‘Stretch’: Experts slam broke Aussies

In a controversial claim, experts have slammed Australians who think they are cash strapped saying some just have “money illusions.”

Are you one of the millions of Australians who are feeling the pinch of a cost of living crisis? Well don’t worry, because economists say you’re not doing so bad after all.

Interest rates being on hold shouldn’t be seen as such a big deal, according to several economists on comparison site Finder’s panel of experts.

Seven of those commentators, from a panel of 25, believe the severity of the current cost of living crisis is exaggerated, especially when compared to tough times hundreds of years ago. They believe things could be worse, despite 81 per cent of respondents to Finder’s Consumer Sentiment Tracker – equivalent to almost 18 million Aussies – saying they felt financially stressed in October.

RELATED: Why the RBA must cut rates

Mark Crosby from Monash University pointed to the fact that people are generally better off than they have been in recent years and that the unemployment rate remains low, even though wage growth has been stagnant.

“Much of the rise in the cost of living has been associated with rising energy costs and one off factors,” Mr Crosby said.

“For those in the lowest quintile of the income distribution these cost increases should be addressed, but for middle income earners, we are still a wealthy country.”

Jakob Madsen from the University of Western Australia agreed, pointing out that real wages have hardly decreased, especially when compared to other financial crises in history.

MORE: ‘Stretch’: Experts slam broke Aussies

RELATED: Surprise rates call creates trap for home buyers

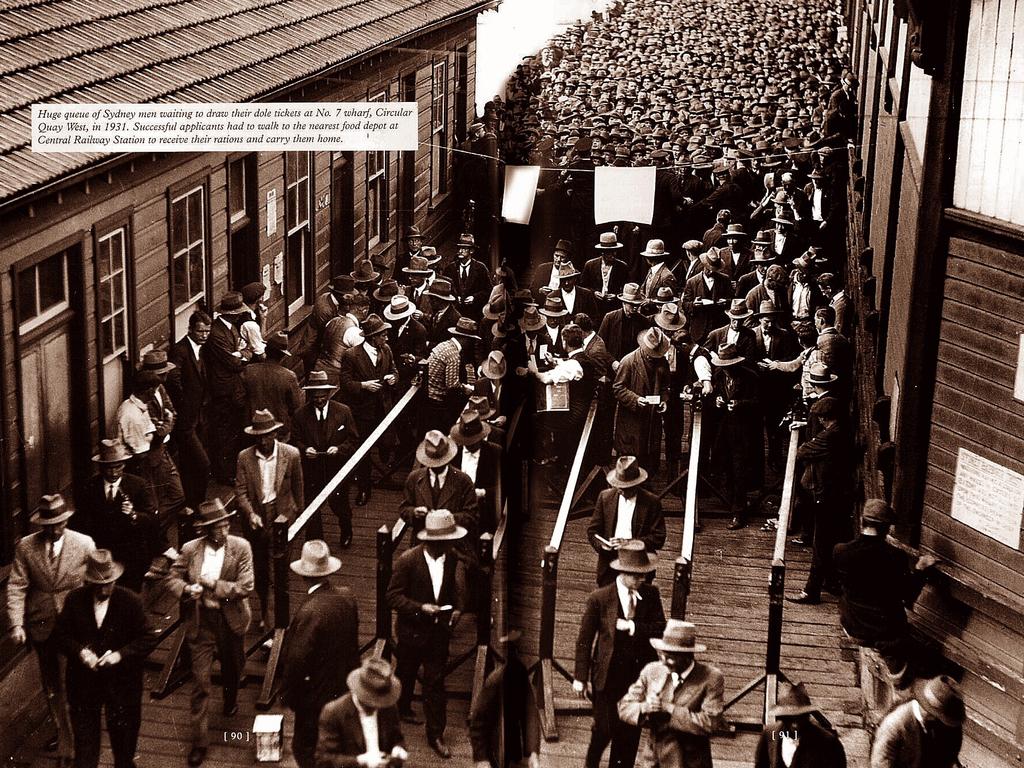

“During the Great Depression real wages fell by more than 30 per cent in Australia,” Mr Madsen said, before bizarrely going further back in time to point to Italy, where “real wages fell to 75 per cent over the period 1450-1900” and not to forget that “during WWII, real wages plummeted in most countries”.

“Seen from this perspective, calling it a cost-of-living crisis is a stretch.”

Stephen Miller from GSFM said “historically- at 3.5 per cent, trimmed-mean inflation is not that high and at 4.35 per cent the policy rate is not that high.”

Cameron Murray from Fresh Economic Thinking, said some people had “money illusions”.

“People see the nominal price increases in things they buy and think these are caused externally, but they think that their own increase in nominal incomes is happening because of personal effort. Yet it too is rising because of inflation,” he said.

MORE: Where house prices ‘fell’ for the first time in 2 years

According to the RBA, by the end of this year, real wages will have fallen more than five per cent below pre-pandemic levels. That puts real wages back to 2013, essentially, cancelling out over a decade of economic growth.

AFR reported the prices of many staples such as food and drink are up 20 per cent since 2019.

Since 2020, home prices around the country have gone up 39.9 per cent, according to PropTrack Senior Economist Eleanor Creagh.

The majority of the expert panel however didn’t expect families living week to week to see things from the perspective of those who lived long ago in other countries. The remaining 18 out of 25 did not think the cost of living was exaggerated.

Noel Whittaker from QUT said, “Talk to anybody and you’ll soon be told that cost-of-living is one of their major issues.”

MORE: Strange truth of Trump’s election home base

Finder head of consumer research Graham Cooke said some homeowners would struggle to wait until at least February next year for the rate cuts they needed to get out of stress.

“Even though inflation has hit the RBA’s target window of 2-3 per cent, this doesn’t trigger the RBA to automatically start cutting rates- which will disappoint homeowners,” Mr Cooke said.

“With a record high 47 per cent of borrowers struggling to make their repayments in October, thousands will be forced to cut back on spending in other areas. Many are depending on the multiple rate cuts predicted to come in 2025.”

However, these households may be forced to wait even longer, with Ms Creagh warning the RBA may want to go deeper within its inflation target before cutting.

MORE: Update in Albo’s new $4.3m beach mansion splurge

“Despite the economy continuing to track through a period of weak growth, the RBA is likely to remain on hold unless an external shock, higher unemployment or lower underlying inflation occurs, as it aims to sustainably return inflation to target,” she said.

“Households remain under pressure with consumer sentiment subdued. Although employment growth has been strong and unemployment steady at 4.1 per cent in September, the labour market has softened over the past year.

“Slowing employment and inflation may prompt rate cuts from February 2025, but the resilient labour market and stickier components of inflation could delay this timeline.”

MORE: Aussie idea could gift Kamala the presidency

Originally published as ‘Stretch’: Experts slam broke Aussies