Four cuts: Aus bank’s huge move before RBA

One of Australia’s big four banks just pulled the trigger on a massive interest rate move, refusing to wait for the RBA’s next meeting in four weeks.

One of Australia’s big four banks just pulled the trigger on a massive interest rate move, refusing to wait for the RBA’s next meeting in four weeks.

Westpac has trumped the Reserve Bank by putting in the equivalent of as much as four rate cuts for owner-occupiers and five for investors in one go for its variable home loans as Australia’s major banks gear up for a 25 basis point rate cut by RBA come May 20.

RELATED: ‘Escalated’: Shock RBA call to stun Aussies

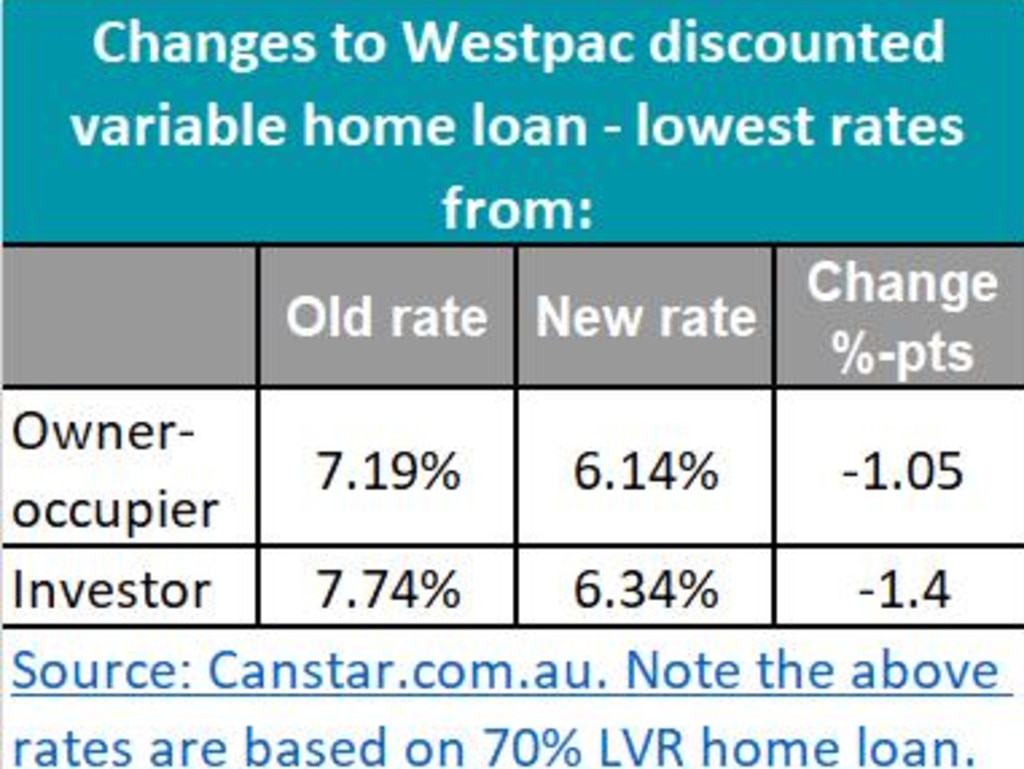

Westpac announced a whopping 1.05 percentage point cut for owner-occupiers and 1.4 pp for investors for its variable home loan rates which come with an offset account.

For owner-occupiers the old rate was 7.19 per cent, which has now changed to 6.14 per cent for new customers - a drop of 1.05pp: equivalent to four rate cuts by RBA.

For investors the figure has gone from a 7.74 per cent interest rate to 6.34 per cent - which is an even bigger fall of 1.40pp: equivalent to more than five RBA rate cuts.

But Canstar.com.au data insights director Sally Tindall poured cold water on the move, saying it wasn’t necessarily a cause for major celebration as the advertised rates now just reflected what customers were offered in-branch.

