Rental pain eases across Australia

Renters are finally able to breathe a sigh of relief as the sting comes out of price surges in the majority of Australia’s rental markets.

Renters are finally able to breathe a sigh of relief as the sting comes out of the majority of Australia’s rental market – though prices were still up higher than inflation.

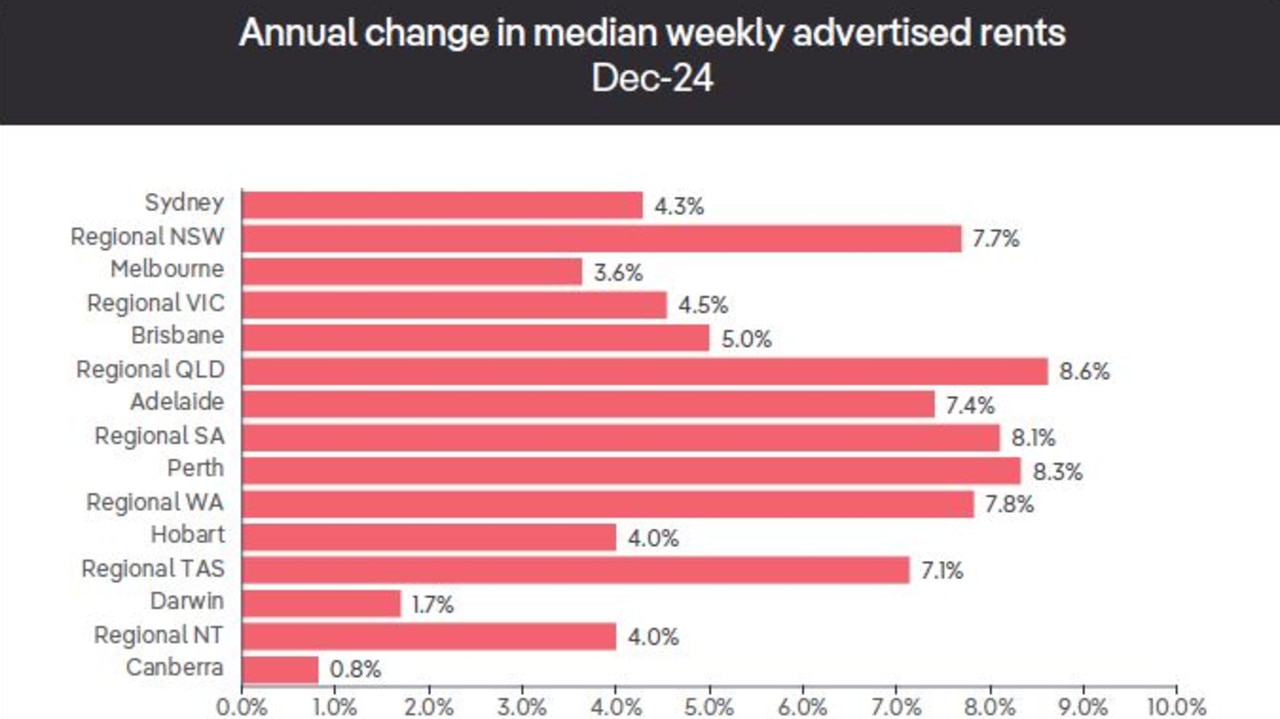

Two of the biggest – Sydney and Melbourne – have flatlined for six months, according to the latest REA Group Rental Report December 2024, released Thursday, helping temper the national rise to 6.9 per cent overall – a far cry from 2023’s 20 per cent surge.

RELATED:

Shock as Queensland regions see biggest rent rise in Australia

Depressed: Experts say Melb home market is ‘stuck in neutral’

‘Good news’ for Sydney renters but regional tenants suffer

REA Group executive manager economics, Angus Moore, said rental price growth slowed through the year as the availability of properties improved – though the pace of rises were still much higher than inflation overall.

“Conditions are gradually beginning to ease for renters,” he said. “While rent prices recorded annual growth of 6.9 per cent in December 2024, outstripping that of inflation or wage growth, we did see the pace of rental price growth slow to less than half of that of 2023, marking the slowest annual increase since late 2021.”

The national median rent was $620 a week in December with Sydney the highest still at $730, followed by Perth’s $650 and then Brisbane on $630. Adelaide continues to be more expensive to rent in overall $580 compared to Melbourne ($570).

“So we are starting to see the pace of rent growth slow down. It’s still pretty strong, but it is a lot slower than we saw in 2023 and a big part of the story there is the two largest rental markets, Sydney and Melbourne have both seen a slowdown in growth, particularly in the past six months or so, and are seeing a lot more availability again.”

MORE: Entire town for sale at price of a house

Is this Australia’s cheapest house?

Mr Moore said “Melbourne was kind of the surprise” in the mix now.

“It’s much less affordable than it used to be, but it hasn’t seen as strong growth in rents as many other parts of the country so median rents there at $570 a week are actually cheaper than every capital city except Hobart now.”

Adelaide beat Melbourne in September in terms of median rent per week, after two quarters of being equal through the early part of last year.

“Sydney’s been flat since June as well. They’re just not moving at all. It’s not as if we’re fully out of the woods there, but they are seeing a slower pace of growth than most other parts of the country.”

Part of the reason for the flatlining, he said, was “there are more rental properties, and so any given property is less competitive than it used to be”.

Renters had a greater choice of rental properties with December’s total rentals advertised up 9.5 per cent year on year, with new rentals up on realestate.com.au 4.6 per cent higher over two consecutive quarters – the busiest it has been since 2020.

“Slowing national rental price growth was largely driven by tempering capital city markets over the past year; meanwhile regional rent growth outpaced capital cities and availability tightened further.”

He warned rental markets were still “tighter than pre-pandemic levels” and expected rents to keep rising in 2025 though at “a more moderate pace”.

MORE: Fire damaged Brisbane house listed over $749,000

Cheaper way to live like a richlister in $22.5m mansion

Regional rents rose faster than capital cities over the year, the data found, 10 per cent versus 6.7 per cent respectively, with country zones $90 cheaper overall at $550 a week.

Part of the reason the easing could be coming off a resurgence in confidence among property investors amid strong returns.

Sarah Hackett of Place Estate Agents said 40 per cent of home loans written in Australia last year were investment homes.

“People are more confident investing in real estate now with continual price growth and incredible strong rental demand.”

“Less than 1 per cent vacancy rates for our portfolio of 3000 properties. It’s a near 100 per cent guarantee you will find a tenant immediately.”

She said the government could influence investor confidence massively.

“If they make mention of reducing negative gearing it has a huge impact on demand. Labor suggested this and sales dropped.”

Originally published as Rental pain eases across Australia