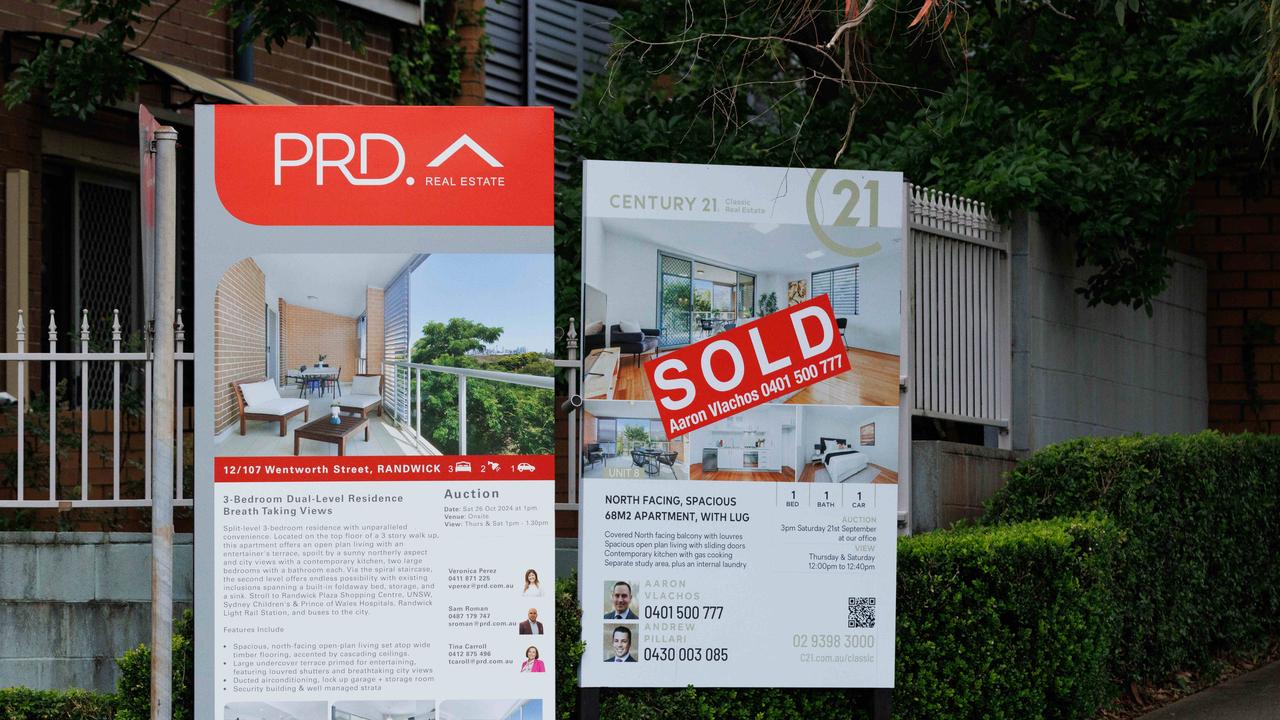

Cities where house prices will grow fastest in 2025

House prices are exploding in these surprise Aussies cities and that’s expected to continue in 2025.

The average home price has hit $800,000 for the first time in history, despite buyers being spoilt for choice thanks to a surge in new listings during spring.

National home values hit a new record in November, after nearly two years of consecutive growth — rising another 0.15 per cent or $23,000 over the month to sit 5.5 per cent higher than a year ago, the latest PropTrack Home Price Index, released Monday, reveals.

But it’s a tale of very different markets across the country. Hobart (+0.43 per cent) and Adelaide (+0.4 per cent) recorded the strongest growth of the capital cities last month, followed by Brisbane and Canberra — both up 0.28 per cent.

MORE: New listings surge to stunning decade-high

Melbourne’s market continued to soften in November, easing 0.07 per cent, while Darwin’s median home price remained flat.

Perth, Adelaide and Brisbane remain the strongest capital city markets for annual growth, with prices up between 12.5 and 18 per cent in the past year.

Given the rise in listings in the capital cities, the regional markets outperformed the capital cities, with prices in regional areas rising 0.26 per cent over the month compared to a tenth of a per cent in the capitals.

MORE:Sign RBA is creating ticking time bomb

Regional South Australia was the strongest performer nationwide, with home prices gaining more than 1 per cent in November to $454,000. Regional Tasmania, NSW, and Queensland also performed well.

PropTrack senior economist Eleanor Creagh said the pace of growth was continuing to slow, despite remaining reslient in the face of persistent affordability pressures.

“This softening in growth has occurred alongside a surge in stock for sale, giving buyers more choice and reducing the urgency to transact,” Ms Creagh said.

MORE:Home loan trap taking years to escape

“However, performance has varied across markets with differing supply and demand conditions.

“The increase in properties hitting the market this year has been met with strong demand, but increased stock for sale has been a contributor to slowing price growth, along with affordability constraints and the sustained higher interest rate environment.”

Heading into summer, Ms Creagh said she expected home prices to continue to rise, though at a slower pace than in previous years.

MORE:Where the population has boomed most and why

Despite inflation now being within the Reserve Bank of Australia’s target range, coming in at 2.8 per cent for the September quarter and 2.1 per cent for October, Ray White chief economist Nerida Conisbee expects the RBA to keep interest rates on hold after their next board meeting this month.

“Up until a few weeks ago, markets were predicting four rate cuts for 2025. Now they are predicting two with the first to come in around May and the second in September,” Ms Conisbee said.

“The main driver of this has been the election of Trump in the US and the potential for widespread economic challenges in the US, and by extension, for us.”

MORE: Hidden cost of appearing on The Block

Originally published as Cities where house prices will grow fastest in 2025