How lowering mortgage buffer could help 400,000 young Australians buy homes

The dream of homeownership could become reality for thousands of Australia, if one key barrier is finally torn down.

Lowering the mortgage stress test by just half a per cent could help almost 400,000 young Australians finally get a foot on the property housing ladder.

New Finance Brokers Association of Australia research revealed reducing the serviceability buffer from 3 per cent to 2.5 per cent would boost borrowing capacity and allow thousands of would-be homeowners to qualify for a loan.

It comes as first-home buyers continue to battle soaring house prices, tougher lending rules and limited housing supply.

RELATED: Mortgage over marriage: couples ditching the altar for bricks and mortar

Young family’s reno pays off with $1m+ result in Seaford

Inside quirky Vic house made from 13,569 bottles

FBAA managing director Peter White said it was a simple move that could make a life-changing difference.

“These are people who can afford the repayments, but they’re being unfairly locked out by an unrealistic system,” Mr White said.

CoreData modelling found the tweak would lift national borrowing power by 5 per cent and unlock an extra $276bn in loan capacity.

Around 270,000 more Australians would qualify for a median home loan, with almost 400,000 first-home buyers aged 25 to 34 among the biggest winners.

Buyers agent Cate Bakos said the 3 per cent buffer was a hangover from the era of emergency interest rates, and was now doing more harm than good.

“Dropping the buffer by just half a per cent would put better homes within reach,” Ms Bakos said.

“It could be the difference between buying a one-bedroom apartment or a two-bedroom unit, or getting into a better suburb closer to work and family.”

MORE: Brighton beach boxes: Six-figure sale for coastal icon

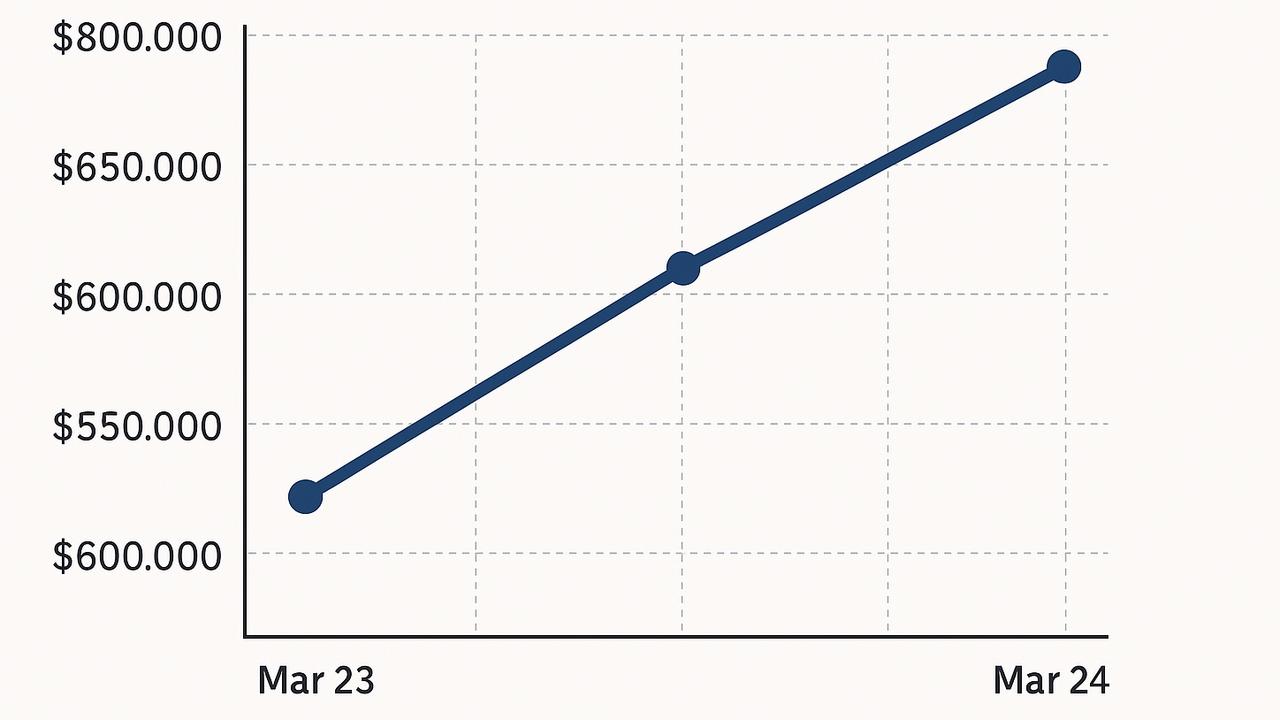

She said the Melbourne $600,000 to $900,000 market, where many first-home buyers operate, remained “relatively soft” — giving young buyers a rare opportunity to purchase without fierce competition.

However, independent property economist Cameron Kusher warned the policy could have unintended consequences.

“It would definitely help first-home buyers in the short term,” Mr Kusher said.

“But if you boost borrowing capacity, you inevitably boost prices too, and that could make it even harder for the next group trying to get in.”

Mr Kusher said while a 5 per cent lift in borrowing power was meaningful for buyers on the cusp, it would not fundamentally reshape the market.

He said the real solution to housing affordability was unlocking more supply, not just tweaking lending rules.

Both Ms Bakos and Mr Kusher said the serviceability buffer should be reviewed regularly to reflect changing economic conditions, rather than staying at emergency settings indefinitely.

The FBAA has urged both major parties to commit to a review of the buffer ahead of the federal election.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Real estate guru selling $36m penthouse in Melb tower of power

New hope for home cost hitting 1.27 million Victorians

Vic sculpture home with 400kg rhino hosts ‘White Lotus’ parties

david.bonaddio@news.com.au

Originally published as How lowering mortgage buffer could help 400,000 young Australians buy homes