Australian rental market finishes 2020 with unexpected decade-high growth

After months of chatter around dramatic rent reductions, new data shows that the market actually finished 2020 in positive territory. But what could that mean for rental moratoriums?

After 12 months of chatter around dramatic rent reductions, data shows the market actually finished 2020 in positive territory, prompting one industry insider to call for the scrapping of rental moratoriums.

Australia’s dwelling market actually recorded the largest monthly increase in rents for a decade, according to CoreLogic’s Rental Review for the December quarter.

RELATED: Australian suburbs with the biggest rental price drops in 2020

Rental reforms: Date incoming for minimum standards, minor modifications

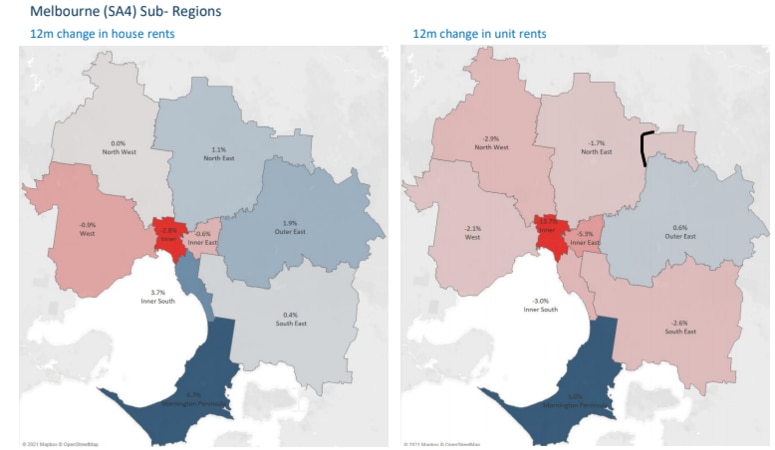

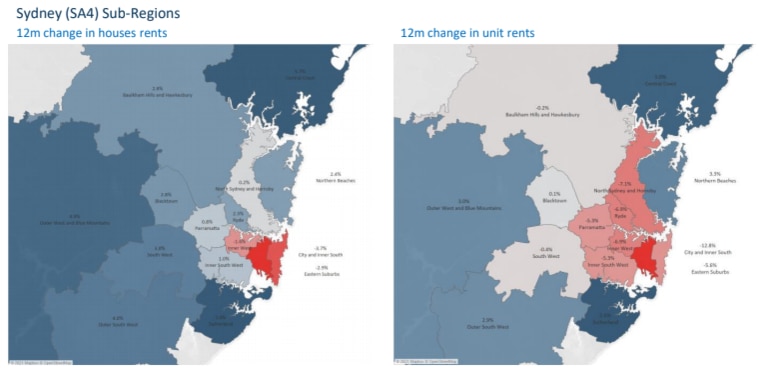

However, once examined on a micro level, figures showed the diverse scope of rental conditions experienced in 2020 as regional markets outperformed the cities.

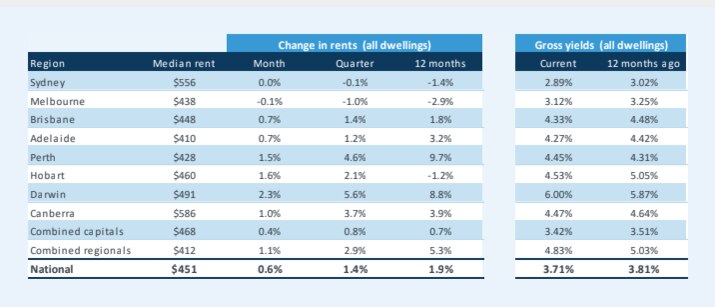

By December 2020, Australia’s rental market recorded a 0.6 per cent rise over the month.

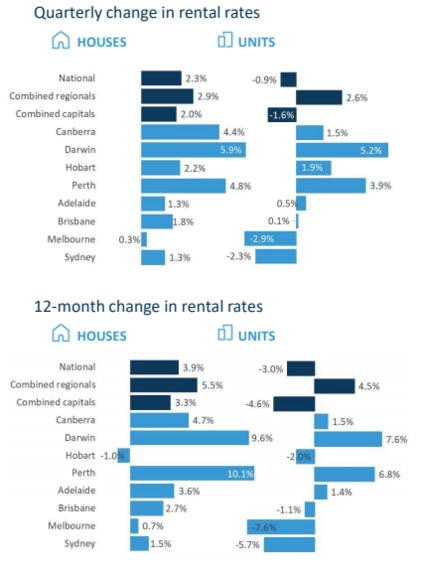

The 10-year record can be attributed to growth across the house market, which saw a 0.9 per cent rise in rental rates.

This increase in house rents more than offset the 0.1 per cent fall for units.

Capital city houses and units travelled on separate paths throughout 2020, with house rents up 3.3 per cent annually against a 4.6 per cent decline in unit rents.

CoreLogic’s research director Tim Lawless, said the pandemic “not only disrupted how we live, but also reshaped housing demand” as a preference for lower density housing gained momentum.

“Higher density housing markets have seen less demand during the pandemic; a trend that has been amplified by stalled overseas migration and remote working opportunities luring residents further afield,” he said.

“Whether this trend has some longevity is yet to be seen, but international borders are likely to remain closed for some time yet, and for many, remote working conditions have proved to be productive.”

MORE: What your city’s median house price buys you

Whole Aussie ‘oasis’ town for sale for $11m

Simple trick to make $100k more on your house sale

That longevity will be tested when COVID-19 rental eviction moratoriums cease – a move that Real Estate Institute of Australia president, Adrian Kelly, said should be made sooner, rather than later.

He said with rental evictions ending in some states and unemployment at 6.6 per cent, it is time for all moratoriums to be removed so that some normality for both tenants and property owners can resume in 2021.

“The rental eviction moratorium was the absolute right decision at the time by our nation’s leaders and played a critical role in Australia’s initial COVID-19 line of defence,” he said.

“However, issues around tenants being impacted by COVID-19 and their ability to pay rent has not been anywhere near what was expected in early 2020,” he said.

“Despite this, almost all jurisdictions except for Queensland and the Northern Territory continue to extend the moratorium period far beyond six months with most extending until the end of March,” Mr Kelly said, adding that the percentage of impacted tenants is less than 5 per cent in major cities and less than 1 per cent in regional parts of the country.

“Queensland felt minimal impact when their eviction moratorium was removed and with economies now opening up, it is time for all the states to do the same,” he said.

First National CEO Ray Ellis backed the REIA’s call.

“At First National, recognising that many landlords are mum and dad investors on average incomes and have been very generous towards tenants during the pandemic, the principled agreement had a purpose 12 months ago and was beneficial,” Mr Ellis said.

“However landlords now need the ability to recommence a normal commercial relationship with respect to all situations.”

The CoreLogic analysis demonstrated the tremendous difference in rental performances across the country in 2020.

Melbourne and Sydney’s inner city unit markets recorded the largest falls, down 7.6 per cent and 5.7 per cent respectively over the year. Conversely, Perth and Darwin were the best performing capital city rental markets of 2020, with overall dwelling rents up 9.7 per cent and 8.8 per cent respectively.

Regional markets, however, were the standout performer with house rents 2.9 per cent higher over the final quarter of 2020 and unit rents up 2.6 per cent.

- Additional reporting James MacSmith

Originally published as Australian rental market finishes 2020 with unexpected decade-high growth