Only 0.6 per cent of rentals are affordable for minimum wage workers in Australia: report

The housing crisis in Australia is “the worst it’s ever been”, according to a shocking new report.

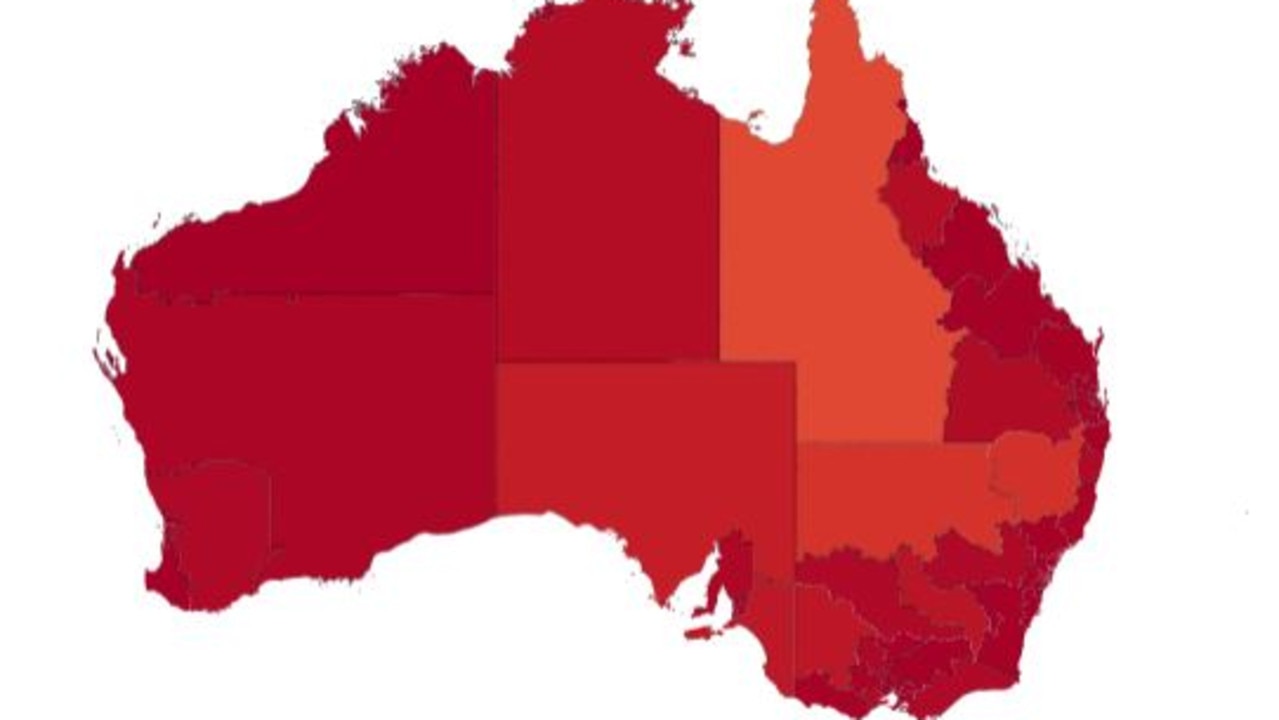

A new rental affordability heat map reveals the housing crisis in Australia is “the worst it’s ever been”.

Anglicare Australia is calling on the federal government to build more social housing as it released its annual Rental Affordability Snapshot on Tuesday.

Of more than 45,000 rental listings across the country, just 0.6 per cent (289) were considered affordable for a person earning a full-time minimum wage.

Heat maps prepared by Anglicare show the dire state of this data, with the entire country painted a shade of red to indicate how impossible it is to find an affordable rental for a single person on a full-time minimum wage.

Only 0.2 per cent were affordable for a person on the aged pension and 0.1 per cent for people on the disability support pension.

None were affordable for someone on the Youth Allowance support payment.

“The housing crisis is the worst it’s ever been,” Anglicare Australia executive director Kasy Chambers said.

“This is not hyperbole. It is Australia’s new normal.

“We’ve never seen such bad results for people on the minimum wage, with affordability halving for a single person in the last two years.”

She said even couples with both partners working full time were locked out of nearly 90 per cent of rentals.

“People on Centrelink payments are being pushed out of housing altogether,” Ms Chamber said.

“A person on the age or disability support pensions can afford less than 1 per cent of rentals. For a person out of work, it’s 0 per cent – and that includes the highest rate of rent assistance.”

Australian Council of Social Service chief executive Cassandra Goldie said rents had risen on average by 7 per cent last year and more than 640,000 low-income households were waiting for suitable homes.

“It is wrong for one of the world’s wealthiest nations to continue condemning people on low incomes to poverty, unable to afford the bare essentials of life and keep a roof over their head,” she said.

Ms Chambers said the government must step up and invest in social housing rather than “propping up private investors”.

“This approach is wrong, and it’s supercharging rents and house prices,” she said.

“Instead of spending billions on tax breaks for investors, the government should be building the housing we need.”

Greens’ housing spokesman Max Chandler-Mather said the figures reinforced the need for a federal government-led cap or freeze on rent increases.

“The rental crisis is breaking people, and Labor needs to wake up and stop giving billions of dollars to property investors through negative gearing and the capital gains tax, and start investing that money in public and community housing instead,” he said.

Minister for Housing Julie Collins said “sadly too many Australians don’t have a safe and secure place to call home”.

The Albanese government has promised to deliver $25 billion in new housing investments over the next decade - including the $10 billion Housing Australia Future Fund and the $2 billion Social Housing Accelerator.