Horror warning as rent rises tipped to hit insane highs up until 2026

A horror warning has been sent out for one-in-three Australians who are about to fork out a significant amount more money.

The grim news continues for the one-in-three Australians who rents a home after new analysis revealed that rents will jump a staggering 10 per cent more this year – the highest level since the GFC – and will continue to rise by extraordinary levels into 2026.

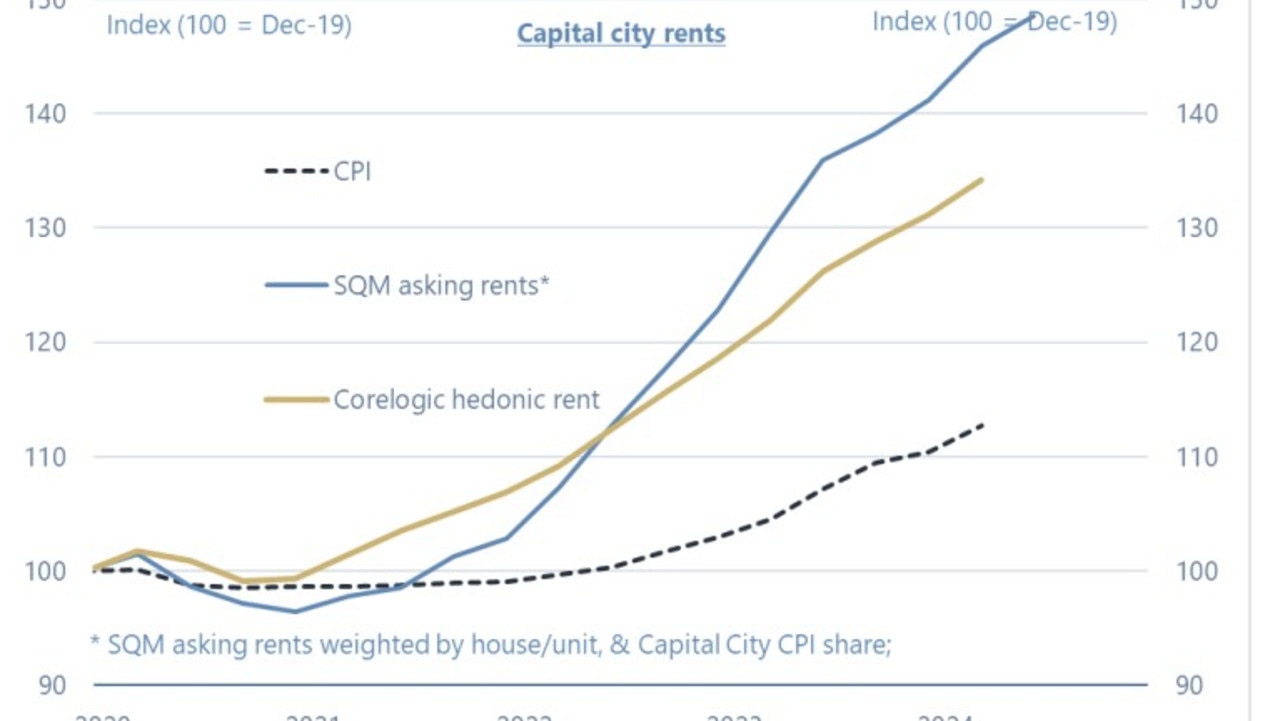

Analysis from investment group Jarden shows how the cost of living crisis will continue to hit the one third of Australians who rent, with rental price growth expected to soar beyond its current 15-year high of 7.8 per cent.

It has examined rental inflation in Australia and found it is already running at 10 per cent higher this year – a figure not seen since the GFC in 2008 – and will jump by 8 per cent in 2025. Rents are expected to continue to rise above 6 per cent into 2026 too.

Jarden’s economist Anthony Malouf said a combination of factors including rebounding migration, record low rental vacancies, subdued dwelling investment and strong income growth has seen market rents rise at the fastest pace in decades.

