‘Fussy’: Real estate agent’s warning to first time buyers

A popular Sydney real estate has revealed the “fussy” trend that is costing first time home buyers big time.

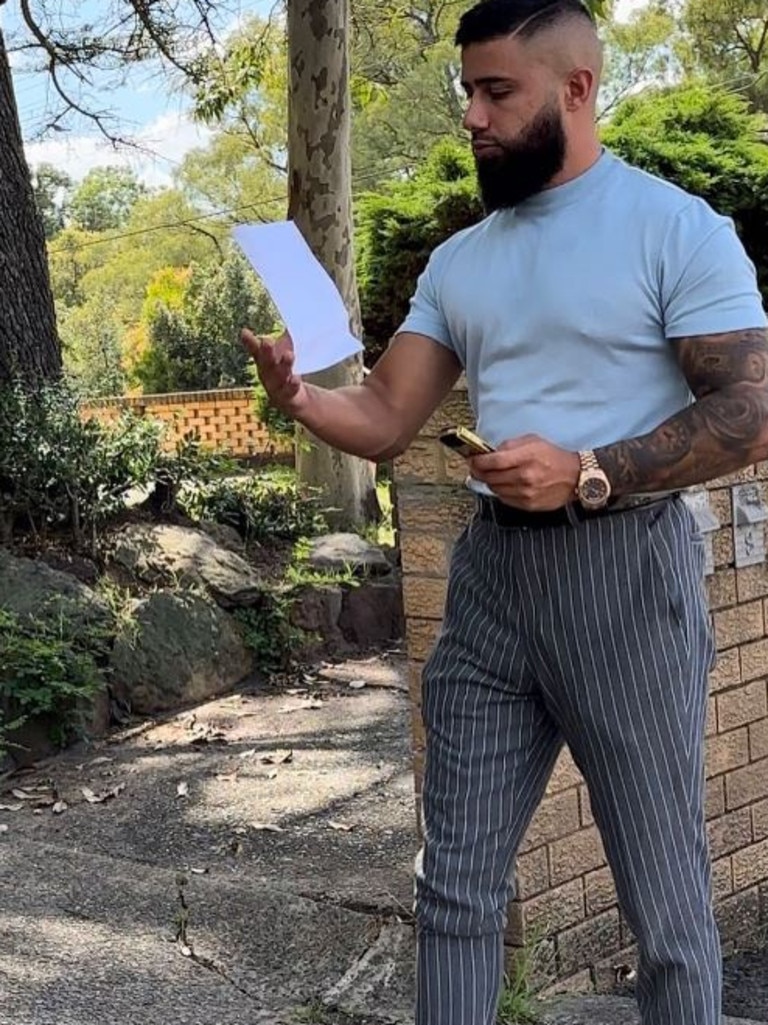

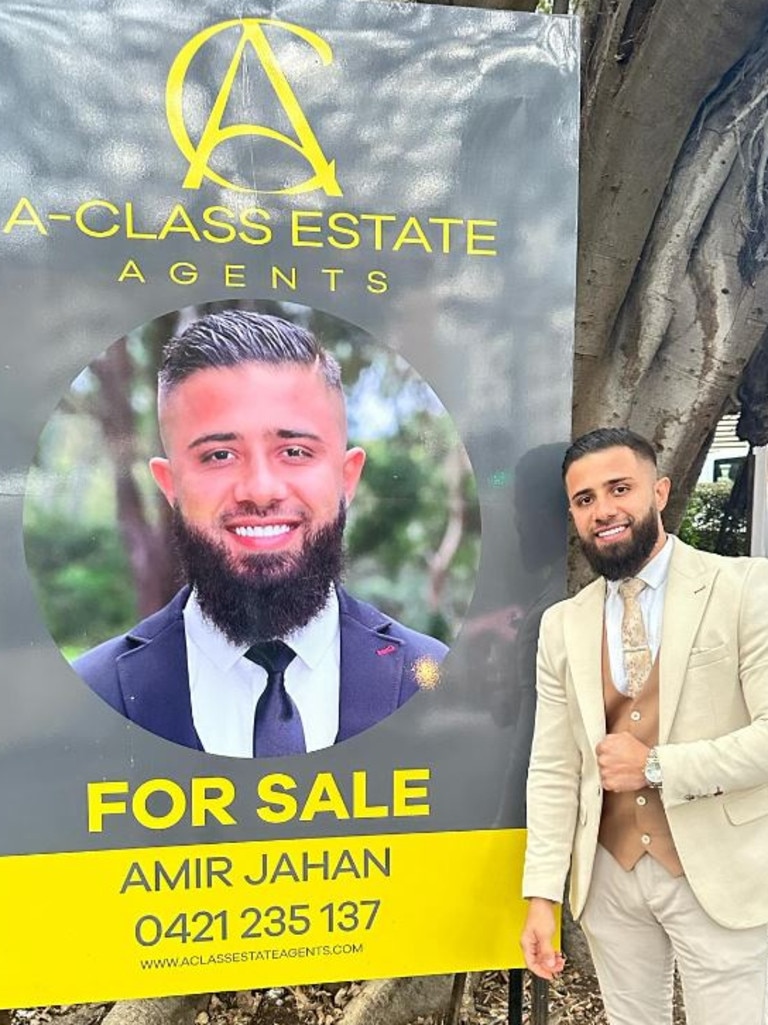

Sydney real estate agent Amir Jahan is getting exhausted by “fussy” first-home buyers whose expectations are “unreasonable”.

Mr Jahan lives and works in Parramatta. He owns property in the area that he helps buyers get into, although he’d say he doesn’t own anything because he hasn’t paid it off yet.

“When you haven’t paid it off! It isn’t yours; if I fall behind in my mortgage, the bank will come and take it off me,” he told news.com.au.

The 25-year-old spends his days watching Australians try to get into, stay in, or invest in the market.

He has noticed a trend of hesitant and fussy first-home buyers locking themselves out of the market.

“The first home buyers are just getting too fussy and their expectations are too high,” he told news.com.au.

Parramatta is booming at the moment. The median house price is $1.5 million, and for units, it is $625,000.

Mr Jahan explained that new units are being listed daily which means buyers are spoiled for choice and always assume something better will come along.

For an investor or a downsizers, that might not be the worst thing. They usually have more funds; if they wait too long to make a decision and the market goes up again, well, they can still afford to buy into the market.

However, first home buyers can overthink it and end up pricing themselves out of areas.

“They spend so much time finding the perfect property, and then they have to compete with someone with more money,” he said.

Mr Jahan said that when first-time home buyers start looking, they want everything and eventually realise they can’t have it.

“They want the best kitchen, best bathroom,” he said.

Early on, they’ll pass on affordable properties that might not be perfect but would be a great buy and end up regretting it.

“I’ve seen it heaps of times. A first buyer three months later will still be looking at properties and they’ll tell me, ‘I should have bought that property three months ago’.”

