Three bedroom house in Mount Druitt sells for same price as castle in French countryside

Thanks to Australia’s ridiculous housing market, that dream to pack everything up and disappear to some European burrow might not seem so out of grasp.

That dreamy retirement plan to pack everything up and disappear to some European burrow tucked away in the countryside might not seem so out of reach.

All you have to do is take a look at what $1.3 million gets you in Sydney these days and compare.

As house prices continue to skyrocket beyond what’s reasonable for ordinary Aussies to save for and repay, some castles in France remain surprisingly stagnant.

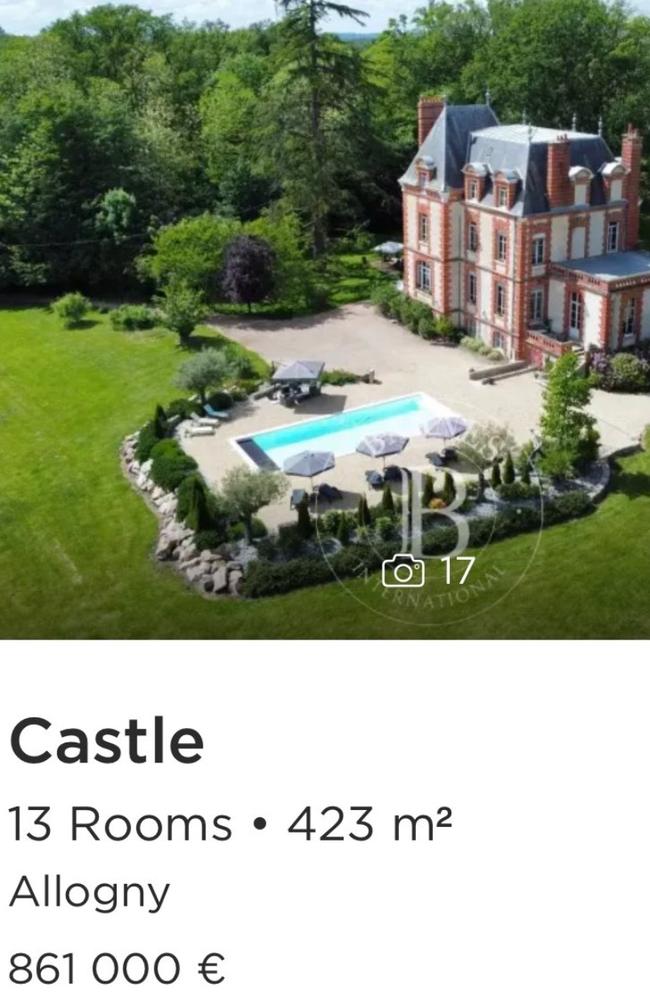

One image posted by the Reserve Bank of Property X account showed just how bad Sydney’s housing market has become, with a three bedder in Mount Druitt some 33km west of the CBD going for roughly the same price as a 13-room castle with a swimming pool smack bang in the middle of France.

At a going price of 861,000 euros, or $1.38 million, the chateau features a lot more than your average brick and tile quarter acre block on offer in Australia.

“With a total surface area of 420 m² and 4 levels (excluding cellars), this chateau stands in the centre of 1.4 hectares of parkland. Renovation work has been carried out to make the interior more comfortable, while carefully preserving period features such as moldings, parquet flooring, wood panelling and fireplaces,” the property’s description reads.

On the other hand, you could get a house with three bedrooms, three bathrooms and five parking spaces in Mount Druitt for $100,000 less.

While other parts of the developed world are also going through housing price booms that have whittled away home ownership aspirations in younger generations, it’s no secret Sydney has become one of the worst places on the planet to live, if you earn a modest wage.

Just last week, Sydney topped the list for being the most unaffordable in Australia and was only behind Hong Kong across the world for real estate prices.

Another report released in March found buying a house in Sydney is less affordable than in the notoriously expensive markets of London, Los Angeles and Miami.

Almost all of Australia’s capital cities ranked in the top 25 per cent least affordable markets for middle-income home buyers, with Sydney, Melbourne, Adelaide, Brisbane and Perth making up a grim list of the least affordable 25 per cent of cities across the globe.

In the NSW capital, housing is 13.8 times the median income in the city, meaning young people will now have to save for around 15-20 years from scratch to pull together a deposit.

Melbourne was also categorised as drastically unaffordable, with cost of a home coming in at 9.8 times more than the median income.

“For decades, home prices generally rose at about the same rate as income, and homeownership became more widespread,” The Chapman University report said.

“But affordability is disappearing in high-income nations as housing costs now far outpace income growth. The crisis stems principally from land use policies that artificially restrict housing supply, driving up land prices and making homeownership unattainable for many.”

The government has reportedly placed housing affordability high on its agenda as young Aussies get increasingly vocal about the reality they have stepped into after joining the workforce.

Housing Minister Julie Collins said the government had committed more than $25 billion to address the housing crisis over the coming decade.

One of its flagship programs is the Help to Buy scheme will help low- and middle-income Aussies to purchase with just a two per cent deposit. The Commonwealth then takes an equity stake of up to 40 per cent for new dwellings and up to 30 per cent for existing properties.

“We want to help more renters become homeowners through our Help to Buy shared equity scheme, which will reduce the cost of a mortgage by up to 40 per cent for low- and middle-income earners,” she said.

“For tens of thousands of Australians, this will mean a smaller deposit and smaller ongoing repayments.”

One of the major underlying issues is the fact that wages are not keeping up with the booming housing market and inflation.

While households on low incomes have seen faster income growth than other demographics in recent years on the back of minimum wage increases, it simply isn’t enough as the price of services and groceries skyrocket.

The Fair Work Commission also increased the minimum wage by 5.75 per cent for the 2023-24 financial year, adding about $48 per week to the pay packets of full-time workers.

But the rental market remains uncomfortably tight, especially in Sydney and Melbourne. Sydney in particular has seen a massive spike in rent prices following the pandemic as the government boosts immigration numbers to bolster the economy elsewhere.

People in the bottom quarter of incomes are now paying around $53 per week more on rent over the past 12 months, much to the benefit of landlords.

Aussie homeowners on high incomes have become more reliant on the private rental market, according a recent ANZ report.

“Part of the reason for higher income households in the private rental market over time likely comes back to longer term declines in the rate of home ownership,” the report said.

But even those who scraped together for a deposit are finding themselves in trouble, with record amounts of Aussies now under mortgage stress, which is when you pay more than 30 per cent of your take home income back into your house.

“Based on the latest estimate of median annual household income nationally of $100,244 before taxes, and assuming 30 per cent of this income is used on mortgage payments at current average variable rates, an affordable dwelling purchase would be around $503,000,” the report continued.

“However, ongoing increases in housing values mean that this affordable purchase price is below most actual dwelling values, with the median Australian unit price around $640,000, and the median house price around $834,000 across Australia.”

More Coverage

In short, you’ve simply got to earn more money to be comfortable in Australia’s biggest cities.

But if ever you throw your hands up, flip your desk and say “I’m out” ... there’s always that castle in France.

Because that lovely $1,242,000 three bedroom house in Mount Druitt has already been sold.