Melbourne and regional Victorian suburbs where mortgage repayments now cheaper than rent after rate cut | Finder

Buyers are cashing in as mortgage repayments dip below rent in dozens of suburbs, but experts warn the window of opportunity may not stay open for long.

Interest rate cuts are boosting the number of Melbourne suburbs where it’s cheaper to pay a mortgage than rent — with buyers saving more than $150 a week in some areas.

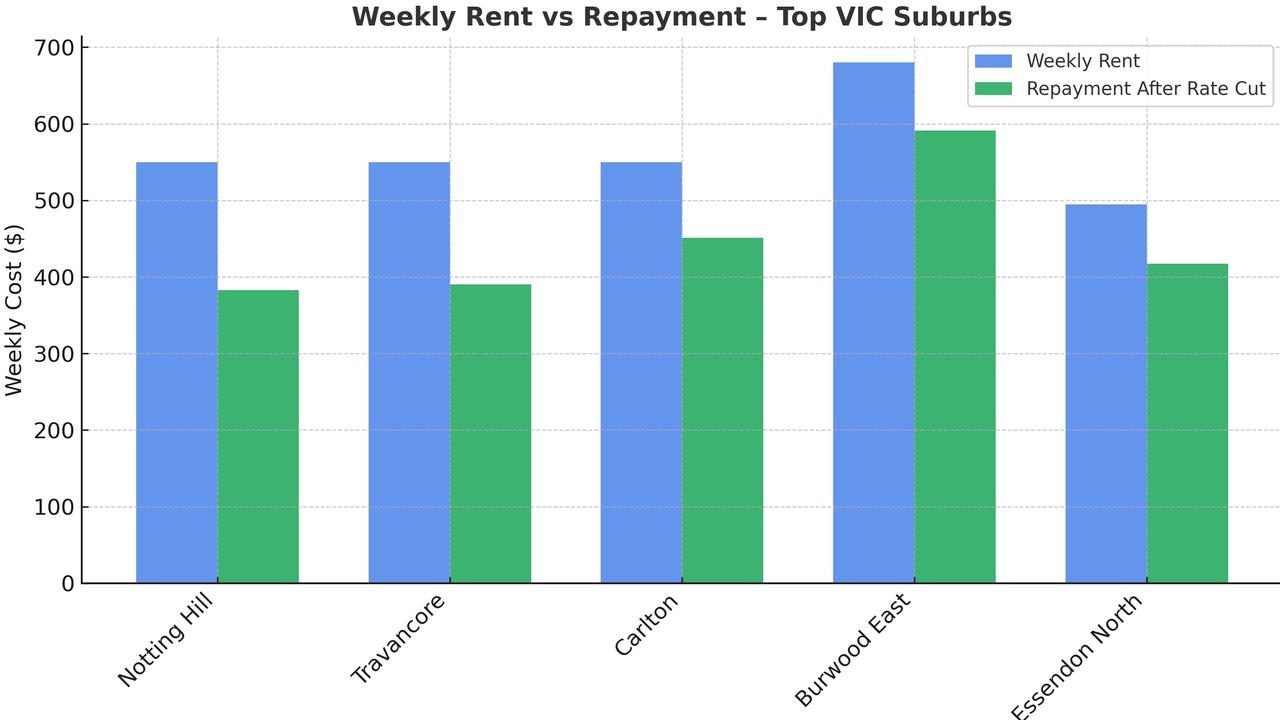

Finder analysis shows the number of suburbs where the mortgage on a median unit undercuts the average rent has risen from 25 to 32.

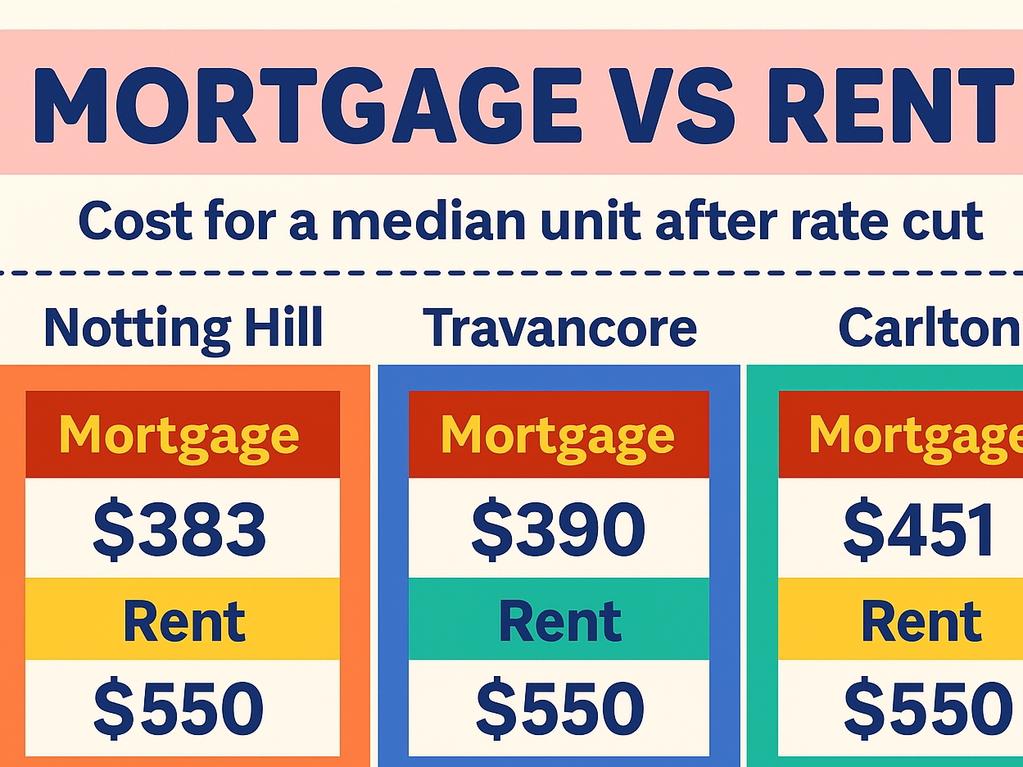

In Notting Hill, Travancore and Docklands, weekly savings for buyers now range from $110 to $156.

