Grim amount now needed to afford the average Aussie rental

Aussie renters now need an eyewatering annual income just to afford the average rental, with even six-figure earners facing housing stress. See the worst spots to be a tenant.

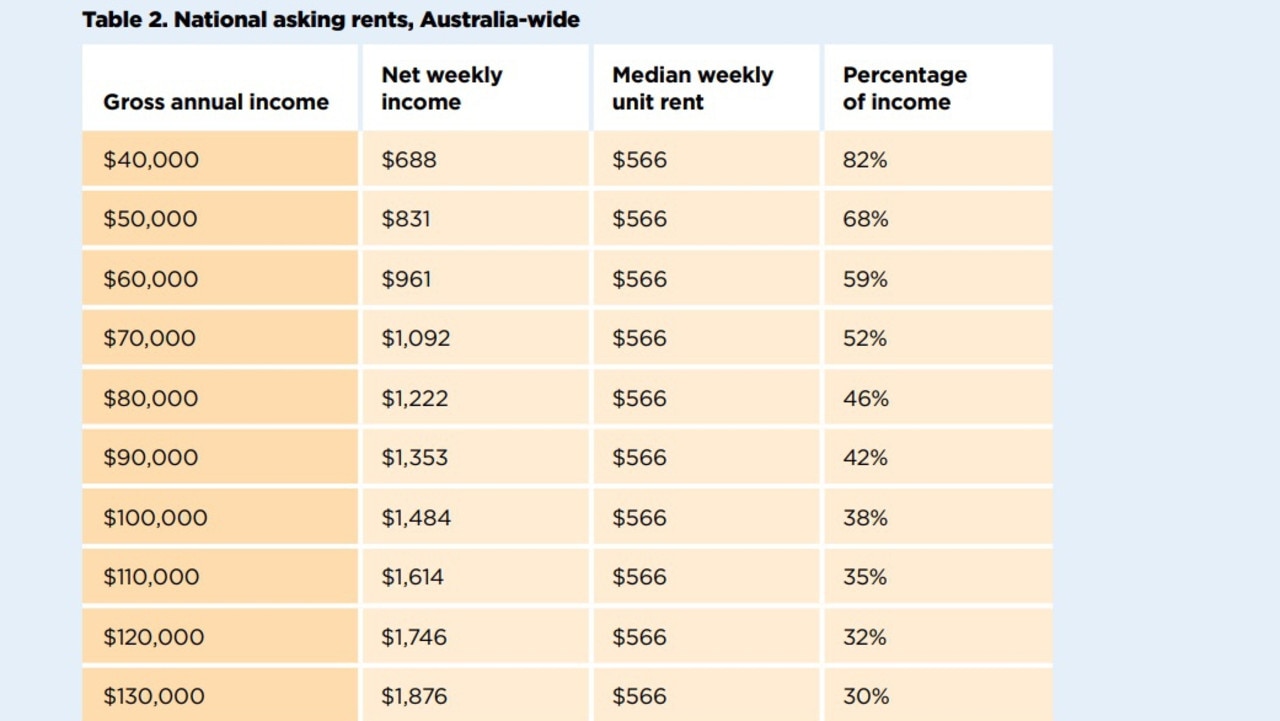

Aussie renters now need an annual income of $130,000 just to afford an average rental, with even six-figure earners facing housing costs exceeding 30 percent of their income in capital cities and many regional areas.

The 2025 Priced Out report by national housing campaign Everybody’s Home found that

a single person needs to earn at least $130,000 per year to comfortably afford the national weekly asking rent for a typical unit, while an even higher income is required to afford the average unit rent across capital cities.

The report, which analyses rental affordability for Australians earning between $40,000 and $130,000 per year, found rental stress had extended well beyond low-income earners, with even middle-to-high income Australians increasingly struggling to find affordable homes.

It revealed that even renters earning $100,000 per year - well above the median income of $72,592 - were struggling in locations across Australia.

And even some of the traditionally more affordable locations have become out of reach for many, with tent cities popping up in areas once considered cheap.

Northern WA tenants are spending 55 per cent of their income on rent - the largest percentage in the nation.

But hot on its heels was the Gold Coast where 54 per cent of income was being spent on rent.

Sydney - Australia’s most expensive housing market - came in third, with tenants there forking out 48 per cent of their income to keep a roof over their heads.

It was followed by the Sunshine Coast (46%), Perth (43%), Beenleigh Corridor (42%), Brisbane and Woollongong (40%), Canberra and NSW Central Coast (39%), Melbourne (38%), NSW North Coast (37%), NSW South Coast and South West WA (36%), Adeliade and NSW Hunter Region (35%), Darwin and the WA Goldfields Region (34%), Cairns and the NSW Blue Mountains (33%), Hobart (32%), Queensland North Coast and Southern NT (32%) and Ipswich, South West Victorian and Queensland Far North Coast (31%).

Everybody’s Home spokesperson Maiy Azize said the report exposed the stark reality facing Australian renters everyday.

“Rental stress is no longer confined to those on lower incomes - it’s affecting professionals, essential workers, and middle-income families who simply can’t keep up with soaring rents,” she said.

“These findings underscore an alarming shift in Australia’s housing market.

“This crisis is stopping people from being able to live and work in their communities, leading people to delay major life choices, and threatening social cohesion.”

Ms Azize said that a $100,000 salary used to be considered a secure income, but their research showed people on this wage were struggling in both cities and regional areas because rents were so staggeringly high.

“The situation is even more dire for those on lower incomes, with people earning $40,000 per year facing extreme rental stress nationwide,” she said.

“They are facing rents that are up to 119 percent of their income, putting a stable home out of their reach.

“With an election coming up, the next government needs to urgently boost social housing. “These are low-cost rentals for people in the most severe housing stress - people who are being smashed by the private rental market.

“We are also calling on parties and candidates to scrap investor tax handouts, like negative gearing and the capital gains tax discount.

“It is unfair to spend billions of dollars propping up investors and pushing up costs while people on low and middle incomes are left behind.”

Housing crisis failure: 96,000 homes short of Qld target

Home loan hell: Shocking 10-year savings stat kills first-time buyers’ hopes

Ms Azize said that the Federal Government must treat housing as its top priority or risk even more Aussies being priced out of safe, decent, affordable homes.

The call to arms comes after it was revealed that the nation is facing a shortfall of nearly half a million homes under the national housing target in a race against the clock to ease the housing crisis.

Under the National Housing Accord, a target of 1.2 million homes has been set for 2029, but Australia is projected to be 462,000 homes behind that target, according to a new Property Council of Australia report.

The report found bridging the gap and building the extra homes could save renters on average $90 a week across Australia.

New South Wales has the largest shortfall in the country, with 185,000 homes still needed to meet its 375,000 target, followed by Queensland, which is 96,000 short of its target, while Victoria has a 71,000 home shortfall.

Property Council chief executive Mike Zorbas said more than seven million renters would collectively save $253m every week if housing targets were reached.

“2025 is the year for Australia to redouble our housing supply efforts with the urgency and commitment this crisis demands,” Mr Zorbas said.

“Missing the target by 462,000 new homes by July 2029 would set off a housing affordability time bomb.

“Boosting housing supply is the only long-term, sustainable way in which we can boost affordability of homes to buy and to rent.”

Originally published as Grim amount now needed to afford the average Aussie rental