RP Data analysts reveal Perth real estate affordability and where we stand against rest of Australia

SOME of the sharpest analysts at RP Data crunched the nation’s property numbers. Here’s what they found for Perth.

SOME of the sharpest analysts at RP Data crunched the nation’s property numbers at a recent roundtable. What did they find for Perth?

AFFORDABILITY

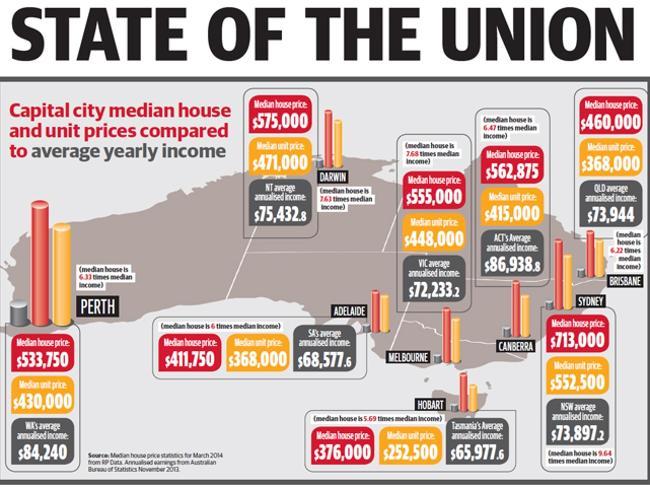

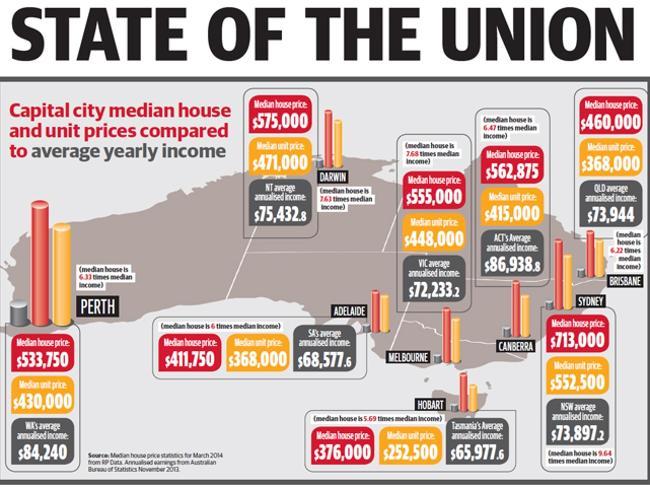

WA buyers need six times their annual household income to afford the median house in Perth.

The median house sales price in March was $533,750, according to RP Data figures.

That’s 6.33 times more than the average annual WA wage of $84,240 — a figure based on Australian Bureau of Statistics data for the average weekly WA income from November 2013.

RP Data research shows the cost of a median dwelling in Perth has risen from three times the median annual income in 2001 to six times the income in 2011.

The figures show the market has slowed slightly from 2013’s strong dwelling price growth, however, with values dropping back 0.6 per cent from the start of the year to March.

“The Perth housing market appears to have moved through the peak of the growth cycle late last year and since that time values have continued to rise but at a much slower pace,” RP Data national research director Tim Lawless said. “We will probably see these more sedate growth conditions persist as Perth moves out of the growth phase.”

Momentum Wealth managing director Damian Collins said he didn’t expect values to drop significantly this year.

“In a rising market there will be a time when the market takes a break and that is where the market is currently,” Mr Collins said. “Demand is still solid but there has been some more supply come on to the market.”

Hegney Property Group chief executive Gavin Hegney said there was a lot of heat coming out of the market but some pockets, in the northern suburbs particularly, were still doing well.

Mr Hegney said both sellers and buyers had become more prudent and areas where new benchmarks were set last year would settle. Similar property cycles occurred in 1994 and 1984, he said.

“Nothing’s different,” Mr Hegney said. “Demand spikes and supply takes 18 months to respond. The market gives back 1 to 2 per cent, followed by a period of long, slow growth over the next five, six or seven years.”

