Up 90pc: Single rooms in sharehouses soar to $570 a week

Aussie share homes have hiked 90 per cent, with wild prices for a single room now revealed - and they’re not even in the city.

The cost of renting a single room in a city sharehouse has soared by up to 90 per cent in a year, with tenants paying more than the median weekly rent for an entire house in some outer suburbs and regions.

The shock finding was revealed in the annual Flatmates.com.au National Share Accommodation Survey (NSAS) of over 8700 respondents across the country.

It revealed that 35 per cent of respondents reported rent increases in the past six

months – half of which were higher than anticipated.

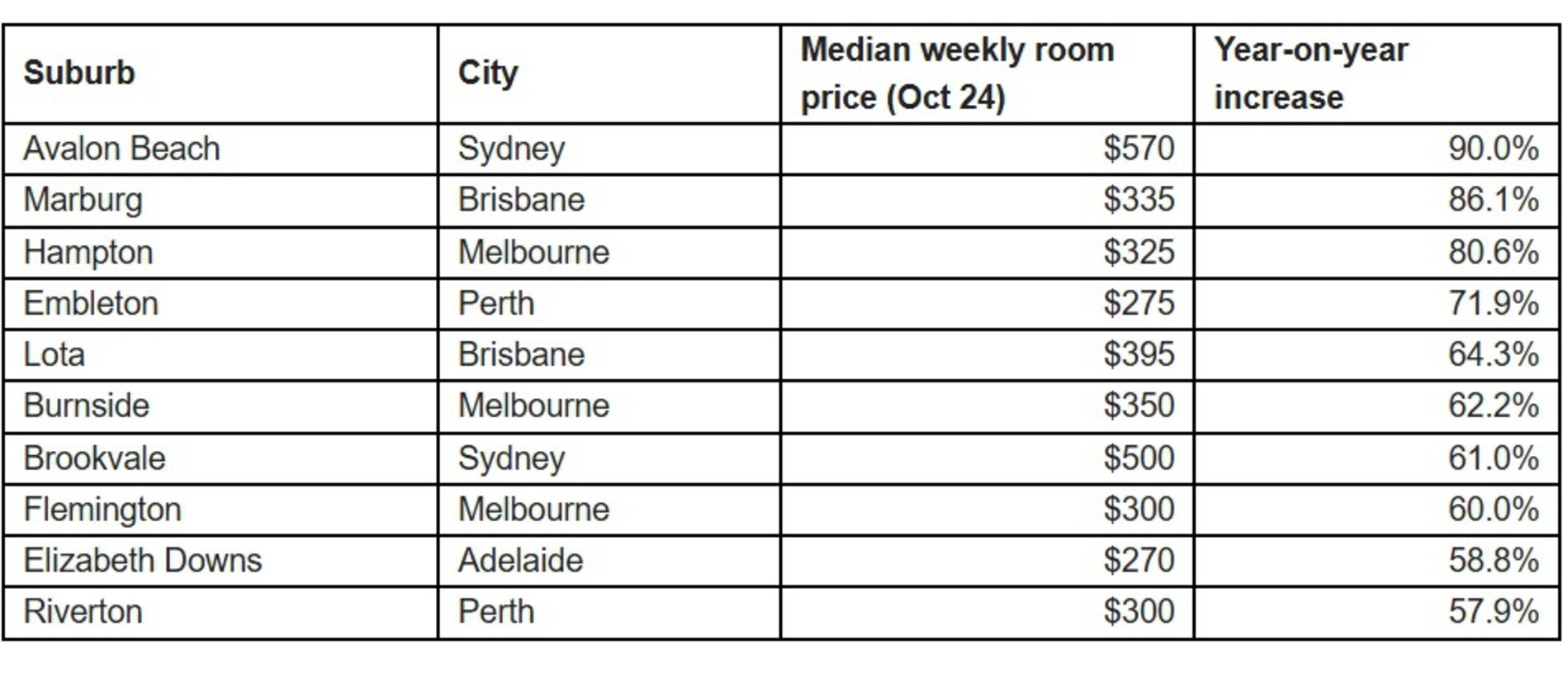

The biggest year-on-year increase was at Avalon Beach in Sydney, with an average room in a sharehouse now costing a whopping $570 a week - up 90 per cent compared to last year.

