Geelong sales that should have buyers are licking their lips

Strong December sales show buyers are developing a taste for passive investments on some of the city’s busiest retail strips.

Strong December sales for tenanted retail investment properties in Newtown and central Geelong have underlined growing confidence in commercial real estate in the city.

Auction sales in Pakington St, Newtown and Wright Place, Geelong put an exclamation mark on a year when a significant amount of property owned for generations has changed hands.

A Geelong investor landed the dual tenanted property at 317 Pakington St, Newtown under the hammer for $2.295m, reflecting a 3.6 per cent yield.

The property was part of a deceased estate but owned by a family for 35 years, Darcy Jarman agent Tim Darcy said.

RELATED: High profile location to drive interest in Belmont property

Twelve Apostles eco-resort site listed for sale

World-renowned Great Ocean Road restaurant listed for sale

Newtown Provedore and SAS Designs & Concepts have been long-time tenants that recently committed to new three-year leases, Mr Darcy said.

“It was very keenly sought after by a parochial audience of a number of locals who understand the strength of Pakington St and all the attributes that this property had,” he said.

Mr Darcy said the result and the response to the property from four bidders underlined the respect commercial investors had for quality Pakington St real estate.

“It’s a very niche strip and it supports a vibrant demographic happy to patronise the various fashion shops and other ancillary shoulder retailers that are in that area.”

Much of the interest for a medical consulting property in central Geelong was from Melbourne and Sydney, but they couldn’t beat a local buyer at auction.

The freehold tenanted investment with a six-plus-six year lease to Berth, a pregnancy and birth care services provider, sold for $1.33m, securing a yield of 5.26 per cent.

The 201sq m triple-fronted freehold property at 2 Wright Place was sold 15 months after the owners acquired it with a complex of neighbouring commercial properties and repositioned it.

Mr Darcy said six bidders contested the auction, an endorsement of a perception among local and external investors that Geelong has a vibrant and prosperous real estate market.

“Irrespective of what’s going on in regards to general market conditions, it’s a commanding endorsement for where good quality real estate sits particularly in a commercial sense,” Mr Darcy said.

“Both of those sales were bought as passive investments. The evidence speaks for itself – it’s just a glowing endorsement for how people see and perceive a better grade properties.”

The auction sale came after a fully let CBD hospitality property sold for $2.251m, setting a 5.3 per cent yield.

The 370sq m dual tenanted investment property at 41 Gheringhap St and 9 Downes La, Geelong, is home to Augustus Gelatery and Felix Restaurant.

Gartland, Geelong agents Michael De Stefano and Adam Farrell handled the expressions of interest campaign with Chris Kombi and Lewis Waddell of Fitzroys, who were also conjunctional agents at 2 Wright Placce.

The building has 330sq m floorspace split over two tenancies that share one title and earn $125,000 annual rental income, plus GST.

Landmark properties traded at other major retail centres this year including Pakington St, Geelong West, and Barrabool Rd, Highton.

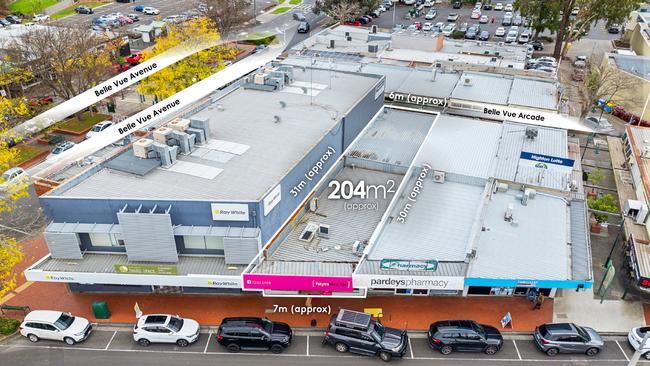

At Highton Village, investors paid $1.825m to secure a 204sq m dual tenancy building at 79 Barrabool Rd.

It was the first time this property was on the market since the 1960s, selling agent James Wilson said.

The property offered an $80,000 annual income, with tenants holding five-year lease options to be renewed next August.

Highton Village also offers a development upside, with an urban design framework setting a preferred three-storey height limit to Barrabool Rd, with setbacks.

On Pakington St, Geelong West, the 150sq m property leased to the city’s first cheese train, Splatters Cheese Bar, was traded in June for $1.777m.

The property at 168-170 Pakington St was listed with an annual rental income of more than $63,000, plus GST and outgoings.

It had been listed with price hopes from $1.625m to $1.7m.

Originally published as Geelong sales that should have buyers are licking their lips