Survey reveals how long it takes first homebuyers to save a home deposit

New research has revealed how long it is taking first homebuyers – both singles and couples – to save a deposit.

First homebuyers are taking more than eight years to save for a home deposit, according to new research.

A survey of first homebuyers across Australia has revealed almost 90 per cent are stressed about their ability and the time it takes to save, citing bills and household expenses as their biggest roadblocks.

Meanwhile, 29 per cent of first homebuyers are receiving some form of help from family, up from 21 per cent last year.

MORE

Fallen NRL star’s big post footy move

King Charles ‘miffed’ at being forced to pay rent

Canstar’s 2023 First Home Buyer Survey revealed that first homebuyers are saving an average of $1605 per month, an increase of $188 from the same time last year.

According to the research, the increase in savings cuts nearly two years off time to save a 20 per cent deposit for a single buyer however it will still take eight years and eight months.

For a couple, the increase cuts nearly a year off savings time to just over four years.

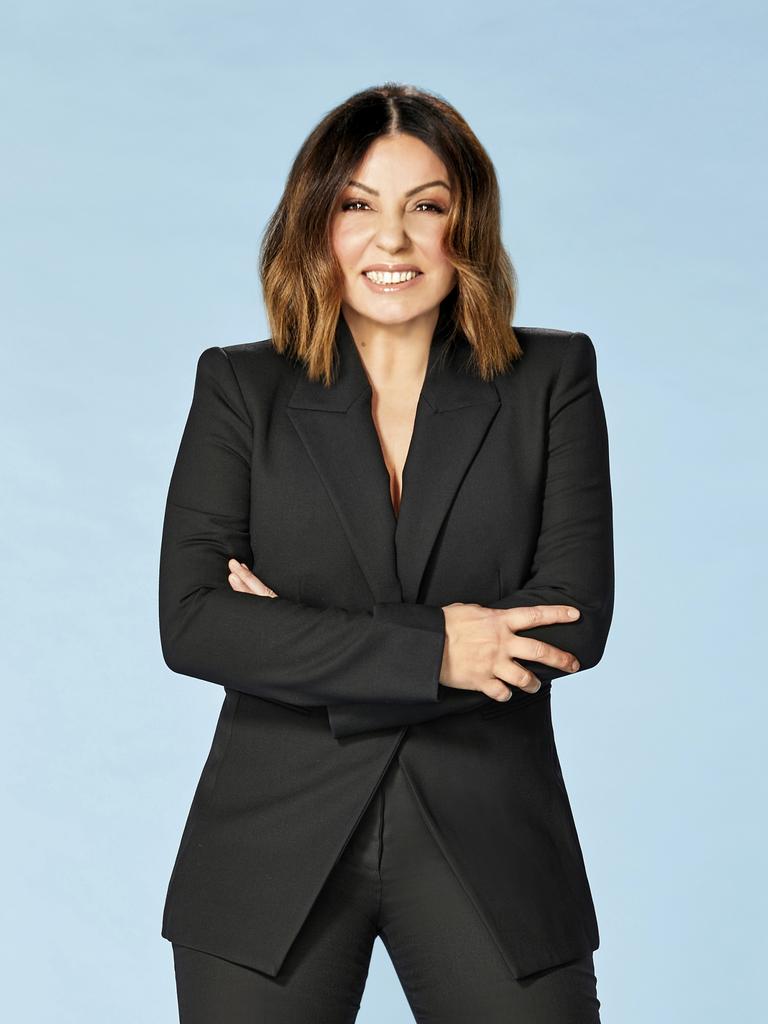

Canstar’s editor and money commentator Effie Zahos said the savings data showed that first homebuyers were determined despite the costs of living challenges.

“Property prices are continuing to rise but rents are also rising to historic highs,” she said.

“Renters are no doubt feeling the pressure to get a foot on the property ladder. Nine in every ten potential first home buyers are prepared to make comprises to buy sooner.

“Radically reducing their spending was top of the list for what they would comprise on followed by purchasing an older property and buying an apartment over a house rounded out the top three.”

One quarter of first homebuyers didn’t know how much they were saving while 13 per cent said they weren’t in a position to save.

Barries to saving included bills and household expenses, followed by rent and eating out.

Ms Zahos said young people needed to be realistic about their savings.

“Focusing on what you can realistically save and being flexible with your timeline can alleviate the pressure until your financial situation improves and you can boost your savings balance,” she said.

She said the bank of mum and dad had also changed with many parents offering “less risky” help such as allowing kids to live at home rent free as opposed to diving into their pockets.

MORE

‘Never say die’: Bond-style home has secret trapdoor

Hoarder home full of junk sells for millions

Sydney suburb where prices are going ‘bonkers’

The data comes as Australian Housing and Urban Research Institute (AHURI) research – from the University of Sydney and RMIT University – reveals one third less homebuyers are getting into the market compared to previous generations.

It shows modern first homebuyers face house prices three times compared to previous generations, while only earning 1.6 times the income.

“Our research certainly shows that over the last 30 years, ownership rates for households at age 30 to 34 have declined substantially; from 65 per cent of people born in the mid to late 1950s being homeowners by age 30 to 34, to only 45 per cent of people born in the mid to late 1980s,” Professor Stephen Whelan, from the University of Sydney, said.

“This fall in ownership rate has happened as house prices have nearly tripled, indicating that increasing house prices and falling affordability are associated with a delay in housing market entry for Australian households.

“But more importantly, while this may represent in part simply a delay in younger Australians buying a home, our research shows that as these younger groups of people grow older they are less likely to ‘catch up’ and buy a home.”

Prof Whelan said this increased the likelihood of poverty among people who have retired but are still renting.

Originally published as Survey reveals how long it takes first homebuyers to save a home deposit