‘More than double their market value’: ‘Megalot’ phenomenon making homeowners rich

Ten neighbours who banded together to sell monster “megalots” made $100m overnight. It’s a sweeping trend that’s transforming suburbs across Sydney.

Property owners in some of Sydney’s most affluent neighbourhoods are joining forces to become overnight multi-millionaires.

Rather than offload their home alone, residents in affluent harbourside suburbs like Mosman and Cremorne are selling at “more than double their market value” to developers in “megalot” amalgamations.

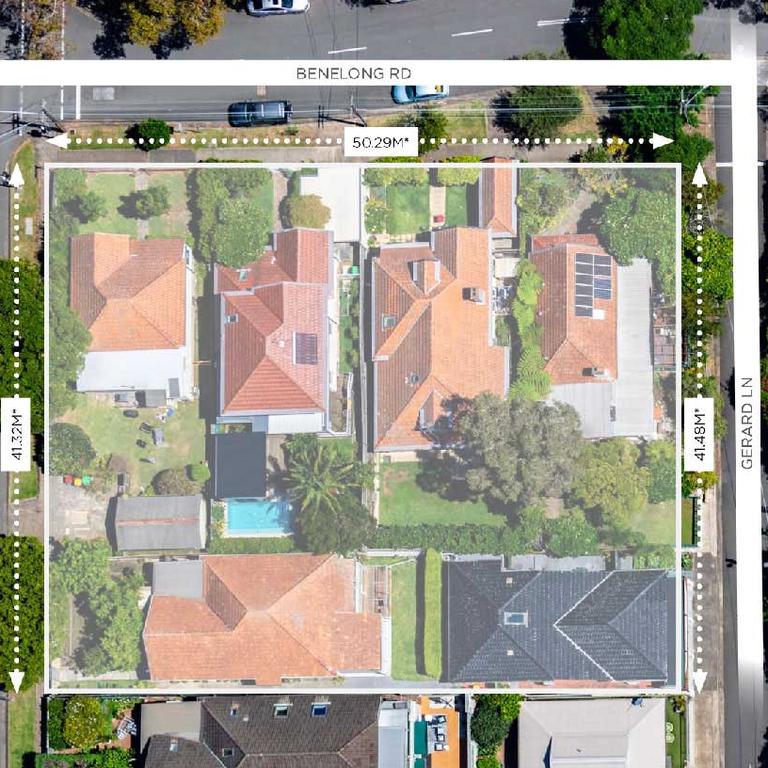

In May alone, two groups of property owners – five along Cremorne’s Benelong Rd and Gerard St; the other five along Mosman’s Rangers Ave just two minutes down the road – were involved in collective sales worth an eye-watering $100 million combined.

It’s a sign, experts say, of the future of urban development in Sydney.

MORE: What your home will be worth in 2030

A team of UNSW and Macquarie University researchers recently published Reassembling the City: understanding resident-led collective property sales – a study funded by the Australian Research Council that cast a spotlight on the phenomenon.

Professor Simon Pinnegar from the UNSW City Futures Research Centre and Professor Kristian Ruming from Macquarie University’s Housing and Urban Research Centre both contributed to the study.

“Collective sales have been a part of the urban renewal landscape in Sydney for many years,” the pair told news.com.au, pointing to developments surrounding the North West metro.

“The current wave being seen in Sydney’s high value land and property markets – the likes of Mosman, Roseville and Gordon – reflect areas where the ‘business of densification’ stacks up given current feasibility considerations: large lot sizes – which means you only need to get 4 to 6 properties together, rather than 10 to 12 – and the ability to command premium sales prices for the apartments that will result.”

MORE: Where the population has boomed most and why

Director of residential sales at Savills, Stuart Cox, has been involved in a number of these amalgamations. He told news.com.au the agency already has “another good raft of sites coming to market in the next two weeks”.

Mr Cox estimated more than 200 homes have now sold across “the heart of this site rezoning” – the North Shore – driven by the NSW State Government’s Transport Oriented Development (TOD) Program, which is designed to increase housing supply near new transport hubs.

The new controls gave the green light to medium- to high-density apartment blocks with a six-storey height limit and 2.2:1 floor space ratio (FSR): which is your site area x 2.2 x the sales rate for that area, Mr Cox explained.

‘Buy for $3 million, sell for $10 million’

For homeowners, the “primary appeal” is “a belief that they will be able to sell their property for a much higher price, compared to if they sold individually”, Professors Pinnegar and Ruming said.

“Coming together to sell ‘in one line’ means that they’re able to deliver the larger amalgamated sites that developers require for higher density development,” they continued.

