‘End the nightmare’: Australian landlords selling up in one key state

Furious landlords are vowing to flee one Aussie state, with one claiming selling is the only way to “end the nightmare”.

The proposed changes to Victoria’s rental laws have struck a nerve with local landlords, with many claiming strict rules and increased taxes, combined with brutal interest rate hikes, have already pushed many to breaking point and created “investment mortgage prisoners”.

Now, new proposed minimal rental standards have caused even more upset among investors, with many threatening to sell their rental properties if the changes go through.

The proposed changes are in line with the government’s commitment towards net zero emissions by 2045 and would ensure that tenants are provided with “comfortable and energy efficient living arrangements”.

It would include things such as installing ceiling insulation where none exists, draught-proofing with weather seals on all external doors, four-star shower heads in all showers, new electric hot water systems and three-star efficiency cooling for systems in the main living area.

If introduced, the changes would start coming into effect from October 2025.

Appliances would not need to be upgraded until the existing ones reach the end of their lives. Insulation and draught-proofing would need to be upgraded at the start of a new lease.

Multiple landlords who have investment properties in Victoria have told news.com.au that they will be selling if the changes go through.

Former landlord, Brad, who has previously rented out properties in both Victoria and NSW, said that his experience in the former state had him vowing never to purchase an investment property there again.

“As long as I live, I will never buy another rental, investment or second property in Victoria ever again,” he told news.com.au.

The 44-year-old, who has since sold both properties, said he found the experience of renting out the NSW property to be “much easier” due to it not being subject to “ridiculous Victorian laws”.

“I found NSW was much fairer for both renter and rental provider,” he said.

Brad advised other potential investors to “steer clear” of Victoria, claiming that, in the end, the only way to “end the nightmare” that was his rental property was to sell it.

Even now, he said he is still owed around $7000 in unpaid rent, house cleaning and rubbish removal costs due to the state in which the property was left.

New data from PropTrack has showed a significant increase in selling activity, with Melbourne one of the cities leading the growth.

PropTrack Listings Report for May 2024 found new listings nationally on realestate.com.au up 18.5 per cent from a year prior.

Melbourne saw the second largest increase in total listings over the past year among capital cities, with a 24.7 per cent spike.

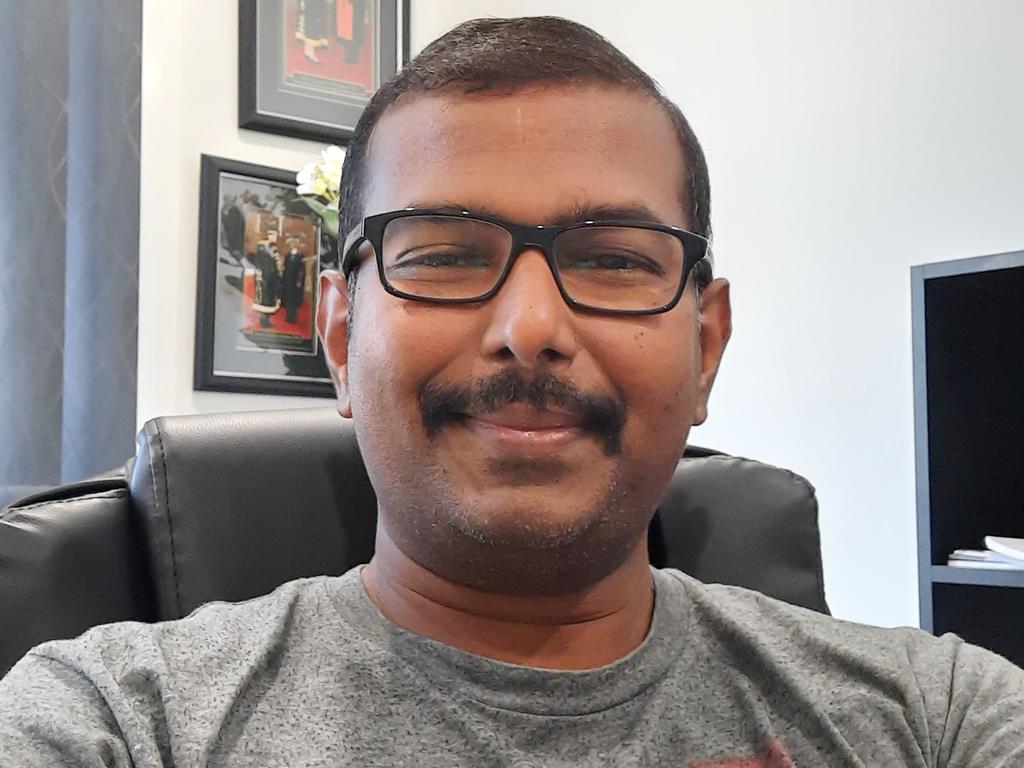

Vijay is one of the landlords who feels he has no option but to sell his rental property, particularly if the changes come into effect next year.

