1.5 million Aussies in limbo despite possible rate cut

A single rate cut is like ‘throwing a cup of water on a bushfire’ and will do next to nothing to ease at least 1.5 million Aussies. Here’s why.

A single rate cut is like ‘throwing a cup of water on a bushfire’ and will do next to nothing to ease the financial strain for 1.5 million households, Aussies have been warned

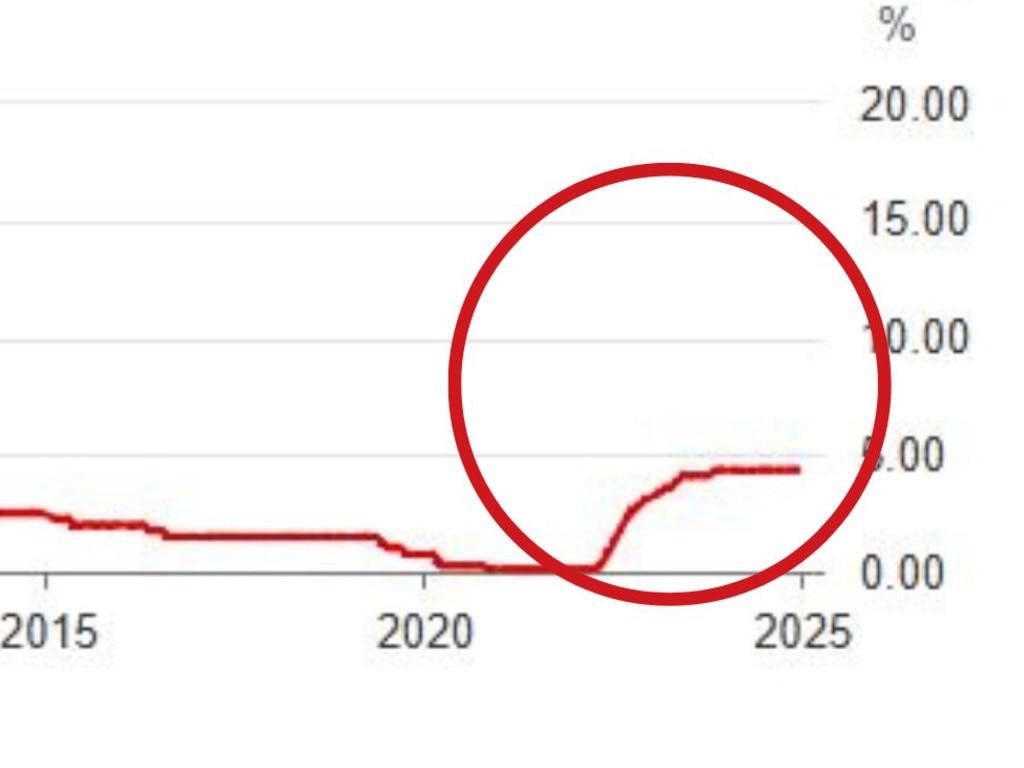

The RBA is expected to finally cut interest rates for the first time in four years on Tuesday, however Aaron Scott, co-founder of Aussie Proptech service bRight Agent argues it will do very little to ease the cost of living crisis for millions of Australians.

Scott said many Australias will continue to struggle during to high mortgage costs and living expenses, even if the cash rate falls from 4.35 per cent.

“A rate cut might sound like good news on the surface, but the reality is that it’s unlikely to make a meaningful difference for many homeowners who are already stretched to their financial limits,” he said.

MORE: RBA cut: Insane way to save $250k

“One rate cut might save you the price of a coffee each day, but it won’t be enough to bring back the Wagyu beef or shiraz.”

“A single rate cut is like getting a 4-cent discount on a $2 per-litre fuel. It might make you feel good, but the saving’s gone by the time you leave the servo.”

“Unless you’ve got half a dozen cuts lined up, one drop in rates won’t move the needle on most household budgets.”

According to recent Roy Morgan research 30 per cent of Aussie mortgage holders – 1.5 million Aussie families – are suffering from mortgage stress. These financial woes have been deepened by the cost of living crisis including the skyrocketing grocery prices.

“On a $1.4 Million loan, a 6.75 per cent loan rate dropping to 6.5 per centwill only save the mortgage holder around $107 per fortnight” Scott said.

“That’s not likely to be enough to give most mortgage holders a meaningful reprieve.

“A single RBA cut is like throw

ing a cup of water on a bushfire — it won’t contain the raging mortgage stress pain.

MORE: Shock mortgage tip to help you save $148k

“Although the RBA’s interest rate hikes didn’t curb property prices as expected, they have been successful in stripping money out of savings accounts through higher mortgage repayments.

“Many families are already at the limit, or beyond it, of what they can afford.

“Inflation has compounded year after year, and real wages still have a long way to go to catch up to pre-Covid norms. A small interest rate cut won’t undo the financial stress that has already set in,” he said.

With real wages not expected to catch up to inflation until 2020, Aussies could be in for years of penny pinching.

However mortgage holders might get some further rate cut relief throughout 2025, with three of the four big banks expecting multiple rates cuts throughout the year.

That could drop the cash rates as much as 100 basis points.

However leading commentator Louis Christopher, SQM Research director believes Reserve Bank Governor Michele Bullock might play things more conservatively.

“If they do cut, I expect confidence to return to home buyers and sellers. Almost immediately, we’ll see clearance rates pick up,” Christopher said.

“The probability is reasonably high that the RBA will cut again at its following meeting in April, but the likelihood depends on the language they use in their February announcement.

“If they cut a second time, I believe that will be it for the year. They may want to wait and see what happens.

“There may not be as many cuts as we have been expecting in this cycle.

“The RBA copped a lot of criticism for not going as high (with hikes) as other central banks. The strategy was that they would not cut as early either. To their credit, I think it’s worked. The strategy has somewhat paid off. The tradeoff for not hiking aggressively is higher interest rates for longer.”

+ Additional reporting Tim McIntyre

MORE: ‘Not true at all’: home loan lie blown apart

Originally published as 1.5 million Aussies in limbo despite possible rate cut