Interest rates today: Australian mortgage payments ‘could double’ as home prices plummet

Many Aussie households are already spending half of what they earn to cover the mortgage as home prices plummet and worse is expected.

New research shows close to half of Australian mortgage holders are spending more than what they earn because of rising interest rates and the soaring cost of living.

Data from Digital Finance Analytics (DFA) indicates about 1.7 million Australian borrowing households, or 45 per cent of mortgage holders, are currently dipping into their savings or relying on credit cards to cover higher expenses brought about by six months of interest rate hikes and surging inflation.

The survey-based analysis shows families are choosing to cut back on healthcare and education costs in order to prioritise loan repayments as further rate rises loom on the horizon.

It comes amid reports of a growing number of borrowers being unable to refinance their mortgages due to higher assessment rates.

MORE: Homeowners become ‘mortgage prisoners’ after rate hikes

Big risk Australia’s biggest builders now face

Digital Finance Analytics principal Martin North said the amount of households in mortgage stress had jumped significantly from pre-Covid levels of 32 per cent, and 10-20 per cent in the early 2000s.

“We have a problem,” Mr North said.

“There are very high proportions (of mortgage holders) who have cashflow issues.”

He said households were prioritising mortgage repayments as interest rates went up by cutting back on health care and paid subscription services, with many considering removing their kids from fee-paying schools.

A further one per cent increase to the cash rate as forecast by Westpac would bring “pretty horrendous” consequences, he said.

“The rule of thumb is for every 1 per cent increase in the cash rate, the average mortgage repayment goes up by 15 per cent per month,” he said.

“In other words, if you go from 2 per cent to 5 per cent, then that’s nearly a doubling of your mortgage repayments.”

“This is the danger that I see – it’s going to get worse and worse.”

He said property prices could fall a further 20 per cent as a result.

