Why fixing your home loan now could lead to regret

One in ten homeowners are planning to refinance their mortgage to a fixed rate following the latest rate cut, but experts warn they may come to regret acting prematurely.

One in ten homeowners are planning to refinance their mortgage to a fixed rate following the latest rate cut, but experts warn they may come to regret acting prematurely.

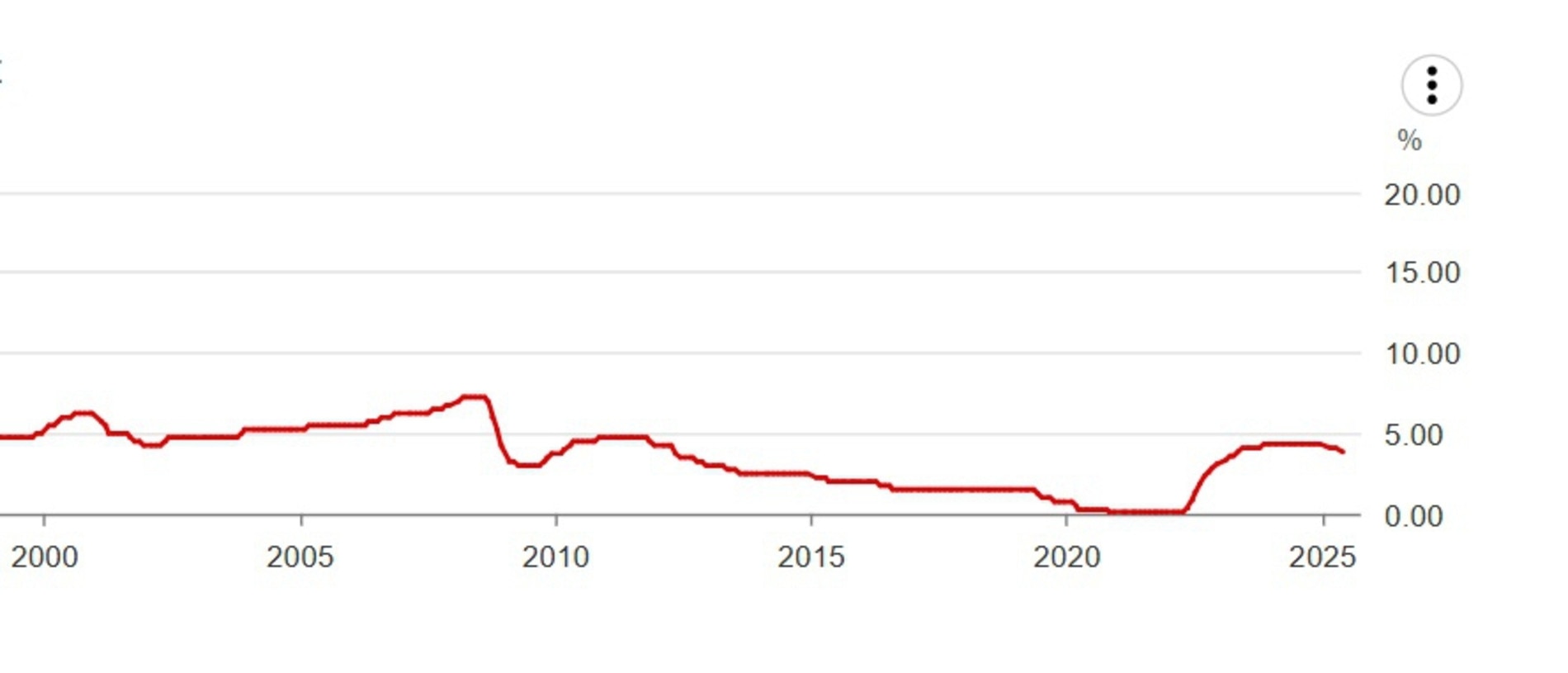

The Reserve Bank of Australia slashed the official cash rate by 25 basis points on Tuesday to 3.85 per cent, marking the first time the cash rate has been below 4 per cent since May 2023.

It was the second cut this year, with more expected in the coming months.

A survey of 1000 Aussies for Money.com.au found that 10 per cent of borrowers were now looking to fix their home loan but mortgage expert Mansour Soltani has warned it is still too soon to fix,

with more rate cuts expected this year and lenders likely to keep adjusting their offers.

“The best time to fix is at the bottom of the rate cycle and when markets aren’t expecting any

more rate cuts,” Soltani said.

“It’s also when banks start offering real discounts to lock you in.

“For example, back in 2021 when rates were below 2 per cent and there was no sign of movement, a huge segment of the market sensibly fixed their home loan for two, three, and even four years.”

But Soltani said that fixed rates were still catching up to the new rate environment, so the most competitive fixed rates will likely come later this year or in 2026.

“Banks expect overall interest rates to settle around the high 4s to low 5s, and that’s when we’ll start to see more competitive fixed rate offers as lenders look to lock in customers,” he said.

MORE: Stubborn bank’s shock call after ‘shame list’

‘Stupid’: Blunt warning amid RBA rate cut frenzy

Rate cut reality check: 60pc of Aussies still struggling

Based on RBA data from the past five years, the average short-term fixed rate (three years

or less) was 4 per cent a year, while the average long-term fixed rate (more than three years) was 4.42 per cent.

The research found that 45 per cent of homeowners have not yet decided if they will refinance in 2025, while 25 per cent are waiting for rates to fall further.

About 17 per cent plan to refinance to a lower variable rate, and 3 per cent are considering a split loan.

But those that move too soon may live to regret it, Soltani said.

“Besides the fact that you won’t benefit from future rate cuts while on a fixed loan, you also

need to consider the term and rate on offer — each fixed period comes with a different rate,

and there are trade-offs,” he said.

“Most lenders cap extra repayments on fixed loans at around $10,000 a year, so if you earn commission or bonuses, fixing might not be the best fit.

“Plus, if you’re thinking of selling, you could get stung with break fees for closing the loan

early.

“These fees can run into the thousands, depending on how many years are left on your

fixed term and how much market rates have changed since you locked in.”

The research comes after Finder revealed that 60 per cent of Aussie borrowers are still experiencing financial strain despite recent interest rate cuts.

It found that half of borrowers (50%) would still need two or more interest rate cuts to comfortably afford their mortgage, while 17 per cent – equivalent to 561,000 mortgage holders – would need five or more cuts.

“Only one in three (32%) said they would be completely fine with their rate even before the cut,” the survey found

“A further eight per cent said they only needed one cut to be comfortable, and they just got it.”

Originally published as Why fixing your home loan now could lead to regret