She said “it might sound counterintuitive, but for years the banks have used higher rates as part of their marketing playbook. By intentionally advertising higher rates, banks create the illusion of a win when customers are ‘rewarded’ with a special discount”.

MORE: Shock: Brisbane prices to smash Sydney

Australia’s biggest political property moguls revealed

Ms Tindall warned borrowers that “rather than getting caught up in the size of the discount, borrowers should pay close attention to the actual interest rate and make sure it’s competitive”.

“If you’ve got a home loan with Westpac, now is the time to do a reality check on your rate,” she said. “If it’s higher than what the bank is offering new customers, ask them for a reduction.”

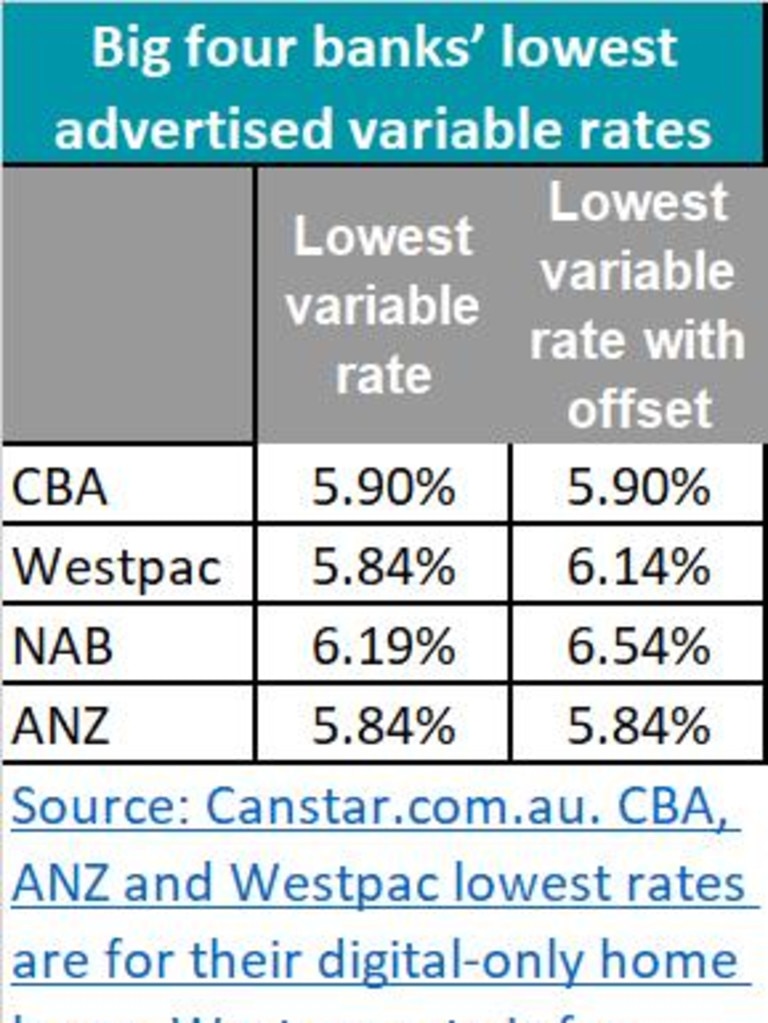

The lowest variable rate among the Big Four was now 5.84pc out of Westpac and ANZ, 5.9pc CBA and 6.19pc NAB though with offset the lowest variable was ANZ’s 5.84pc, followed by CBA’s 5.9pc, then Westpac’s new level 6.14pc and then NAB on 6.54pc.

And she urged borrowers to still negotiate to go lower than what was now being advertised.

“If you’ve got a home loan with a big four bank, know that a new customer with an owner-occupier variable loan is getting an estimated average rate of 6.01 per cent. If your home loan rate is above this mark, it’s time to ask your big bank, why?”

Originally published as Four cuts: Aus bank’s huge move before RBA