He said rents were up by more than 30 per cent since 2019.

Surging demand was one of the biggest factors driving the rental crisis, Mr Malouf explained.

Initially, it was driven by Australians forming smaller households during the pandemic, with the decline in household size between 2020 and 2022 increasing the demand for dwellings by 120,000, he said.

“Since borders reopened, the surge in migration – 750,000 net overseas migration since June 2022 – has further increased demand for housing,” he noted.

“Interestingly, despite the large rise in rents, we did not see the material rise in household size that might have been expected over the last year. We expect that an increase in average household size – as renters move back in with friends and family, or take on housemates – is likely to play a part in managing higher rents and more challenging rental affordability. “Indeed, if average household sizes returned to early 1990 levels, Australia would need 1.2 million fewer dwellings to house its population.”

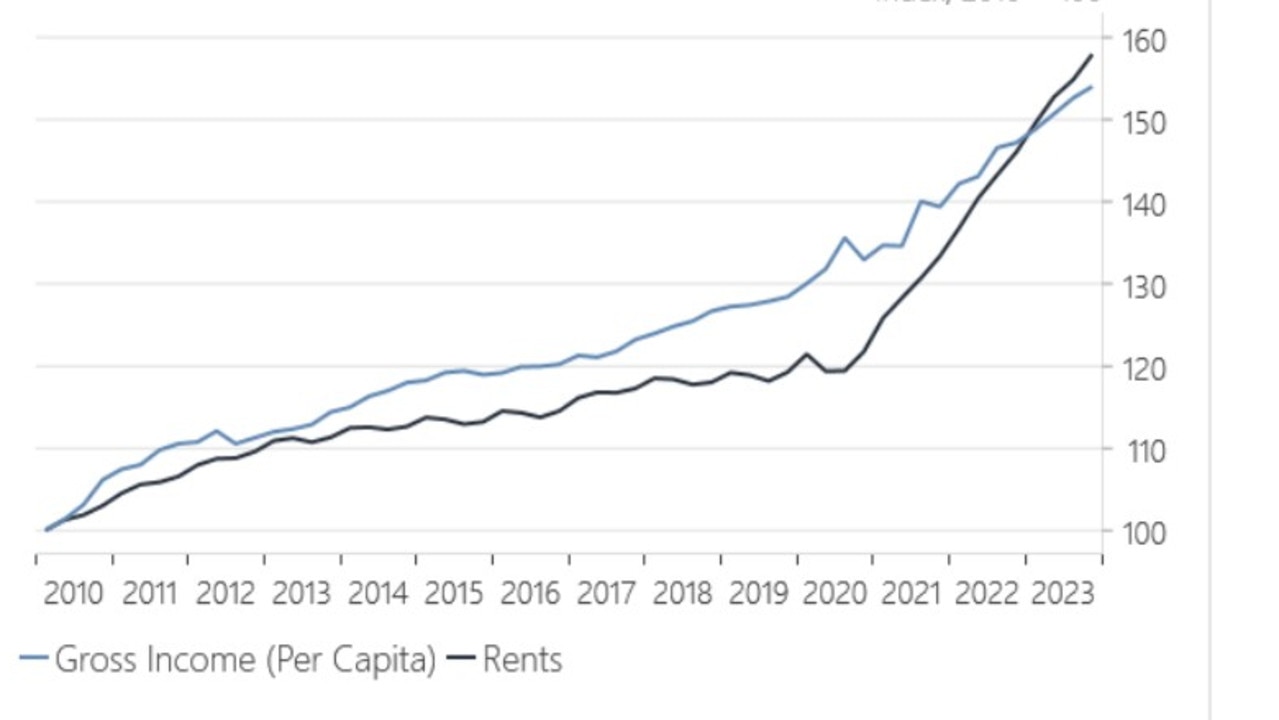

Mr Malouf said the asking rents have now outpaced any income growth, stretching affordability for households.

The increases in rent relative to income have risen by approximately 5 per cent since December 2019 to an alarming 30 per cent, Jarden found.