“By facilitating the assembly process among them removes a traditionally complex task for developers, and so homeowners think that by coming together they will be in a better position to negotiate a higher sales price.”

The median price of a four-bedroom home in Mosman is $5 million.

“(But) if they’ve got amazing views like they have on Rangers Avenue – the one we sold looking straight back at the whole CBD from the ground floor – they’re selling from anywhere from $13,000 up to $15,000 a square metre of GFA (gross floor area),” Mr Cox said.

“And then the ones on Balmoral Slopes, they’re selling anywhere from $15,000 up to $20,000 a square metre. So if you think about it, a 1000 square metre house block can yield 2200sqm of GFA, which times 220,000 is $40 million.

“A lot of these homes are worth like 13, 14 or 15 million. They get more than double their market value.”

Mr Cox said a lot of younger couples – those in their 30s and 40s – partaking in collective sales initially bought their properties for “three or four million and are getting 10 million”.

“So they can now go, buy a more improved, more modern home for their family,” he said.

“Because none of them want to move out of the area – they obviously all love Mosman, they love the schools and the proximity to all the amenities.”

‘How well do you know your neighbours?’

The possibility of achieving such a high sales price is no doubt appealing.

But, as Professors Pinnegar and Ruming found in their research, “it is far from a simple process, (and) while some sales may proceed in a straightforward and timely way … it is a complex and often fraught journey for many”.

Collective sales present two key challenges – the first entirely dependent on the answer to the following questions: How well do you know your neighbours? And, more importantly, do you all get on?

“Pleasantries over the fence and agreeing to put your neighbours’ bins out while they’re on holiday is one thing, but tying your property interests and largest asset together, requiring all to up sticks and move elsewhere, demands quite different levels of co-operation and trust,” they said.

Each individual household will come to a collective sale from “quite different starting points, household circumstances, and future needs”, as well as with conflicting sales price expectations and preferences as to the agent they want to use or developer they want to sell to.

“Group dynamics come into play and there are many reasons that can cause groups to fall apart,” Professors Pinnegar and Ruming said, adding it’s “not uncommon” for this to happen over the sales process.

“It is also important to remember that some people just don’t want to sell their home, no matter what price they might get. These people love their home and neighbourhood and don’t want to leave – or at least not yet.”

Mr Cox also warned it is “highly critical in all these deals that they get one solicitor representing the whole group”.

“You can’t have eight owners with eight solicitors,” he said.

“The deal will never get over the line.”

The other challenge raised by Professors Pinnegar and Ruming is that it can take “a very long time” to finalise the sale – which can be attributed to everything from owners holding out for a higher sales price to the way developers tend to buy these properties.

“In most cases developers purchase options on the land, providing owners a small percentage upfront, with the final sales occurring at a later date,” they said.

“As time passes, market and economic cycles shift, and expectations of owners in the collective may change. Some sales fall over, requiring homeowners to go through the process again.

“Developers will also closely track viability and feasibility of development tied to market conditions, availability of finance and evolving planning parameters. In our research, we spoke to owners in collectives who had been looking to sell for many years.”

According to Mr Cox, the typical settlement for these deals can be as long as two years.

“No one’s buying these sites for a six-week settlement, because obviously these homeowners live there for many years,” he said.

“It’s going to take these developers at least 12 months to get their DAs in most instances, plus the Construction Certificate after that. Every deal up there at the moment is around that 18- to 24-month settlement.”

‘It’s not a bad life for some of these people’

Whether in Mosman, Marrickville or Merrylands, according to Professors Pinnegar and Ruming “residential densification through TOD will be the fundamental defining feature of urban development in Sydney in the coming decades”.

“The government’s planning reforms place a great deal of expectation that land assemblies will occur, that sites will be amalgamated and new residential supply will be delivered through density,” they added.

“Much of the new supply to be enabled through the TOD Program rests on assumptions that land assembly is something that the market will drive and make happen. In reality it is a highly contingent and intensely ‘peopled’ process, involving a great deal of complexity.

“So yes, we will increasingly see these developments brought forward through collective sales and land assemblies, but not in a seamless, timely or indeed particularly strategic way.”

As for where these homeowners go when all is (hopefully) said and done? In terms of putting down fresh roots, Mr Cox said, it often isn’t far.

“I think you’re going to find a lot of them are going to have a lot of leftover cash,” he said.

More Coverage

“A lot of them have talked about buying back into these developments because they love living in the area – they don’t want to move away from the area.

“So they’re selling their home for, say, $10 million, buying a three-bedroom apartment for $6 million, $7 million – which will be a very high-security, lock-and-leave scenario – then they go travelling with the balance of the funds.

“It’s not a bad life for some of these people.”