The 44-year-old purchased his Victorian property in June 2022 with a tenant already residing in the four bedroom home and paying $425 a week,

The property was managed privately by the previous landlord and, when Vijay had a property manager take over, he was informed there were a number of “compliance requirements” that had recently come into effect that he had to comply with that the previous landlord hadn’t actioned.

In late 2023, he increased the rent to $445, saying he was “strongly advised” that any increase over $25 could end up in the Victorian Civil and Administrative Tribunal (VCAT).

“I have attended to any complaints that were raised, installed solar to reduce the energy cost to the tenants and did everything possible as a good landlord,” he said.

“In a nutshell, per annum income is under $23,000 and expense (including interest) is $55,000 which still ends up bleeding $20,000+ after return from tax. Just can’t continue to be an investor in Victoria.”

The landlord claimed that, when he first purchased the property, the rent covered about two thirds of the total loan repayment, but now it only covers about half of the interest alone that he pays on a monthly basis.

He said the situation was “very painful” and the proposed changes will only serve to add additional costs in order to maintain the property.

Many landlords have claimed they will just pass on any additional expenses incurred by the changes to tenants.

However, having been a tenant himself and knowing the pain of big rent hikes, Vijay says he does not to go down that path and selling the property is the only way to get out of being an “investment mortgage prisoner”.

“Adding tougher condition like the ones proposed is making it next to impossible for investors like me to have a property in Victoria for rental purpose,” he said.

Commissioner for Better Regulation Cressida Wall confirmed there would likely be rent increases associated with the new policies.

“The departments acknowledge that it is likely that at least some of the costs will be passed on to tenants, and that recent cost-of-living pressures and interest rate rises may limit the amount of cost increases that rental providers and rooming house operators can absorb,” she said in documents relating to the proposed changes.

“The departments explain that rental supply may contract in the short term as providers undertake upgrades to comply with the new minimum standards.

“The departments also explain that these impacts will be limited by varying when compliance with each standard is required, and as some of the preferred options account for potential implementation risks (e.g. supply chain issues).”

The government estimates these proposed upgrades would save renters about $567 a year off their energy bills.

Not every landlord views the proposed changes in the same light, with property owner Hugh Spencer telling news.com.au the idea that someone may rent out a property with no insulation is “utterly unacceptable”.

Hugh owns homes in both NSW and Victoria, but currently only rents out the NSW property, which is located in Goulburn.

The rental was already insulated but he determined it needed to be better so made the choice to upgrade it to ensure the comfort of his tenants.

“All homes, because that’s what they are, a home, must be well insulated comfortable places to live. This is especially so, in my opinion as buying a home has become unaffordable to the average Australian,” he said.

While he does not agree with all of the changes, claiming requiring people to move to electric heating is “problematic” as gas can be a more cost effective alternative, he noted that, at the end of the day, “maintenance costs are fully tax deductible”.

If the same changes were to be brought in across NSW, Hugh said it would not encourage him to raise the rent or sell the property.

“I deliberately keep my rent increases to the absolute minimum. And I encourage my tenants to contact my agent if they have any issues,” he said.

“Ethically I can remember renting property and it was expensive. Today it’s much worse and I would much rather have happy tenants than struggling ones.

“Life is short it’s better to be nice to people. Greed never makes sense.”

Hugh isn’t the only landlord who thinks there is some merit to the proposed changes.

One landlord who shared his thoughts with news.com.au claimed he “had to laugh” at some of the views he has seen fellow property investors express, pointing out that the cost of what is being proposed is mostly tax deductible.

“I think those landlords that are moaning about this are not the type of landlords that Australia needs and paints us all with a bad name,” he said.

More Coverage

Others shared their opinion in local landlord Facebook groups.

“I actually do think minimum standards need to rise because I’m tired of being lumped in with useless do-nothing slumlords,” one person wrote.

“I rented for 18 years before becoming a LL so I have nothing but disgust for the pathetic lower end of LL’s who skirt minimum standards. I’m proud of the quality of my rental. You should be too. Better min standards are win/win for most LLs.”