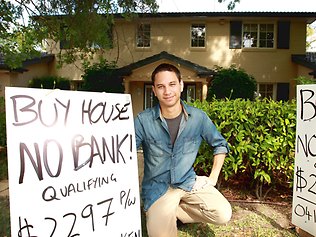

Desperate Ken Slamet's unreal estate offer

NO cash for a deposit? Bad credit rating? Can't get a loan? Don't worry, you can still buy a luxury pad in an upmarket suburb.

NO cash for a deposit? Bad credit rating? Can't get a loan? Don't worry, you can still buy a luxury pad in upmarket St Ives.

Ken Slamet will take your car, boat or whatever's lying around as a deposit for his father-in-law's home.

The 25-year-old is so desperate to sell he has tacked signs to telegraph poles and worn a sandwich board around St Ives offering the five-bedroom home on a rent-to-buy scheme.

"It's like Radio Rentals. You rent for a while, and if you like it by the end of a period, you can choose to buy it or walk away," Mr Slamet said.

The signs have attracted a lot of calls from recent migrants who can't get loans or high-income earners with a poor savings record.

"Even a 10 per cent deposit requires $150,000 in your bank account," Mr Slamet said. "Who's got that money lying around for a rainy day?"

The house at 228 Warrimoo Ave has been on the market through an agent for more than 100 days, pulling in ridiculously low offers, Mr Slamet said.

"Rather than negotiating the price, we're trying to negotiate the way people buy it, by offering finance."

He is proposing a buyer would pay $2297 a week for the home until they owned enough of the property to refinance with a bank and pay out the final amount.

"The people that have called haven't even asked for the full price of the house," he said. "They're seeing it more as an opportunity to own a house with weekly payments."

A year of rent-to-buy payments would offer Mr Slamet breathing space.

President of the Real Estate Institute of NSW Christian Payne said it was tricky.

"What if his valuation doesn't stack up? You can't take his word for the value of the property," he said.

Both vendors and buyers determine the value of a home based on emotion, and the figures don't always match up, Mr Payne said.

Depending on the deposit, Mr Slamet is seeking between $1.5 million and $1.6 million for the house his wife grew up in.

"It's a trade-off for someone to get in the door," he said.

Government and consumer watchdog organisations warn against rent-to-buy schemes.

Pitfalls can include:

The rent that is charged is often in excess of the market rent.

The price paid for the home is often in excess of the market value.

The biggest danger is the 'buyer' is legally not the homeowner. Their most important right, having their name on the title of the property, is denied to them under a rent-to-buy arrangement. This means that the buyer can meet all their payments but if anything goes wrong from the seller's end, the buyer can lose everything.

If the seller falls behind in loan payments, their lender can repossess the home and kick out the buyer. If the buyer gets behind in their payments, the seller can then kick out the buyer and keep their money.

In the United States, rent-to-buy schemes are often known as 'lease options'. There have been instances where sellers have 'turned over' the same property to a dozen or more buyers.

Source: Jenman Ethics in Real Estate