$4.5 trillion: Baby Boomers’ seismic move

They’re sitting on an insane amount of wealth and Baby Boomers have started making the move that will wipe the rest of us out.

Baby Boomers are making their move.

Queensland recorded the highest number of property settlements among the five mainland states in the September quarter, according to data from electronic conveyancing company, PEXA.

There were 183,288 settlements across the five states, with Queensland recording 48,361 – or 26 per cent.

The reasons for Queensland having more sales include strong levels of interstate migration.

Queensland has always been a popular lifestyle destination for retirees, and that trend continues. But we’re finding it’s on a larger and increasing scale today.

MORE: ‘Walking on water on LSD’ Russell Crowe’s $42m play

As we discuss in the McGrath Report 2025, we’ve now got this historically large generation of Baby Boomers reaching their 60s and 70s, and many of them are deciding to downsize or relocate now.

This has implications for many sea-change and treechange markets, not just because it’s lifting demand generally, but also because many Baby Boomers have generous budgets to buy with. So they can compete at auction more confidently and with fewer limits compared to other buyers.

This group of Australians bought family homes many decades ago when the cost of housing against income was lower. Thirty or forty years of capital growth has generated significant wealth for them, and they’re taking that money out of the expensive capital cities into more affordable regional areas.

This is one of the reasons for the particularly strong price growth and record high median home values we see today in Brisbane and regional Queensland.

MORE: Infamous Aussie spy home’s mind-blowing reveal

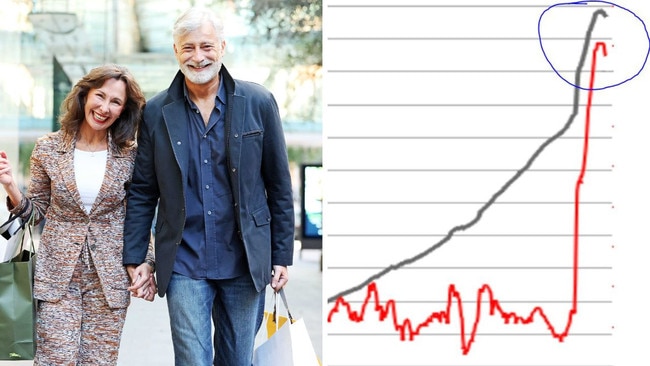

According to McCrindle data, Baby Boomers hold close to half of Australia’s private wealth. Australians aged 60 and over own a combined $4.5 trillion in assets, with at least $3 trillion of this – much of it in property – to be passed on to their children over the next decades.

Many Baby Boomers are releasing capital by selling their family homes, buying a new place for themselves on the coast, and giving their kids a bit of help to fund the deposit on their first home.

That transfer of intergenerational wealth is already affecting the market.

Many young people, especially in the big cities, cannot buy their first home without the Bank of Mum and Dad.

The power of that wealth transfer is glaringly evident, given we’re seeing above-average numbers of first home buyers in the market despite higher interest rates and a cost of living crisis.

Downsizing from the family home to one requiring less upkeep becomes more appealing as people age, and the downsizer super contribution scheme is encouraging Baby Boomers to make this move.

MORE: Why this humble house sold $2m over expectations

The scheme allows Australians aged over 55 years to contribute $300,000 per spouse from the sale proceeds into their superannuation fund tax-free.

Whilst some potential downsizers need to carefully consider the impacts of a home equity release on asset thresholds that apply to income support payments, these issues do not come into play for the one in three Australians aged over 65 who are fully self-funded retirees*.

Baby Boomers typically want a safe home that has space for hobbies and guests, is near public transport, requires little maintenance and has room for a small garden. So, they’re often drawn to medium and high-density attached dwellings, such as semis, terraces, townhouses and apartments.

However, to date, it has been difficult for Baby Boomers to find the types of homes they need in their preferred locations. The good news is that things are about to change.

MORE: $5m secret that delivered Hunt to Broncos

More supply of quality, affordable housing will likely be made available over the medium term as the National Housing Accord is embraced by all levels of government and the residential development sector.

This presents a strong opportunity for private landowners and developers to take advantage of new planning controls to build more of those smaller homes that will appeal to downsizers.

*Older Australians, Australian Institute of Health and Welfare website, published July 2, 2024

** John McGrath is the founder, Managing Director and Chief Executive Officer of McGrath Estate Agents

Originally published as $4.5 trillion: Baby Boomers’ seismic move