IWD 2021: Australia’s great gender property divide — does more need to be done to even the playing field?

While the gender pay gap is always a hot topic around International Women’s Day, it is the wealth divide caused by a disparity in property ownership that has come under the spotlight.

While the gender pay gap is always a hot topic around International Women’s Day, it is the wealth divide caused by a disparity in property ownership that has come under the spotlight this year.

Experts say because real estate plays such a vital role in Australians’ wealth accumulation, more needs to be done to even the playing field.

RELATED: Surprise Sydney region to buck gender property trend

How 23-year-old woman bought house mortgage free

What’s fuelling Australia’s property insanity right now

Jessica Brady, co-founder of Fox and Hare Financial Advice, and co-host of YouTube series Ladies Talk Money, said the pay gap impacts when and where women can get into the property market.

“If we can do more to get younger people into the property market earlier, it’s obviously going to have a big impact for women because it’s highly likely that they’ll be earning an income and be pre-children,” she said.

“If they do decide to have children or need to sell their property later in life, hopefully, they’ve been able to knock down some debt and build some equity,” she said.

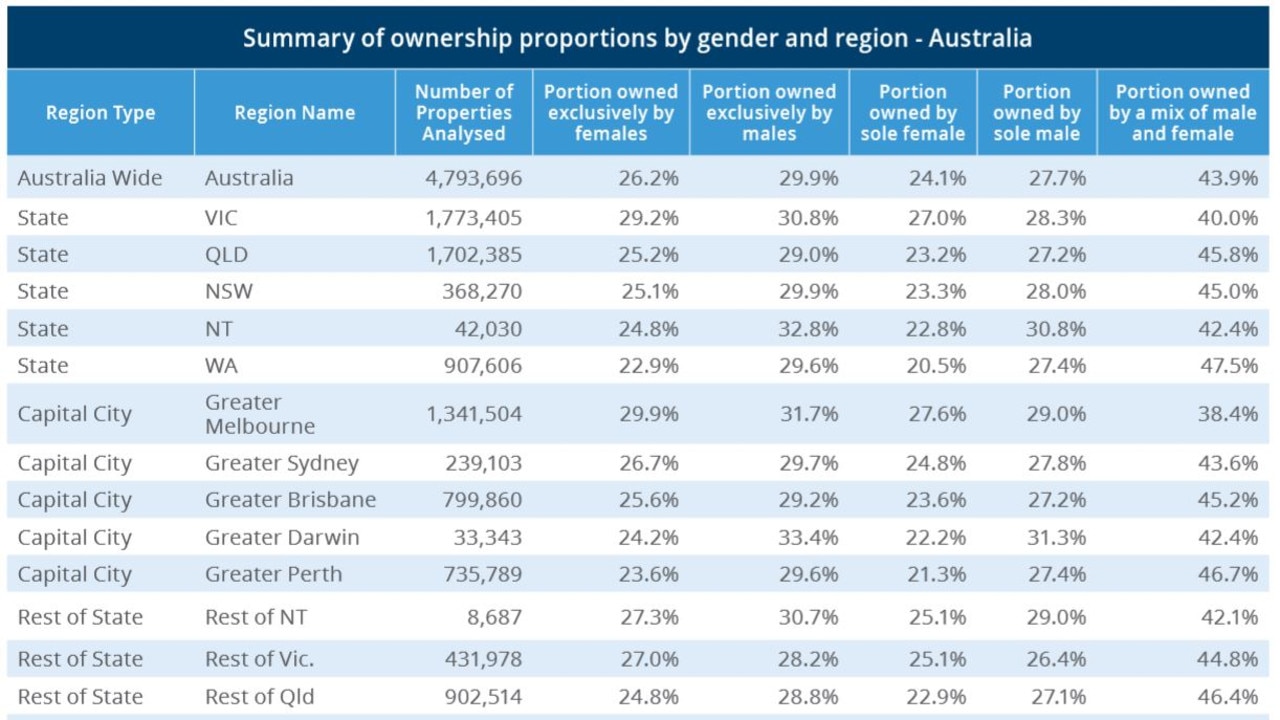

On International Women’s Day, CoreLogic published its inaugural Women and Property Report demonstrating the relationship between the gender pay gap and the gender wealth gap.

CoreLogic crunched the numbers to highlight how the 13.4 per cent pay gap impacted access to home ownership.

Based on the average weekly full-time earnings for men and women, it would take women an additional 10 months to save for a 20 per cent deposit on the current median Australian dwelling value.

“If it’s going to take more time for women to enter the market, then what happens in that time in a strong market? House prices keep growing and it’s just locking women out into perpetuity because they’re constantly having to chase their tail,” Ms Brady said.

“The other thing to consider is the cost of the urban sprawl, particularly if you look at places like Sydney and Melbourne. It’s this really complex situation because to be able to afford rent or a mortgage they’re having to live hours away from their place of work. And if they’ve got small children, it puts the care burden onto someone else, or it means they can’t have those job opportunities.

Milena Malev, CoreLogic International’s general manager of financial services and insurance said property ownership and building wealth are inextricably linked to income, so a long-term policy was needed.

“For government, there are implications for the provision of social support. The gender pay gap appears to be creating a barrier for entry into the property market among women, and this is amplified for single or lone adult households,” ” she said.

“Women are more likely to exit property ownership after the dissolution of a marriage and that’s where we see women over 50 among the highest growing rates of homelessness in Australia,

Ms Brady said in a post-pandemic world we should be more aware of how vital low-income female-dominated roles are to the economy.

“Why don’t we have more incentives for people who work in government care roles like teachers, nurses and emergency workers? What incentives and programs beyond what exists now can we bolster and bring out for them?

“We know that women make up large portions of the care sector and we don’t value their work, and we pay them very little. Yet the COVID-19 lockdown is proof that actually they are, by and large, who we need to keep the country and the economy functioning,” she said.

Eliza Owen, CoreLogic’s head of research, and author of the Women and Property Report, said the findings highlighted the severity of the property ownership gulf.

“CoreLogic estimates Australia’s residential real estate to be worth over $7 trillion. Given there’s a high level of equity held in real estate, if you don’t own property, that’s a big source of household wealth and security you don’t have access to,” Ms Owen said.

One key finding was that the most common type of ownership is two people together; in most cases a male and a female.

“That speaks to affordability constraints and infers you often need dual incomes to achieve property ownership,” she said.

“The other element of this is that lone households would have less success getting into the property market. What’s important about that, when it comes to women and real estate, is that women make up over 60 per cent of either single-parent or lone adult households,” Ms Owen said.

“Yet at the Australia-wide level, sole property ownership among women is less than their male counterparts, which means women are over represented in lone households but under-represented in property ownership.”

According to Ms Brady, it is “extremely frustrating” that governments aren’t focusing on single income households.

“We need more rent-to-own schemes, we need to acknowledge that the huge proportion of women in Australia are doing vital work, and all the home duties, yet home ownership is just so out of reach for them,” she said.

“Another thing that doesn’t get talked about is that women tend to prefer property as an asset because they see it as secure. But if women want to live in the property they buy, they want to feel safe and often safe neighbourhoods are just more expensive to buy into,” she added.