Time and again, Mr Jahan has witnessed first-time home buyers only inspecting properties “worth more than their budgets” and then trying to buy one with lowball offers.

“I’ve seen a lot of times they give me funny offers; I ask them based on what other properties are you giving this offer?” he said.

That annoys Mr Jahan, who has a “come on” response to it. He said when he questions how they’ve come up with the figure, they’ll show him old buildings that sold for the same price while trying to buy a new build.

The seasoned real estate agent said first-time home buyers should stop mucking around and assume better is around the corner.

“It is always good to invest in property; once you get a good vibe with the property, don’t think about other things; go for gold,” he said.

“The best advice I can give is if you get a good vibe, go for it.”

He also sees first-time home buyers coming with their parents to buy their places, which often causes generational tensions.

“Just say the daughter or son likes the property because they want to live on a high floor and have a view. When their parents come, they’ll be like, ‘Nah, this isn’t a good choice’ because they are looking at what it’ll sell for in six years, whereas first-time home buyers just want to live in the unit.”

Ultimately, he has found that first-time home buyers always get outsmarted by investors because investors buy based on research, whereas first-time buyers buy based on “emotions.”

The other trend he is seeing is that people from the eastern suburbs, like Bondi, are heading to Parramatta to get some reprieve from the cost of living.

“I get surprised, but I have seen a lot of them. Some are moving because of the cost of living comparing Bondi to Parramatta,” he said.

He said the cost of living is “cheaper” in Parramatta, which is the “first suburb” people think of because it is close to everything and constantly has new public transport options.

More Coverage

Recently, he spoke with a man who was looking to buy in Oatlands but was currently renting in Manly.

He was paying $1500 in rent for a one-bedroom in the seaside area and looking at a five-bedroom house in Oatland to buy that he’d have a similar mortgage on.

“I see a lot of people, a lot of owners, upgrading or downgrade, they are moving from Bondi, Double Bay, Ramsgate to Parramatta,” he said.