Why the RBA must cut interest rates now

OPINION: The mortgage cliff is finally here and families are on the brink. The RBA must cut before Christmas or it will be too late.

OPINION

The RBA must act now and cut the cash rate today to save Christmas for thousands of Australian families.

It might go some of the way to helping mortgage holders out of a bind that it contributed to, when it implied in 2021 that the 0.1 per cent cash rate would not begin to rise until at least 2024.

We were free to borrow and we were also free to do as the government suggested and spend, spend, spend our money to help the economy emerge from the pandemic.

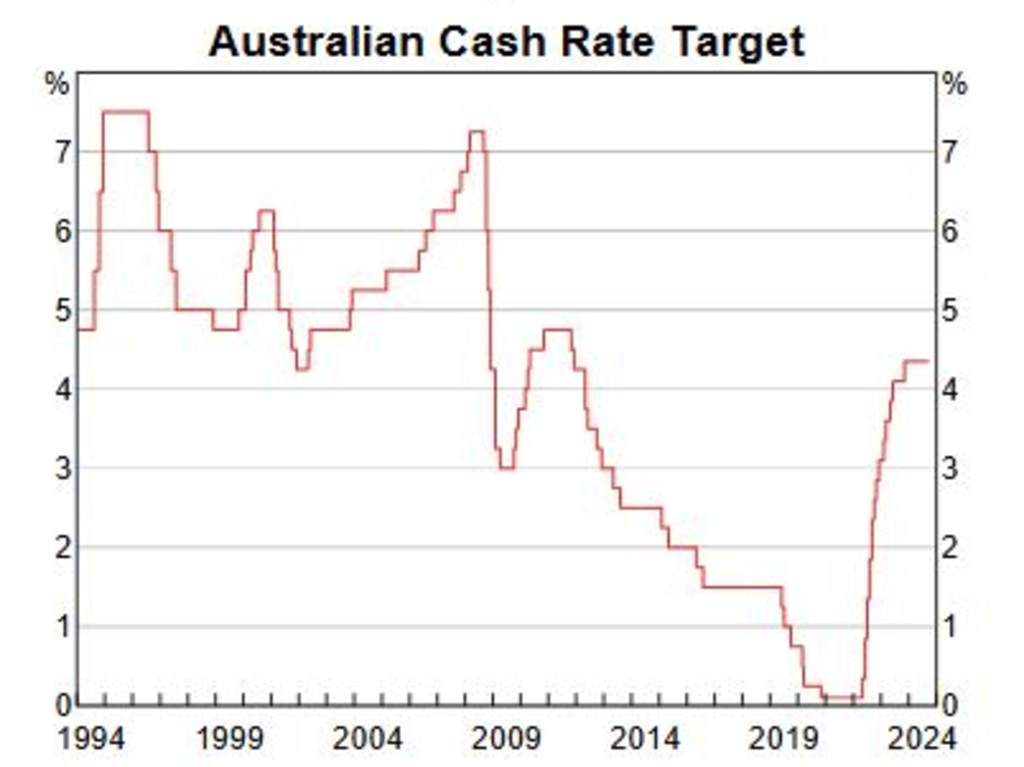

By the RBA’s reckoning back then, the many Aussies who went out and borrowed with confidence would now be dealing with a cash rate between 0.1 per cent and 0.6 per cent.

Instead, we’re at 4.35 per cent. Mortgage holders are paying more than three times the interest we were three years ago.

MORE: Where homeowners owe $1m on their mortgage

And who is to blame? Why we are of course! We shouldn’t have gone and borrowed and spent all that money. What were we thinking?

Alarming research by Finder recently revealed nearly half of younger mortgage holders believe they overstretched when borrowing to buy a home. Now, one in four are skipping paying other expenses to make mortgage payments. Ten per cent of respondents to Finder’s consumer sentiment survey even said they had missed meals to do so.

Imagine then the disappointment that RBA Governor Michele Bullock feels when she looks at the inflation numbers and sees that we are still stubbornly spending! We go out and frivolously splurge our cash on silly things like food, electricity and petrol. Not to mention all that money being thrown away on rent.

‘But’, the mortgage holders protest, ‘we don’t spend on rent. That’s the renters. And doesn’t raising rates actually cause rent to increase? Because landlords hike rent to cover their higher loan repayments?’

MORE:Looming threat if RBA fails to act

That’s not how economics works. Now if you need to come up with extra mortgage money, try bringing your lunch to work. Or maybe skip that morning latte.

‘We’re already skipping entire meals and never buy coffee from cafes.’

OK well maybe you shouldn’t have borrowed so much in the first place … tisk tisk, so foolish.

Monty Python couldn’t make this stuff up.

One of the biggest problems with the cash rate being the only trigger the RBA can pull on inflation is that only roughly a third of Aussie households are paying off a home loan. Everyone else gets higher interest rate returns on their savings, meaning they have more money to spend.

Mortgage holders therefore cop the punishment for everyone else’s spending. It’s little surprise that 47 per cent of borrowers claim to be in mortgage stress.

MORE:Major problem facing Aussies after RBA change

And it’s getting worse. The most recent ABS Lending Indicators reveal the average loan size in Australia has hit a record high of $642,121.

Someone with that loan, back in 2021 would have been paying $12,800 in interest every year if they were on a 2 per cent repayment rate with their bank. Now, with average home loan rates around the 6.5 per cent mark, they’d be paying $41,700 a year, in interest alone.

Do you know any “average” Aussies who could seamlessly absorb almost $30,000 more in household expenses each year?

Long have we been hearing about the mortgage cliff- the giant precipice that we would all tumble over one fixed rate loan periods ended and home loans rolled over from 2 per cent payments to upwards of 6 per cent.

MORE: ‘Not Monopoly’: troubling effect of new rental laws

For a long time, economists noted our stockpiled offset account savings were keeping the wolves from the door. But make no mistake, the mortgage cliff is here.

The latest SQM Research has revealed distressed listings are on the rise, meaning more Aussies are facing having to sell their homes because they can’t make their mortgage payments.

Canstar data insights director Sally Tindall said that “after 12 months with a cash rate at 4.35 per cent, borrowers may have now reached their limit”.

Today is the RBA’s last chance to provide relief before Christmas. After that, it won’t meet again until February. Three more months of hanging on by their fingertips will prove too much for many struggling families. The RBA must cut today or, for many, it will be too late.

Originally published as Why the RBA must cut interest rates now