Suburbs where properties are rising by up to $51k every month

Australia’s property market skyrocketed by 20 per cent in the last year, which for one lucky LGA means their houses are up by $618k since 2020 or $51k a month.

Australia’s property market has been turbocharged by the Covid-19 pandemic with some suburbs experiencing growth of more than one third of their original price in the past year.

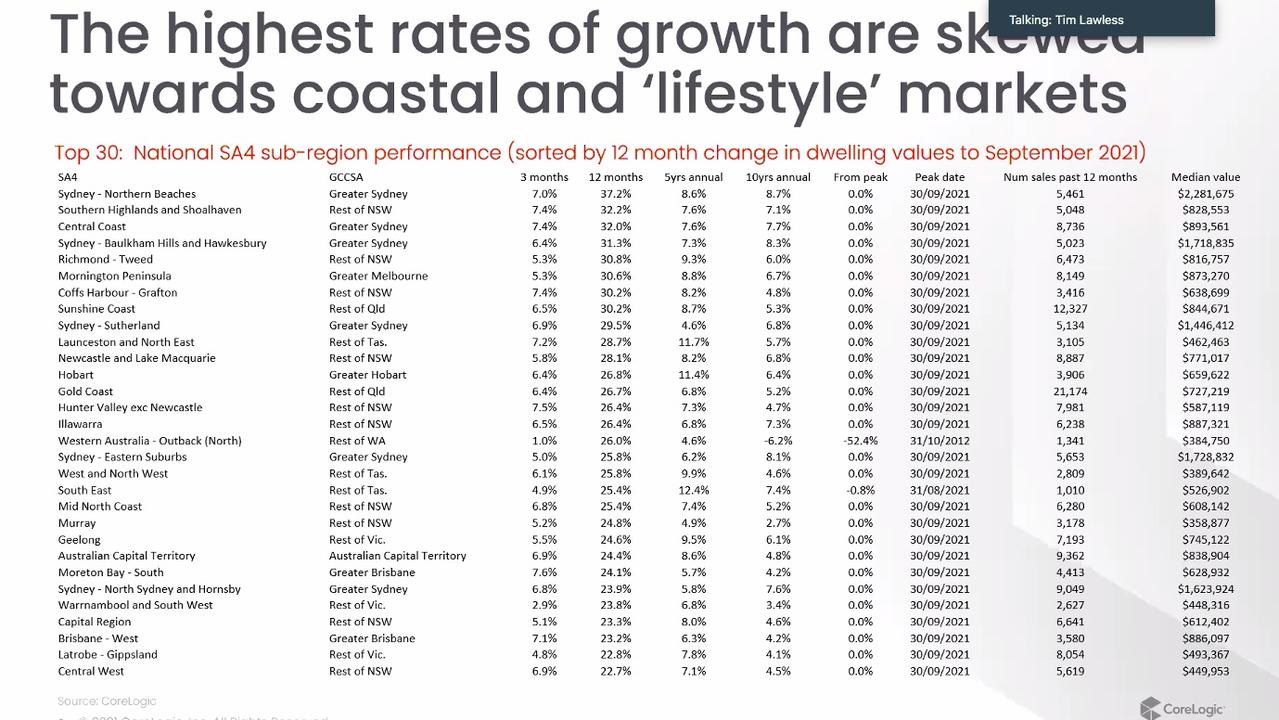

The top performing suburb grew by 37.2 per cent in the 12 months to the end of September, with the median house in that area selling for $2.2 million.

That means homes in that suburb rose by a total of $618,000 in a year, or $51,000 every month.

Property analysis firm CoreLogic released the new data at a live webinar on Thursday with the company’s head of research, Tim Lawless, the keynote speaker at the event.