It comes at a time that the faces of Australia’s devastating housing crisis have been revealed a the first-ever People’s Commission, which kicked off last week.

It heard from the likes of single mum Lucie, who was seeing 80 per cent of her income is swallowed by ever-rising rental costs, forcing her to rely on food banks to feed her two teenage children.

Meanwhile, the government has introduced further rental assistance announced in the federal budget with a 10 per cent increase in the maximum rate of Commonwealth rent assistance. Yet, Jarden is expecting the underlying drivers of rents to persist, keeping rental growth elevated well until 2026.

“Ultimately, we see the strong rise in rents, along with broader services inflation, as the main drivers of inflation over the next two years,” cautioned Mr Malouf.

The rental jump means bad news for the Reserve Bank of Australia as rents are the second biggest cost in the Consumer Price Index (CPI).

“This is likely to maintain upward pressure on inflation and will likely remain a challenge for the RBA as its seeks to bring inflation back to its 2-3 per cent target,” Mr Malouf warned.

But the rental crisis is not contained to capital cities either, despite reports of rises as high as $250 a week in places like Sydney.

Even in regional Australia rents have hit new record highs, new CoreLogic research found.

Rents have risen 6.3 per cent over the 12 months to April, up from 4.9 per cent over the year to January.

It means rents have been accelerating far more in regional Australia compared to the capital cities combined where annual rental growth has eased from 9.6 per cent to 9.4 per cent.

Across the 50 largest non-capital significant urban areas, 37 markets have rents at a record high, with almost all recording rent increases over the past three months and past year.

After recording rental declines throughout 2023, Batemans Bay saw the largest quarterly increase in rents, up 6 per cent or $32 per week over the three months to April, followed by Bunbury at 4.7 per cent and the Sunshine Coast hitting 4.4 per cent.

Bunbury had the largest annual rental growth, up whopping 16.4 per cent, while Kalgoorlie – Boulder had the highest gross rental yield at 9.4 per cent.

Tasmania’s Burnie – Somerset was the most affordable rental market at $419 per week, while the Gold Coast – Tweed Heads border region was the most expensive rental market at $827 per week.

However, in a glimmer of hope a few regions saw rents drop slightly with Nowra – Bomaderry down by a 0.3 per cent, Maryborough dropped by 0.2 per cent.

“Housing affordability has continued to deteriorate through the start of 2024 for tenants and prospective home buyers alike,” CoreLogic Australia economist Kaytlin Ezzy said.

“The outlook for regional housing markets will heavily depend on demographic trends, housing supply, localised economic drivers and the outlook for interest rates.”

However, Greens leader Adam Bandt said big corporations and developers were to blame for the country’s housing crisis – and not migrants – after both Labor and the Liberals flagged plans to slash the country’s immigration intake.

“Well, my view on migration at the moment is this: Labor and Liberal are engaged in a migrant-bashing race to the bottom as a distraction from the real issues facing this country every time that there is a cost-of-living crisis,” he said on ABC’S Insiders on Sunday.

“We can build enough homes for everyone to have an affordable place to live, OK. I’m not going to spend the next year in the lead-up to an election blaming migrants for a problem that they didn’t cause.”

The federal government has allocated $6 billion to help tackle the housing crisis, including a further $1 billion this financial year to help states and territories build more homes.

Governments are using private investors as scapegoats for a shocking underinvestment in social housing while raking in tens of billions of dollars in property taxes each year, claimed the Property Investment Professionals of Australia (PIPA).

Around 175,000 households are on waiting lists for public or community housing across Australia, up by 20,000 since 2014, data analysis by PIPA showed.

Yet, Australia’s total social housing stock of 430,000 dwellings has barely changed in the past 25 years, it added.

The number of people needing housing has shifted with the country’s population surging by 33 per cent in the past two decades, said PIPA chair Nicola McDougall.

“If you want to know why Australia is in such a mess and why so many can’t afford a home, you only need to look at how much the population has grown and the sharp rise in people in need of support and compare it to investment in social housing,” she said.