RELATED: $1bn tower surpasses Australia’s tallest project

State budget: Kick in the guts to first-home buyers

Ex-AFL boss booting $16.5m Toorak home

Across Victoria there are 13 additional suburbs where buying a unit is cheaper than renting, including Mildura, Geelong West, Moe, Sale and Benalla.

Another 18 areas, typically more remote in location, have cheaper house prices than rents, from Rochester near Shepparton to Ouyen south of Mildura and Mortlake towards Warnambool.

The Melbourne list is expected to rise to 44 after another cut, potentially as soon as July, and could reach 57 before the year’s end if the Reserve Bank delivers a third.

107/23 Batman St, West Melbourne, where mortgage repayments now undercut average rent in the suburb.

But with warnings cheaper money could fuel further price growth, renters hoping to escape the squeeze may not have long to act.

Finder personal finance specialist Taylor Blackburn said the rent-versus-buy equation was tipping in more buyers’ favour every month.

“There are a handful of suburbs where your monthly mortgage might be less than the average rent,” Mr Blackburn said.

“This research shows the importance of getting your home loan rate lowered.

“Very few renters are successfully arguing for rent decreases, but homeowners can do this with a rate cut, a phone call or a refinance.”

710/38 Mt Alexander Rd, Travancore could offer buyers $149 weekly savings, one of the top suburbs of Melbourne units where buying now beats renting.

He added that some borrowers could unlock the equivalent of nearly two rate cuts by switching to a better loan.

RT Edgar Inner North auctioneer Jerome Feery said Melbourne’s inner suburbs were already seeing a lift in first-home buyer interest.

“There’s a real shortage of rental stock right now, and it’s pushing tenants to ask: ‘Why am I paying someone else’s mortgage?’” Mr Feery said.

“We’re seeing a big wave of first-home buyers snapping up investor stock and taking that leap into ownership.”

Mr Feery said this week’s rate cut hadn’t caused a market surge, but sentiment was clearly improving.

“A couple of months ago, we were lucky to see one bidder at auction,” he said.

“Now we’re seeing two or three active buyers on entry-level homes.

“It’s not a boom — but it’s a bounce.”

The auctioneer warned buyers not to wait too long if they were ready to act.

“Get organised; have your pre-approval, your building inspector, and know your numbers,” Mr Feery said.

“When a good property comes up, being prepared can make all the difference.”

Melbourne buyers’ advocate Simon Murphy said affordability had now shifted, especially for renters comparing repayments to rent.

“What I’m seeing is that rent is just as expensive, or in some places, even more expensive than mortgage repayments,” Mr Murphy said.

“That’s pushing a lot of renters to finally ask: is it time to jump in?”

But Mr Murphy said the federal government’s First Home Guarantee 5 per cent deposit scheme wasn’t keeping pace with the market, especially in Melbourne.

Latest PropTrack data shows the city’s median house value is $900,000, well above the $800,000 cap on the program.

G10/115 Burwood Highway, Burwood East could deliver buyers a $90 weekly saving, and is one of several eastern units now cheaper to own than rent.

“The same with stamp duty, the exemption at $600,000 is increasingly irrelevant,” he said.

The Melbourne buyers’ advocate added that the 0.25 percentage point rate cut could increase a single buyer’s borrowing power by around $25,000.

“For those with savings in the bank, it’s game on,” Mr Murphy said.

“But buyers using the scheme are still boxed in and many are turning to alternative strategies to enter the market.

“Some are moving further out for a year or two, or they’re rentvesting — buying in a more affordable area while continuing to rent closer in.”

He cautioned that rising demand could quickly drive prices higher.

“There’s energy in the market again, you can feel it,” he said.

“Those who wait may be priced out all over again.”

Top 10 Victorian Suburbs Where It’s Cheaper to Own Than Rent After One Rate Cut

| Suburb | Median Sale Price 12 months | Median Asking Rent 12 months (weekly) | Weekly repayment after 1 cut (-25bps) |

| Notting Hill | $352,940 | $550 | $383 |

| Travancore | $360,000 | $550 | $390 |

| Carlton | $416,000 | $550 | $451 |

| Burwood East | $545,000 | $680 | $591 |

| Essendon North | $385,000 | $495 | $417 |

| Albion | $281,000 | $380 | $305 |

| West Melbourne | $521,000 | $630 | $565 |

| Southbank | $588,500 | $700 | $638 |

| Flemington | $395,000 | $490 | $428 |

Source: Finder and PropTrack – Full list here

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Couple ordered to demolish dream home

Melb family’s bold plan for six-figure rate cut win

Elite Shrublands mansion gets eye-watering price cut

david.bonaddio@news.com.au

Originally published as Melbourne and regional Victorian suburbs where mortgage repayments now cheaper than rent after rate cut | Finder