NEW DWELLING ACTIVITY

A FLOOD of new houses and units have been approved for Perth’s south-eastern corridor.

More than 3000 houses and 1200 units were approved for the region in the eight months to February 2014, RP Data statistics show.

The north, west and southwest corridors also had a similar number of new homes approved but fewer units.

Dwelling approvals for the whole metropolitan area have taken off in the past 12 months, increasing 32.9 per cent on the previous year.

Houses still remain much more popular than units at 75.7 per cent of dwelling approvals.

Experts say the construction boom has yet to hit but when it does Perth will see more housing and rental stock on the market.

It could also further dampen slowing rates of capital growth.

Momentum Wealth managing director Damian Collins said much of the new supply would come on in the outer suburban areas for houses and in limited locations such as the CBD and Northbridge for apartments.

“Those areas may see a slight oversupply of properties,” Mr Collins said.

“For established suburbs with limited new supply, they may still have a shortage of properties.”

RP Data national research director Tim Lawless said the increase in dwelling approvals could be attributed to high population growth which had created additional demand, improved developer sentiment and strong housing market conditions.

“From a less positive perspective though, more housing supply at a time when population growth is slowing could further dampen capital gains across the market,” he said.

FOREIGN INVESTMENT

PERTH’S attraction for foreign investors is set to grow as Sydney and Melbourne markets become more expensive, investment experts say.

WA attracted about 7 per cent of the $17.2 billion foreign investors poured into Australian residential property last financial year, RP Data’s research shows.

Most investors were from China, Canada and the US, with Chinese buyers contributing $5,932,000 nationwide. 25 per cent invested in Victoria, 21 per cent in NSW and 9 per cent in Queensland.

Momentum Wealth managing director Damian Collins said he expected their interest in Perth to grow.

“(Foreign investment) has certainly helped a few development projects get off the ground but unlike the claims in Sydney that it is ‘crowding out’ local buyers it has not had a big impact on the local market,” Mr Collins said.

“As Sydney and Melbourne become more expensive, Perth and Brisbane become more attractive.

“In addition, as wealth rises in Asia they will look to invest more in safe-haven countries such as Australia. While Perth has already seen solid interest from Singapore, Indonesia and Malaysia, we would expect to see more Chinese interest as they widen their interest outside of the traditional Sydney and Melbourne markets.”

Mr Collins said apartments were popular with foreign investors.

“Many of the buyers come from high-density cities in Asia where they are used to apartment living, so many foreign buyers target these types of properties as they are familiar with them,” Mr Collins said.

RP Data national research director Tim Lawless said based on data from Juwai.com, China’s biggest portal for overseas purchasing, most foreign buyers were purchasing for lifestyle reasons rather than investment purposes.

“The most popular reasons were lifestyle (51 per cent), children’s eductions (23 per cent) then investment (19 per cent) and emigration (7 per cent),” he said.

INTEREST RATES

ONLY an “unforeseen economic shock” could prompt another interest rate cut, RP Data national research director Tim Lawless said.

Mr Lawless said most economic data suggested the Australian economy was managing its transition out of the mining construction boom well and rates were likely to rise early next year.

“Dwelling approvals are up more than 20 per cent over the year, retail sales and tourism flows have seen some improvement, inflation is in check, labour markets have been resilient to higher unemployment and jobs are still being created,” he said.

Momentum Wealth managing director Damian Collins said a strong rise in economic growth across Australia was not likely due to the tough state and federal budgets. “We may see a small rate increase early in 2015 from the current historical lows,” he said. “Low rates are certainly a help to the market and this will help underpin the property markets in 2014 into early 2015.”

BUYING VS RENTING

PERTH house prices have risen to the extent that there are just three suburbs in the metropolitan area where it’s cheaper to buy a home than rent one.

This figure is based on principal and interest payments at a rate of 5.95 per cent per annum over 30 years, RP Data has found.