Home loan guru’s big money warning

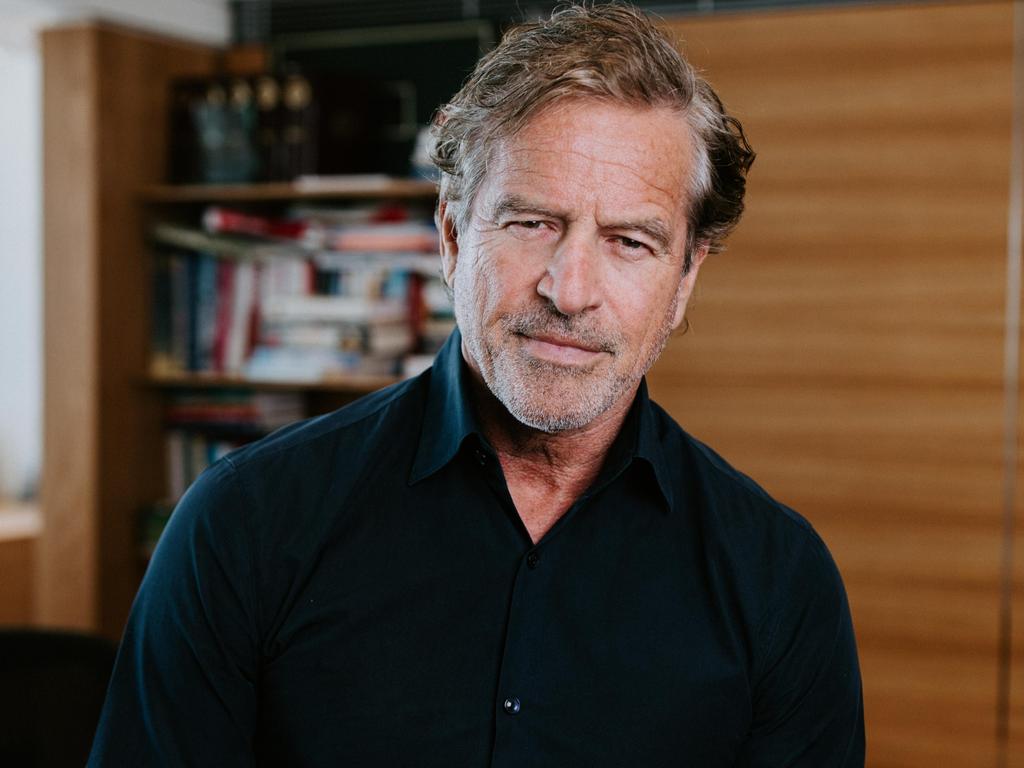

Home loan guru Mark Bouris has issued a stern warning for Aussie homeowners.

Home loan guru Mark Bouris has issued a stern warning for Aussie homeowners over what to expect for the next 18 months.

The finance wizard has warned homeowners not to expect interest rates to fall until next year as inflation continues to be stubbornly resilient.

Last month the Reserve Bank of Australia left the cash rate at its 12 year high of 4.35 per cent. It has sat since there November last year after a series of rapid shifts shot the rate up from a record low of 0.1 per cent in April 2022.

As the cost of living crisis bites hard, homeowners are also feeling the pinch of high interest rates and Bouris, the chairman of Yellow Brick Road and founder of Wizard Home Loans, believes interest rates won’t be coming down any time soon.

MORE: ‘Nonsense’: Joe Biden’s bizarre approach to home loan

“I don’t know if we’re close to it,” he told Channel 7.

“I think we’re more likely seeing rates come down sometime later next year in 2025, at least that’s what the money marketing economists are predicting.

“The Reserve Bank’s predictions about what their interest rate rises were going to do are going to take longer to cut in. They are just taking longer for people to readjust their spending.”

Bouris, who is also a member of the powerful Sydney Roosters NRL board, said those Aussies with a mortgage are really struggling during the cost of living crisis.

Earlier this year, many economists predicted homeowners would enjoy a rate cut by the end of 2024.

However as inflation remains high, that appears to no longer be the case. Some experts have said the RBA might even move to push the case rate higher.

“Inflation remains above target and is proving persistent … The outlook remains highly uncertain,” reads the minutes from the RBA’s Monetary Policy Decision last month.

“Inflation has fallen substantially since its peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance.

MORE: Aussie home prices hit record high, despite falls in two capitals

“But the pace of decline has slowed in the most recent data, with inflation still some way above the midpoint of the 2–3 per cent target range. Over the year to April, the monthly CPI indicator rose by 3.6 per cent in headline terms, and by 4.1 per cent excluding volatile items and holiday travel, which was similar to its pace in December 2023.

“Broader data indicate continuing excess demand in the economy, coupled with elevated domestic cost pressures, for both labour and non-labour inputs.

“Conditions in the labour market eased further over the past month but remain tighter than is consistent with sustained full employment and inflation at target.

MORE: Putin’s $2.1bn ‘kleptocrat’ mansion exposed

“Wages growth appears to have peaked but is still above the level that can be sustained given trend productivity growth. “Recent data revisions suggest that consumption over the past year was stronger than previously suggested. At the same time, output growth has been subdued, and consumption per capita has been declining, as households restrain their discretionary expenditure and inflation weighs on real incomes.”

Originally published as Home loan guru’s big money warning