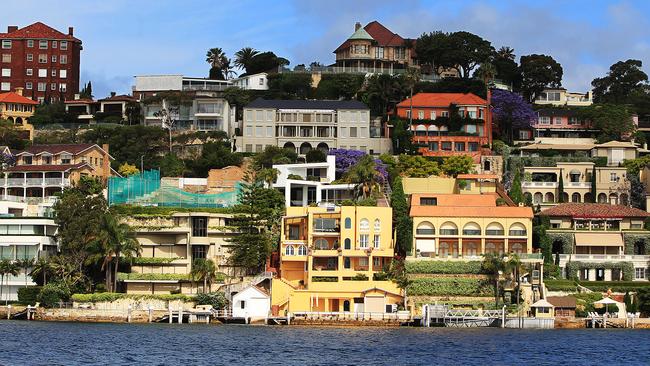

Greens propose trophy home tax to pay for affordable housing

The proposal could rake in more than $32 million a year – targeting billionaires in particular – and fund crucial projects.

Taxing the mega rich for their luxury trophy homes could bring in millions to tackle the affordable housing crisis, according to a new proposal from the Greens.

The NSW political party wants to introduce an Extreme Wealth Property Tax, which would charge a 4 per cent tax on owner-occupied mega-mansions with a land value over $10 million, or for an improved value exceeding $20 million.

Modelling found that just 10 extremely expensive properties in Sydney would rake in $17 million in tax and fund the creation of 86 affordable homes with two bedrooms a year.

Expanding out the proposal further, if just 40 properties valued over $20 million were taxed

it would bring in a whopping $32 million annually based on an average land tax of $1 million per property, the Greens analysis found.

This would fund the creation of 160 units with two bedroom a year which is more than a quarter of the number of public and social homes that the NSW government created in the 12

months between 2021/2022, according to the Greens.

Greens Newtown MP Jenny Leong, the spokeswoman on housing and homelessness, said the tax would target those at “the really extreme wealth end of the housing market”.

“There are people who have [homes worth] $20 million, $30 million, $100 million, and because they’re owner-occupied, they don’t pay any land tax on those whatsoever,” she told the Sydney Morning Herald.

“Let’s start talking about taxing the billionaires and the mega-mansions as a way to be able to fund and invest more in affordable housing.”

However, she flagged there was currently a lack of information “on massive mega-wealthy homes” in Sydney, which was concerning.

“We want a city for everybody, and we want people to be able to afford to live in our city. It shouldn’t just be about substandard key worker housing where people are given a tiny bedroom and shared facilities so they can service the needs of the rich and famous,” she added.

The NSW Greens also want to amend existing land tax on properties above the premium threshold – where they are worth over $5.92 million – by increasing it from 2 to 5 per cent.

It also wants to extend the premium threshold to include investors with eight or more properties.

Other housing proposals from the party include abolishing the build-to-rent 50 per cent land tax concession unless these developments yield at least 30 per cent ongoing social and affordable housing on private land and 100 per cent on publicly owned land.