Eviction moratorium: expert guide for tenants, landlords and agents

Since Scott Morrison declared an eviction moratorium it has been a very confusing time for tenants, landlords and agents. Now the dust has settled on the decision, this is what you need to know.

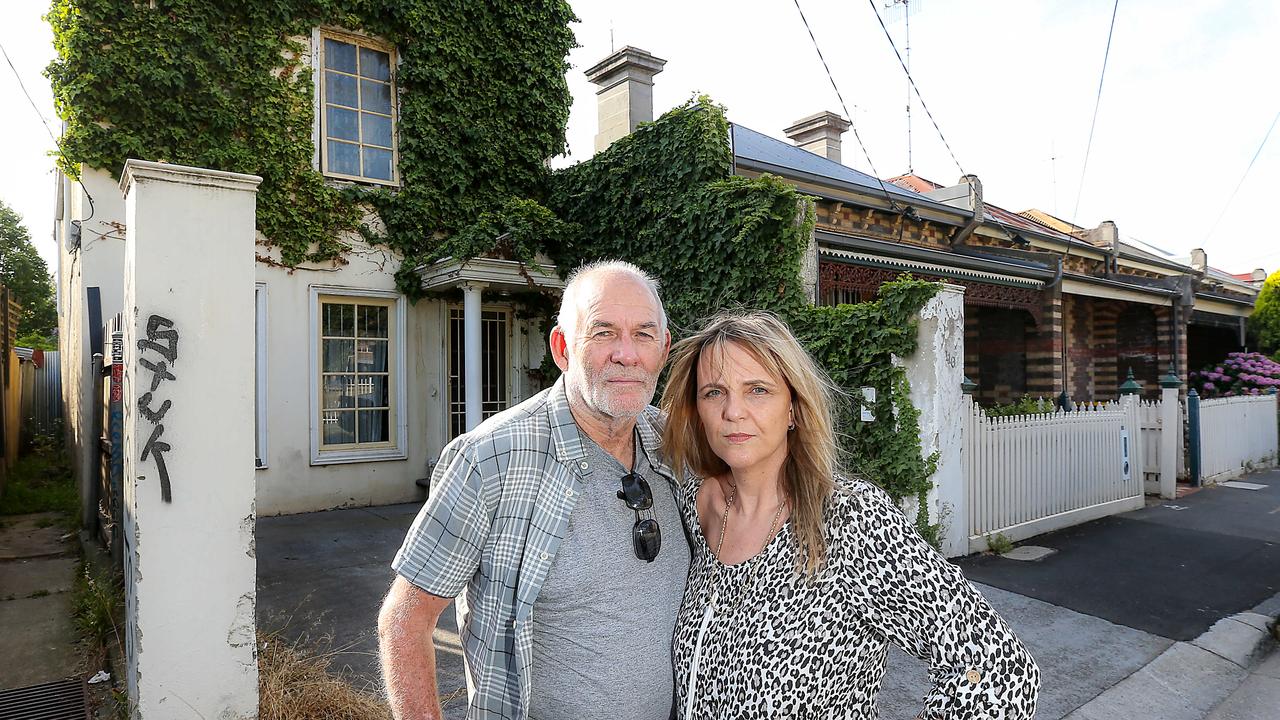

When life went into lockdown, tenants across the country were left stressed and confused thanks to initial mixed messaging from governments, dodgy advice from friends and less than law-abiding landlords.

Prime Minister Scott Morrison announced in late March that renters can’t be evicted from their homes over the next six months, but he also suggested that when it comes to rental payments, tenants and landlords should just “work it out”.

RELATED: Why the time is right for first-home buyers

Home security fears spike due to COVID-19

All your coronavirus/real estate questions answered

While tenants can ask their property manager or landlord for a rent reduction, industry insiders point out there is a right and a wrong way to go about it.

“The first thing to do is pick up the phone and have a chat,” said Maria Carlino, national director of property management at The Agency.

“We understand that for many tenants they’re in a difficult situation right now, they might not know what’s going on themselves, they’re in shock.”

She said in just the first few weeks since lockdown measures were put in place, there had already been three per cent of The Agency’s national residential rental portfolio affected by renegotiated rents.

“The reductions are in proportion to the reduction in income.”

Buyer’s agent Lloyd Edge, director and founder of Aus Property Professionals and author of Positively Geared, agreed that asking for a financial break is a difficult conversation, but a necessary one.

“Try and work with them,” he said.

“Tell them you are in difficulty before you fall into arrears and see if you can devise a plan together. Most landlords will probably be quite understanding, given the current climate, if the tenant is honest and broaches the subject early.”

Find out where you stand financially

Before asking for a rent reduction, tenants should see if they are eligible for either the Job Keeper or Job Seeker programs, then do a budget.

“See if your outgoings can be decreased. You don’t want to be asking the landlord for a rental reduction if you are spending money in other areas that can be reduced. Do you have Netflix or Foxtel which could be put on hold? Or do you order a lot of Uber Eats? Do you have a car loan in which payments could be deferred?” Mr Edge said.

“I suggest working out a payment plan for utility bills and show the landlord that you have tried to cut your expenses in other ways,” he added.

Get it in writing

Tenants can help their case by creating a paper trail demonstrating why they can’t afford the rent.

“Have proof available that you have either lost your job, or your income has gone down substantially. This could be a letter from your employer or proof of industry closing down.

“Gather some bank statements which show you don’t have enough savings to generally be able to cover rent for the foreseeable future,” Mr Edge said.

Ms Carlino said many owners are accepting a rental reduction in line with how much income their tenant has lost due to the virus.

“What we ask for is proof of their change of circumstances, whether that is they’ve been stood down, or the job has been terminated, like an employer letter of some sort, and proof of prior income,” she said.

Outline your short-to-long term plans

“I would suggest that the tenant has a discussion with their employer to see what their work situation looks like in the future and also check out any income insurance policies. If the tenant can show the landlord that work is likely to pick up in the future it might help with negotiations for rent reductions,” Mr Edge said.

Ms Carlino said tenants should try to come up with a payment plan of their own rather than waiting for the owner to decide, and get clarity on whether you will be expected to “catch up” with the rent and when that might be.

“Do it for the next three to six months, then the agent can check with you in on a regular basis to review and see whether things have changed. Just be sure to stick to the obligations of your lease, but work out a plan that will suit everyone.”

MORE: Inside celebs’ $3.5m doomsday bunkers

Aussie private island for less than $500k

COVID-19: Is now a good time to buy property?

Don’t just refuse to pay rent

“Don’t just go to your landlord and say that you cannot pay any rent at all as this will be less likely to lead to an amicable outcome. You need to negotiate and understand that the landlord most likely still has a mortgage to pay,” Mr Edge said.

“While there is a moratorium against evictions it is important for tenants to understand that they are still required to pay rent as per their tenancy agreements.

“Don’t just refuse to pay rent. If your circumstances are genuine then just provide the evidence as that will really help you.”

Try to see matters from your landlord’s perspective

Ms Carlino said landlords might also be doing it tough, so consider where they’re coming from.

“Most owners are open to negotiation. They’d prefer to have a property with a tenant in it rather than it be empty at the moment because we’ve had an increase of rentals hit the market,” she said.

While a property owner has the option of taking out a six-month freeze on their mortgage, Ms Carlino said tenants should realise it’s not a financial holiday - that amount still gets tacked onto the end of the owner’s mortgage term.

“We’ve got retirees on our books who rely on the income. Many are quite happy to look at a reduction if they can afford it. It’s really a case-by-case basis,” she said.

Originally published as Eviction moratorium: expert guide for tenants, landlords and agents