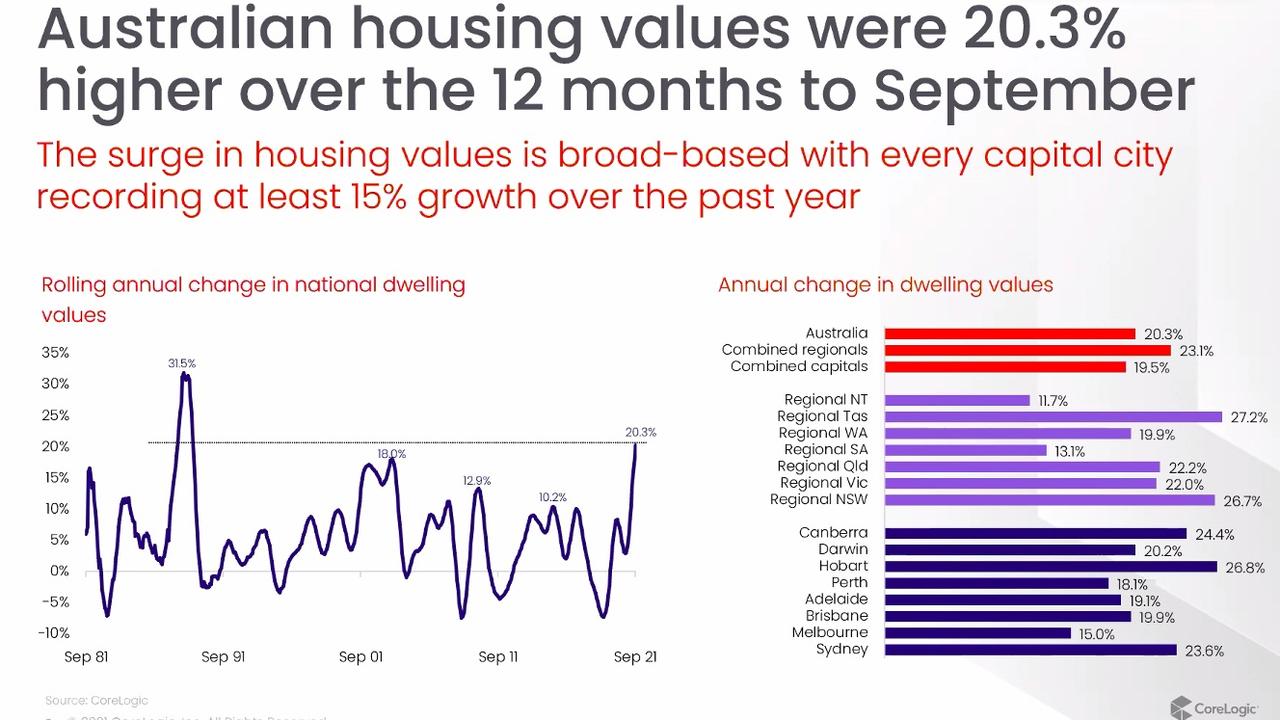

Mr Lawless said that on the whole, “capital cities have underperformed compared to the regions” in the past year.

“Sea change and tree change is driving these regional markets,” according to him, which he added was thanks to the working from home trend inspired by lockdowns across the country.

Some of these suburbs’ massive growth rates were attributed to either the “lifestyle” or “coastal”appeal in the area.

The top five spots were taken up by the state of NSW, with Sydney’s prestigious Northern Beaches taking out the number one ranking.

Behind the Northern Beaches on the leaderboard were three non-capital localities in NSW — the Southern Highlands, the Central Coast and Tweed — as well as one fringe suburb of Sydney, Baulkam Hills.

In total, 16 NSW suburbs made it onto the top 30 spots across Australia, hogging more than half the list.

As well as the ones already mentioned, those areas included Coffs Harbour/Grafton, Sydney’s Sutherland Shire, Newcastle, the Hunter Valley, Illawarra, Sydney’s eastern suburbs, the mid north coast, Murray, Sydney’s north shore, the Capital region and the central west.

Victoria underperformed considering its population size, with just four suburbs making it onto the top 30 places across the nation.

Those suburbs were the Mornington Peninsula in southeast Melbourne and then three regional locales, Geelong, Warrnambool and Gippsland.

Mr Lawless and other real estate experts at the conference suspected this was because the many months of lockdown in the embattled state had seriously handicapped its property market.

Tasmania and Queensland both got four of their regions on the list, the same number as Victoria.

Tasmania’s Launceston, Hobart, and also the west, northwest and southeast of the state experienced major rises in value.

Over in Queensland, the Sunshine Coast, the Gold Coast, Moreton Bay and West Brisbane got honourable mentions.

Western Australia and Canberra each got one mention on the graph.

The property market experienced unbelievable growth in the last year, with a 44.6 per cent rise in sales from September 21 this year compared to last year, according to speakers at the conference.

Housing values rose by 20.3 per cent in that time, with capital cities recording at least 15 per cent growth.

Earlier this month, Australia’s property market surpassed $9.1 trillion in terms of its value.

National house values reached an average of $719,209 over September, while units are sitting at $586,993.

Mr Lawless had both good and bad news when predicting the future of Australia’s property market, especially when it came to first home buyers.

On the one hand, he predicted that the next 12 months would see slight declines in value, making it easier for someone to enter the property market.

“You’d have to expect with pricing coming out of the mainstream budgets, there’d probably have to be a bit of a pullback,” he told viewers.

