Housing crisis shock: Half a million homes short of target

A new report reveals the nation is nearly half a million homes short of its target to fix the housing crisis.

The nation is facing a shortfall of nearly half a million homes under the national housing target in a race against the clock to ease the housing crisis, a new report reveals.

Under the National Housing Accord, target of 1.2 million homes has been set for 2029, but Australia is projected to be 462,000 homes behind that target, according to a new Property Council of Australia report released Tuesday.

The report found bridging the gap and building the extra homes could save renters on average $90 a week on average across Australia.

New South Wales has the largest shortfall in the country, with 185,000 homes still needed to meet its 375,000 target, followed by Queensland, which is 96,000 short of its target, while Victoria has a 71,000 home shortfall.

RELATED: Australia predicted to miss National Housing Accord annual targets until 2028

The Property Council is calling for the New Homes Bonus — a $3 billion reward program for jurisdictions that build more homes than their share of the housing target — to be doubled.

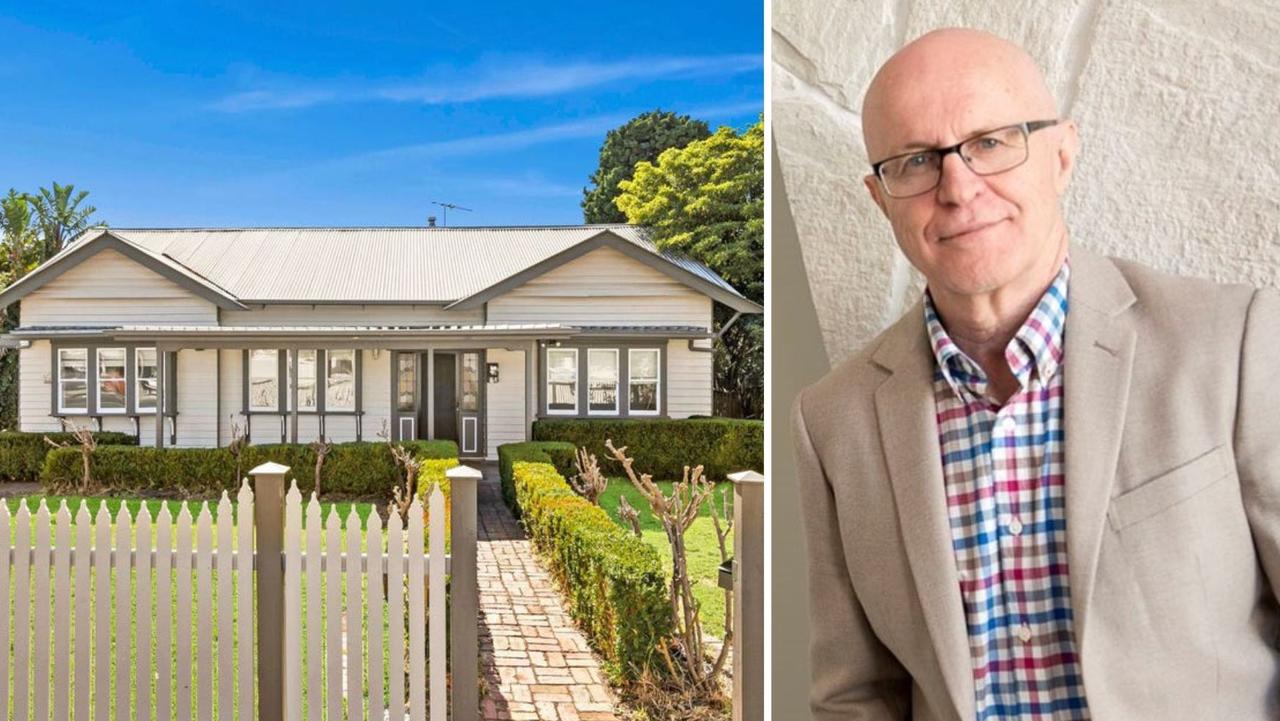

Property Council chief executive Mike Zorbas said more than seven million renters would collectively save $253m every week if housing targets were reached.

MORE: Demographers reveal risk in government’s 1.2m home National Housing Accord plan

“2025 is the year for Australia to redouble our housing supply efforts with the urgency and commitment this crisis demands,” Mr Zorbas said.

“Missing the target by 462,000 new homes by July 2029 would set off a housing affordability time bomb.

“Boosting housing supply is the only long-term, sustainable way in which we can boost affordability of homes to buy and to rent.”

Mr Zorbas said reworking the New Homes Bonus scheme would give “a shot in the arm” to the housing target with only minimal cost to the government’s budget.

“The scheme should be extended to seven years with upfront payments to support long-term reforms,” Mr Zorbas said.

“Its value should increase to $6 billion, with unspent funds reserved for future housing initiatives. That increase would be just 0.1 per cent of the Australian Government’s 2024/25 Budget.

“The Property Council has called for incentives for two decades because they are vital to boosting housing supply.”

The latest figures from the Australian Bureau of Statistics reveal there were 170,719 homes approved in 2024 — the second worst annual figure since 2012.

Affordability is also getting worse, with the average cost of building a new house around the country surpassing $500,000 for the first time in December, according to the ABS data.

Oliver Hume chief economist Matt Bell said the only way to come close to meeting the national housing accord target was to increase new dwellings in both infill and greenfield housing markets.

“This means faster release of new land, better planning incentives for new development — and consequences for those local governments that get in the way — and funding for supporting infrastructure,” Mr Bell said.

The Institute of Public Affairs claims the ABS approvals data shows state and federal governments are 23 per cent below the required average monthly approvals needed to meet the 1.2 million new homes commitment..

“Australians desperately trying to secure a home of their own are being let down by the federal government’s National Housing Accord, which in seven months has failed to meet a single delivery target,” Institute of Public Affairs director of research Morgan Begg said.

It comes as new research from the Australia Institute has found it takes more than 10 years to save a 15 per cent deposit for a home.

Ten years after former Treasurer Joe Hockey advised Australians to get ‘a good job that pays good money’ to buy a house, the analysis reveals a Sydney homebuyer would still be $155,000 short of a deposit if they had started saving in 2015.

The Australia Institute’s chief economist Greg Jericho said capital gains tax and negative gearing reforms needed to be considered in the lead up to the federal election.

“The settings that we have at the moment, that have been in place for 25 years now, are not working — in fact, they’re making things worse,” Dr Jericho said.

He added that public housing, which used to take up 10 to 15 per cent of new housing builds, now made up around 2 per cent of the market.

“The public sector has just departed the field,” he said. “We have a system that is pretty much driven all by the private sector.”

Originally published as Housing crisis shock: Half a million homes short of target