It was followed by Marburg in Brisbane, where the median weekly room rent is now $335, up 86.1 per cent.

Rooms in Hampton in Melbourne are also up 80.6 per cent, with a median now of $325 a week.

It comes as rental affordability sits at its worst level in at least 17 years, when records began, according to PropTrack’s Housing Affordability Index.

Flatmates.com.au product manager Claudia Conley said that ongoing cost of living pressures

over the past 12 months had reshaped how Australians approached housing, with 43 per cent of respondents saying affordability constraints had pushed them into share accommodation.

“Additionally, 35 per cent of renters have faced rent increases in the past six months, with half of these hikes exceeding expectations, highlighting the growing financial strain on tenants,” Ms Conley said.

“With 57 per cent of respondents struggling to keep up with rent payments over the past year, the effects of the rental crisis remain present for many Australians.

“Furthermore, the sentiment among 55 per cent of survey respondents that property ownership is out of reach for young people highlights the growing sense of uncertainty about long-term housing security.”

MORE: Sizzling forecast for Brisbane home prices in 2025

Australia’s cheapest homes: 20 places to buy for under $100k

Huge prediction for Aussie house prices

But the pressure is not just on tenants in the heavily populated eastern state capitals.

The median weekly rent for a room in Embleton, a suburb of Perth, is now $275, up 71.9 per cent.

It was followed by Lota in Brisbane, where median room rates have increased 64.3 per cent to $395 a week.

Room rates in Burnside in Melbourne have increased 62.2 per cent in a year to hit $350 a week.

Renters in Brookvale in Sydney are now paying 61 per cent more now than a year ago, with a room now averaging $500 a week.

Rooms in Flemington in Melbourne (+60% to $300), Elizabeth Downs in Adelaide (+58.8% to $270) and Riverton in Perth (+57.9% to $300) rounded out the top 10 suburbs where room rates have increased the most in 12 months.

And alarmingly, it is not just young renters who are feeling the heat.

The survey revealed a higher proportion of members aged over 55 had entered into share house arrangements (up 7 per cent year-on-year), with the 75-plus age group now the fastest growing demographic.

Of those who are over 55, approximately one in two (51.6%) stated that cost of living and being unable to afford to live alone were their main reasons for entering share house living, while around one in 10 were doing so for companionship.

“While share house living has long been associated with younger demographics who might be

unable to crack into the housing market, we have seen a significant increase in Australians over 55 entering share house living arrangements in recent years,” Ms Conley said.

“Half of respondents over 55 did so through financial necessity, however there was also a 30 per cent rise in respondents opting for shared living for the companionship that it offers.”

Financial strain was also forcing those with a spare room to rent it out to ease the economic burden.

Of the respondents who had listed a room, over a third (36%) had an additional unoccupied room, with nearly three-quarters (72%) aiming to lease the space to manage rising rent costs and financial pressures.

Forty-eight per cent of respondents said they would also be willing to live in a “home

share” scenario with reduced rent in exchange for 10 hours of work per week around the home.

The survey also found that 36 per cent of landlords had offered their home as a share house for less than a year and 28 per cent had done so for one to two years.

“These extra rooms have helped to provide critical relief through more difficult rental market conditions,” Ms Conley said.

“While offering a property for shared housing can help manage overall costs, we did see over

one fifth (22%) of surveyed property listers consider selling one or more of their properties in

2024 due to higher interest rates.”

It comes after The Greens revealed they would now vote in favour of the Albanese government’s Help to Buy and Build-to-Rent housing bills.

The Help to Buy shared equity scheme is poised to help up to 40,000 homebuyers secure a home deposit faster, while the Build-to-Rent changes will incentivise foreign investors to build more rental homes in Australia.

Housing Industry Association (HIA) managing director Jocelyn Martin said the housing bills can play an important role in supporting young Australian’s access housing and address declining rates of home ownership.“The measures supported as part of these ‘Housing Bills’ alongside other forms of housing incentive programs are critical to boost housing supply,” Ms Martin said.

Originally published as Up 90pc: Single rooms in sharehouses soar to $570 a week