“We are starting to see sales activity slipping a bit.

“I wouldn’t be surprised if we finished the 2022 calendar year with between five and 10 per cent growth.”

That’s significantly less than this year’s growth of 20 per cent.

CEO of the Agency Real Estate, Matt Lahood, also thought the outlook was encouraging for newbies jumping on the property ladder.

“Perhaps a little easier for first home buyers to enter the market,” he said in the conference.

However, it’s not all good news for first home buyers.

Mr Lawless predicted by mid-2023 or by 2024, there will be a lift in interest rates.

As a result, “Lenders are going to become more cautious (so) they might be insisting on a 20 per cent deposit,” according to him.

“A lot of government incentives have generally expired,” Mr Lawless added.

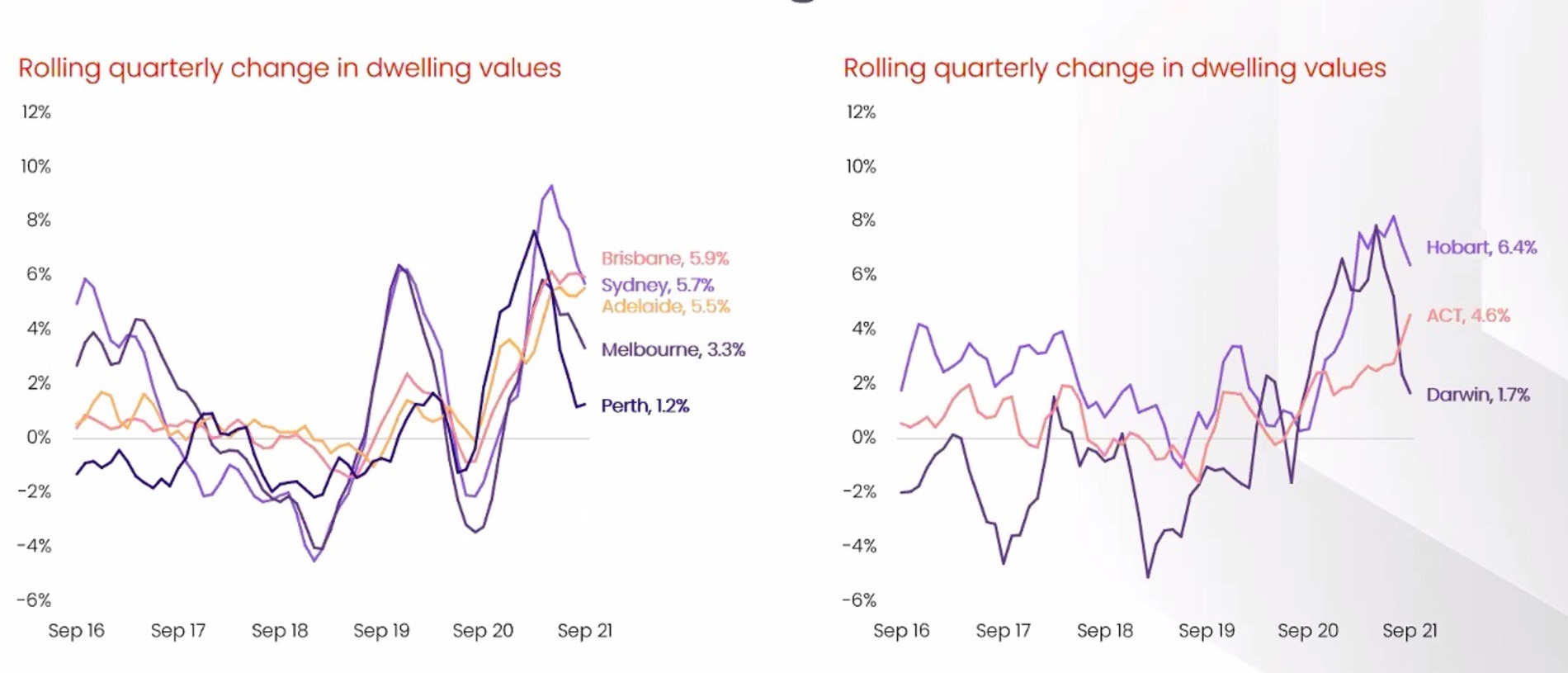

He was also bullish about property markets in southeast Queensland, Perth and Adelaide as they are “outperforming” other areas.

“They offer up commutability, liveability as well as to some extent affordability” he explained, whereas “Really expensive markets like Sydney and Melbourne are not quite as strong”.