Secret advantages of new Aussie mega-housing revealed

Experts have weighed in on this intriguing Sydney development, hinting at what a future Aussie housing market might look like if more like it are approved.

An emerging method of housing development could boost rental stocks in some of Australia’s most sought after suburbs.

Rent to Live Co, a spin-off developer founded by the same people who own and operate the country’s largest student housing accommodation chain Scape, have announced plans to build a $1.5 billion build-to-rent project on the site of the old Marrickville Timberyards in Sydney’s Inner West.

Artists impressions of the proposed development show vast, brick-lined open-air walkways, outdoor gardens, communal gathering places and a healthy smattering of tastefully placed greenery.

The development is also slated to encapsulate 2,400 square metres of retail and commercial space, giving businesses a unique opportunity to thrive inside their own self-contained city.

If the New South Wales Department of Planning, Housing and Infrastructure (DPHI) passes the application, seven housing towers made up of almost 1200 rental units will be constructed on site.

Coming in at over 2.2 hectares, the development site, a short walk from Sydenham Station, will become the largest of its kind in Sydney when construction commences in early 2026 – pending approval.

So, what is build-to-rent, why is it popping up all of a sudden, and – most importantly – what does it mean for Aussie renters?

Build-to-rent promises a ‘ripple effect’ through market

According to the DPHI’s planning agency, build-to-rent housing and apartments are “large-scale, purpose-built rental housing that is held in single ownership and professionally managed”.

So, while a standard apartment or unit complex is built and then individual homes within those buildings are sold off to any number of landlords, build-to-rent complexes are exclusively owned and operated by one entity.

“Build-to-rent housing can provide more rental housing choice in areas where people want to live. Developers tend to focus on shared facilities and services and more communal space than build-to-sell. Tenants may also enjoy the security of a longer-term lease and convenience of on-site management,” the agency said.

Associate Professor Song Shi is an expert in property economics, and he believes that within certain conditions and limitations, a surge in build-to-rent developments has the potential to open up urban rental markets in key suburbs suffering from a lack of housing affordability and growth.

“To understand the impact of build-to-rent on the market, we need to know where they’re going to build these large projects. The location is very important,” said Professor Shi.

“They chose Marrickville to develop a large-scale project. Marrickville is what we call a ‘train-stop’ suburb, meaning it’s in proximity to train stations and a variety of other public transport services and general facilities,” he said.

Professor Shi believes that the construction of high-density build-to-rent projects in ‘train-stop’ suburbs like Marrickville will inevitably have a ripple effect of reduced rental costs in areas typically hosting the most fierce market competition.

“Once you generously pack the market (with more rentals), you will ease the rental market in a train stop suburb effectively. But the impact will only be limited to train stop suburbs. For the wider general rental market, I think the impacts will be minimal,” he said.

Renters call for more decisive action – and quick

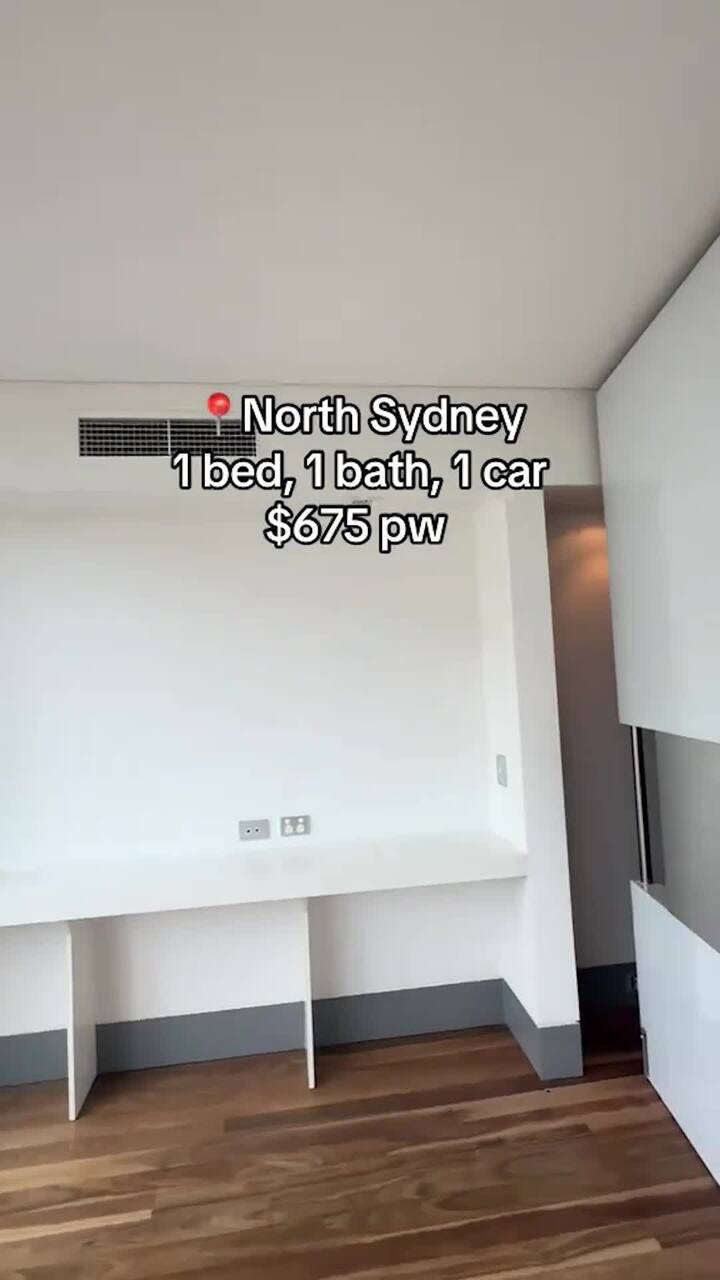

NSW Tenants Union Policy and Advocacy Manager Eloise Parrab believes build-to-rent developments have “so far been priced well above median market levels”.

“In theory, as the sector expands there might start to be more diverse offerings, but this remains theoretical and many years away at a time renters need real relief,” Ms Parrab said.

“There are advantages to the model that may attract renters – some properties don’t charge bonds, are clearly pet-friendly or have amenities in the building that aren’t offered elsewhere (but they) are often packaged as a premium option, with accompanying higher rents.”

Ms Parrab believes the most meaningful changes in the housing market will come from a recommitment by the government to build more public housing.

“We can note that the original build-to-rent (model) in Australia is public housing – with around six times as many properties than the more recent commercial iteration of build-to-rent. We used to build around 1 in 6 properties for this purpose, and should return to this model again in the future,” she said.

Proposals pop up around nation

With similar proposals announced for Meadowbank, Camperdown, Bombaderry and East Lismore it’s likely that those areas will see similar effects as referenced by Professor Shi.

The proposal includes 115 dedicated affordable housing units, which are typically reserved for renters that meet specific criteria of employment and are paid below a specific threshold.

But not everybody believes it will be quite so simple.

More Coverage

In an article in The Conversation, UNSW professor of Housing Research and Policy Hal Pawson suggested that while it is inherently good for the rental markets of particular suburbs to become flooded with units, more still needed to be done to help Australians most in need of housing support.

“When viewed within the context of the wider housing crisis, this scheme is another micro-measure,” he said.

“It has little or no relevance to headline concerns around home ownership affordability, low-income rental stress and homelessness.”