for milking parental guilt in a toddler and junior formula market worth over $99m, we think it’s time S-26 was watered down with a hefty dose of lemon,” Choice said.

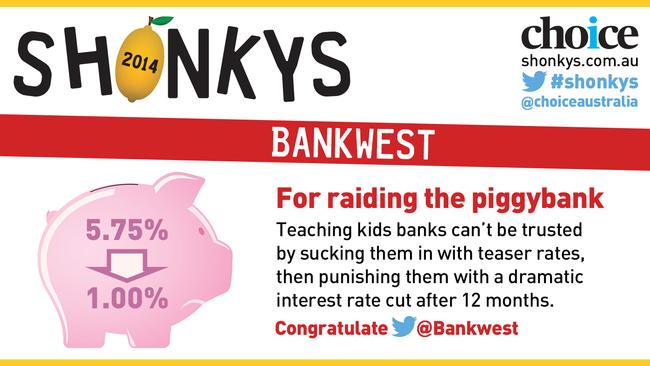

Bankwest

CBA wasn’t the only financial institution to come under the spotlight, but Bankwest also showed it can’t be trusted according to Choice. It was awarded a Shonky for offering a 12 month teaser rate of 5.75 per cent on its Bankwest Kids’ Bonus Saver account before sweeping all but $1 into a low interest account paying just one per cent for amounts below $3000.

But it didn’t stop there, Choice said kids were also punished for making withdrawals with a miserable rate that month of 0.01 per cent.

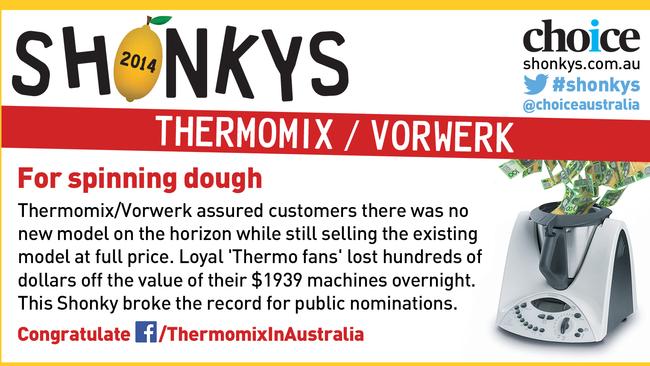

Thermomix/Vorwerk

It is the mixer on all kitchen whiz’s wish lists, but while it preforms well in tests, the company behind it “shredded its public trust” this year, resulting in more than 530 nominations from the public. Not only did the flawed launch of its new model leave loyal ‘Thermo fans’ out of pocket but also sparked a massive consumer revolt. The company’s decision not to notify consumers of the imminent release its first new model in seven years also earned Thermomix a referral to the ACCC.

Kmart Swimwear

Retail giant Kmart earned a Shonky and were called unAustralian for selling swimwear that could become see-through when wet? But what also earned them some unhappy customers was the warning they carried: Avoid “excessive contact” with suntan lotions, oils, rough surfaces, heated pools and span treated with harsh chemicals. All right then.

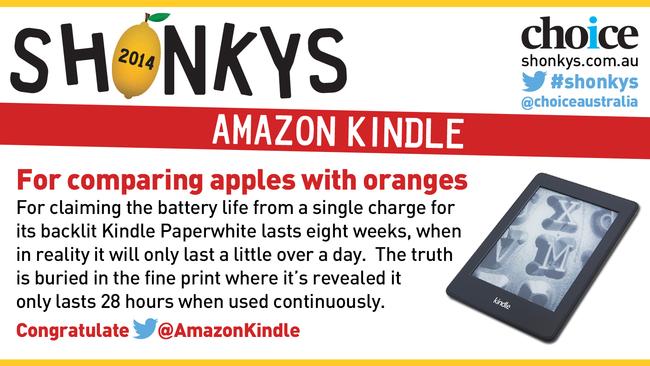

Amazon Kindle

This is one product you shouldn’t judge by its cover, Choice reveals.

While one of Amazon’s biggest selling points for its new Kindle’s Paperwhite e-reader is that it can last an impressive eight weeks, the fine print reveals that the eight weeks of battery life relies on the Kindle Paperwhite being used for just 30 minutes a day. In other words, the Kindle’s battery life is actually 28 hours which according to Choice is typical for many e-readers. The claim not only earned this product a Shonky, but also a referral to the ACCC.