Mortgage arrears fall as home price rises predicted

Fresh new data has shown what Australians could expect to happen with house prices across the country..

Aussie mortgage arrears have fallen despite the ongoing cost of living crisis, with new predictions that national home prices could rise by 4-6 per cent in the next 12 months.

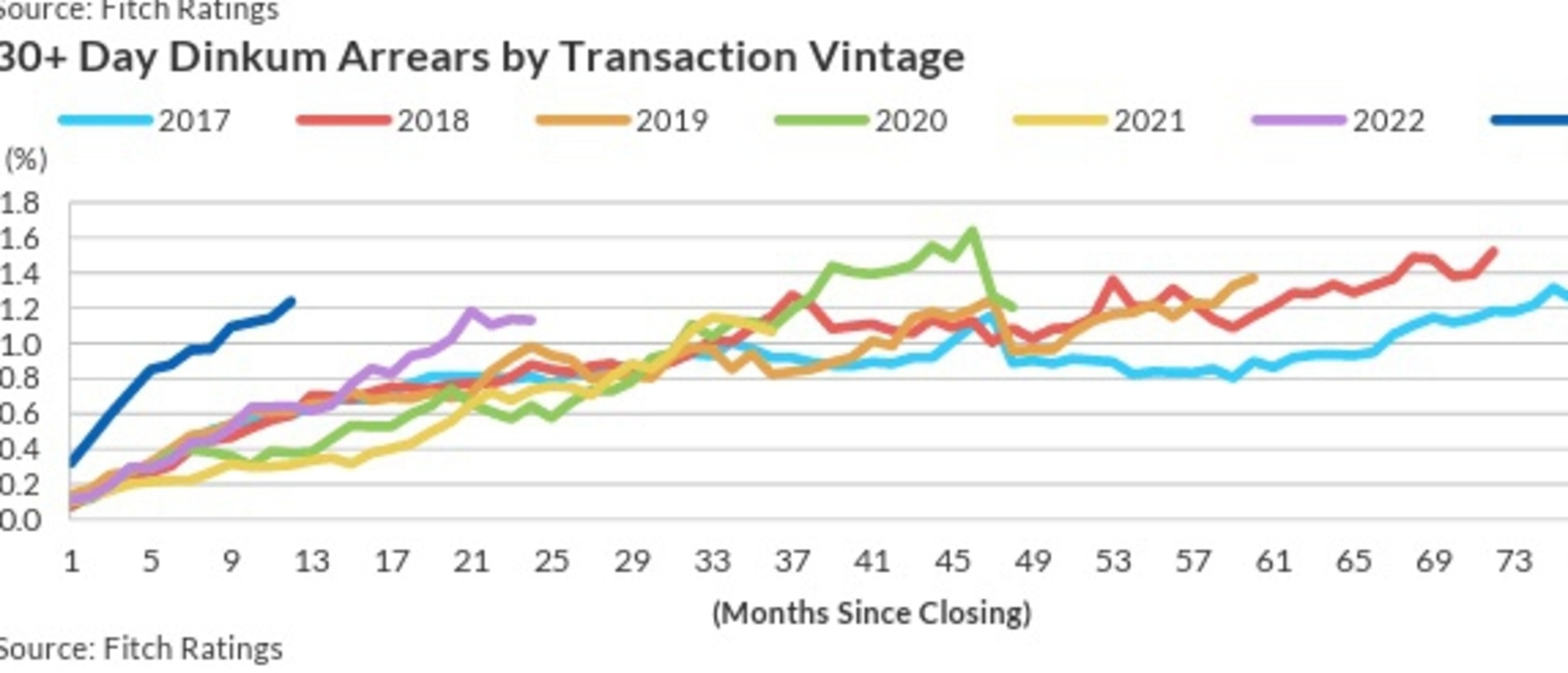

The latest Fitch Ratings’ Dinkum RMBS Index for the last quarter shows that 30-plus day arrears fell quarter-on-quarter by 7 basis points to 1.13 per cent, continuing the decrease seen in the previous quarter.

“Without the addition of new transactions, which typically have lower arrears, conforming index 30-plus day arrears would have increased by 1 basis point to 1.21 per cent,” the report said.

“Non-conforming arrears fell by 32 basis points quarter-on-quarter, but would have risen by 19 basis points without the new transactions.

“The Reserve Bank of Australia cut the cash rate in February 2025 and we expect them to reduce the cash rate twice more in 2025, which is likely to lead to a further fall in arrears.

“Australian home prices fell by 0.3 per cent quarter-on-quarter, but rose by 4.8 per cent year-on-year.

“Prices have continued to rise, to be up by 0.3 per cent in the second quarter.

“We expect prices to rise by 4-6 per cent in 2025 amid limited supply, a tight rental market and high net migration.

“The strong home-price growth for most borrowers should keep losses from the sale of collateral property low.”

But the report, called Australian Mortgage Market Dinkum RMBS Index Monitor: 4Q24, revealed that arrears for home loans borrowed in 2023 remained higher than the norm.

“The 30-plus day arrears for 2023 transactions stood at 1.2 per cent one year after closing, against an average of 0.5 per cent for all other vintages at a comparable time,” it said.

MORE: More than 300 homes planned to meet city’s skyrocketing demand

Australia tipped to be short 400,000 homes by 2029

Grim amount now needed to afford the average Aussie rental

The RBA cut the cash rate by 25 basis points in February, the first cut since November 2020.

The cash rate is now 4.1 per cent.

It comes after another report warned that the Aussie crisis would only get worse, with a 400,000-dwelling shortfall predicted by 2029.

The State of the Land Report 2025 by Urban Development Institute of Australia (UDIA) predicted the Federal Government’s national target of 1.2m new homes by 2029 would fall short by 393,000 dwellings.

The report found 135,640 dwellings were completed in 2024 in the UDIA annual assessment of combined capital city new residential supply, reflecting a modest 2.4 per cent increase on 2023 completions.

This was driven by a 5 per cent increase in the delivery of detached houses across the nation’s greenfield release corridors and within existing urban areas.

Greater Perth lead the way with a 22 per cent annual increase in new dwellings in 2024, while Greater Melbourne was up 7 per cent and South East Queensland was up 1 per cent.

In the same time, dwelling completions fell 4 per cent in Greater Sydney, 6 per cent in Greater Adelaide and 16 per cent in ACT.

UDIA modelling forecasted all capital city markets, with the exception of Perth, would record reductions in completed new product supply in 2025 and further declines in the following year.

Originally published as Mortgage arrears fall as home price rises predicted