Coronavirus: Market adapts as auctions ‘drop dramatically’

Melbourne was due to host one of its busiest auction weeks of 2020 before the shutdown ban on public sales. Digital auctions proved to be a winner for some, but others are opting out.

About a third of Melbourne auctions were canned following the Prime Minister’s ban on public sales last week, but the softened market still produced a solid clearance rate.

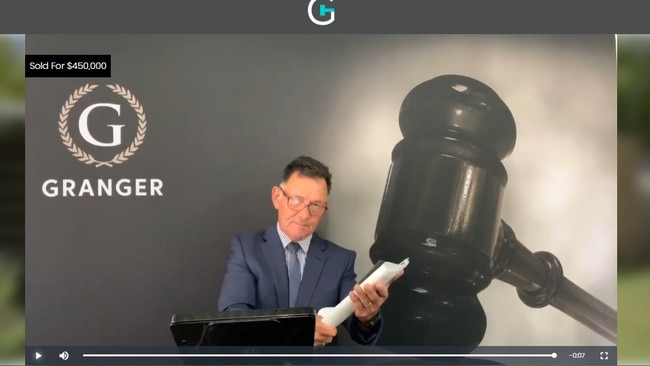

Among the properties to sell were an “absolutely original” 1970s Frankston house that attracted three bidders to fetch $450,000 via auction streaming and bidding website Gavl.

CoreLogic had expected 1517 homes to go under the hammer in Victoria’s capital last week, as part of a nationwide offering of 3203 auctions that would have made it “the busiest week of the year”.

RELATED: How to bid at a digital auction in the age of coronavirus

First-home buyers dominate digital Melbourne auctions

South Kingsville townhouse sold in email auction

But preliminary figures showed 32 per cent of Melbourne auctions were withdrawn following Scott Morrison’s announcement last Tuesday, which temporarily outlawed on-site and in-room auctions to help curb the spread of coronavirus.

CoreLogic also reported a surge in properties selling prior to their scheduled auctions as agents brought them forward to beat the ban, or as vendors expressed new motivation to sell before lockdown measures potentially escalated.

The property data firm recorded an early 58.6 per cent clearance rate for last week, from 752 reported auction results — up slightly from the week before’s 58.4 per cent from 1343 auctions.

CoreLogic auctions analyst Kevin Brogan said the figure — which included properties sold prior to auction — reflected “resilience” in the Melbourne market during challenging times.

“It was a really big ask to switch (1517) auctions into a digital format on three days’ notice, but agents rose to the challenge,” he said.

“About 117 auctions were moved to Wednesday night so they could be conducted before the curfew. And on Saturday, 250 homes sold prior (to auction) while just 59 sold at, which is very unusual.

“That shows agents are adapting.”

He forecast “substantially fewer auctions than normal” for the weeks to come, tipping many vendors would opt for the private sale method instead or withdraw from the market entirely. Another option was to conduct the auction online.

“For the auctions that are still scheduled, agents and vendors will be looking at ways to continue to a successful outcome,” Mr Brogan said.

“It will be dependent on there being buyers who are in a confident position to go through with the transaction.”

Realestate.com.au reported a preliminary 83 per cent clearance rate. But the listings website only counted the 336 properties that were ultimately offered via the auction method, and not those that were withdrawn.

Realestate.com.au chief economist Nerida Conisbee said clearance rates would increasingly become a “redundant” indicator of market sentiment in the weeks to come, given auction activity would “drop dramatically”.

She added it was worth remembering in normal circumstances, just 30 per cent of all Melbourne residential sales were done via auction.

Granger Estate Agents used Gavl to sell 6 Merlin Court, Frankston, on Saturday, March 28.

The dated four-bedroom house on a well-positioned 607sq m block rose from $380,000 to $450,000 in about 20 bids to sell to renovators who planned to renovate and flip it, depending on future market conditions.

Auctioneer Leigh Donovan told those watching on Gavl the house was “not a palace”, but it was an “unbelievable opportunity” as the worst home in the best (street)”.

Listing agent Craig O’Connor-Price said the deceased estate’s reserve had been $440,000, but the vendors would have been content to sell for $430,000.

Gavl chief executive Joel Smith said 50 per cent of the auctions that were due to be streamed on the platform on Saturday were cancelled and moved to other sale methods.

But the ones that did go ahead were “quite exciting”.

“The industry, and buyers and sellers, have transitioned quickly to technology,” he said.

“The toughest thing for auctions at the moment is the environment of uncertainty.”

A Keilor East property marketed as being “suitable for homebuyers, investors and developers” also fetched $645,000 at a digital auction run via Anywhere Auctions.

The sale of 13 Dinah Pde was well below the quoted $680,000-$730,000 quoted range, prompting Barry Plant Moonee Ponds auctioneer Paul Filippone to note: “This will be the cheapest … property in Keilor East for a long time.”

MORE: How to win the private sale game during coronavirus crisis

Greensborough ‘grubby old pool’ on the market for $400,000

Big-name developer brings New York style in Collingwood

Originally published as Coronavirus: Market adapts as auctions ‘drop dramatically’