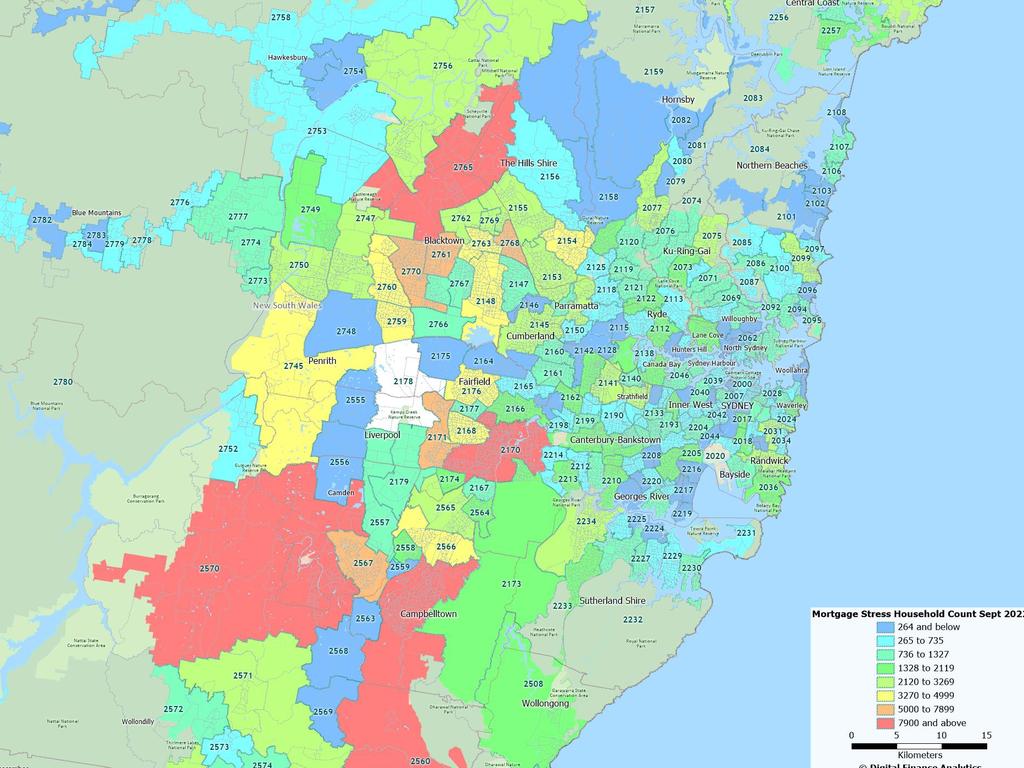

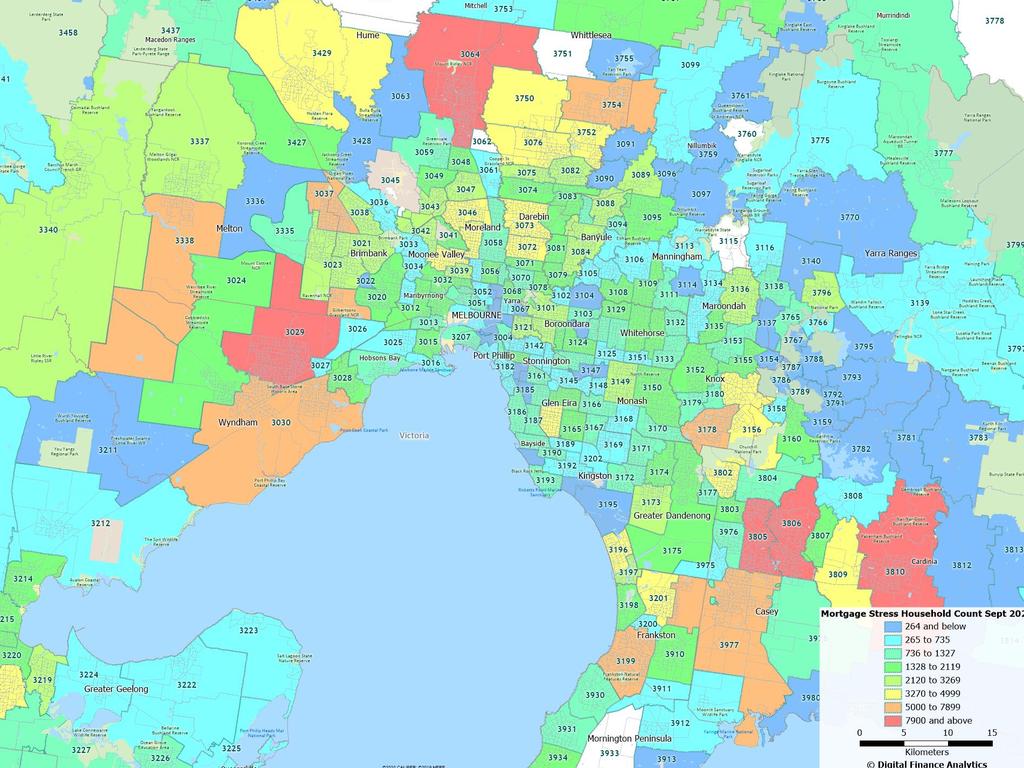

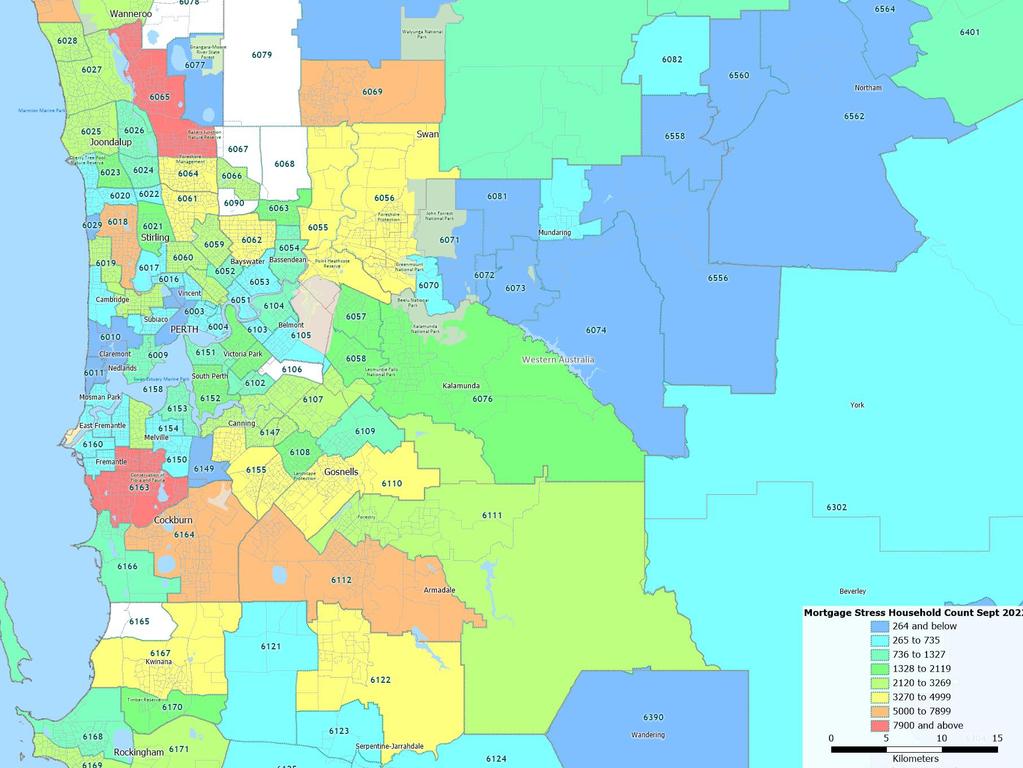

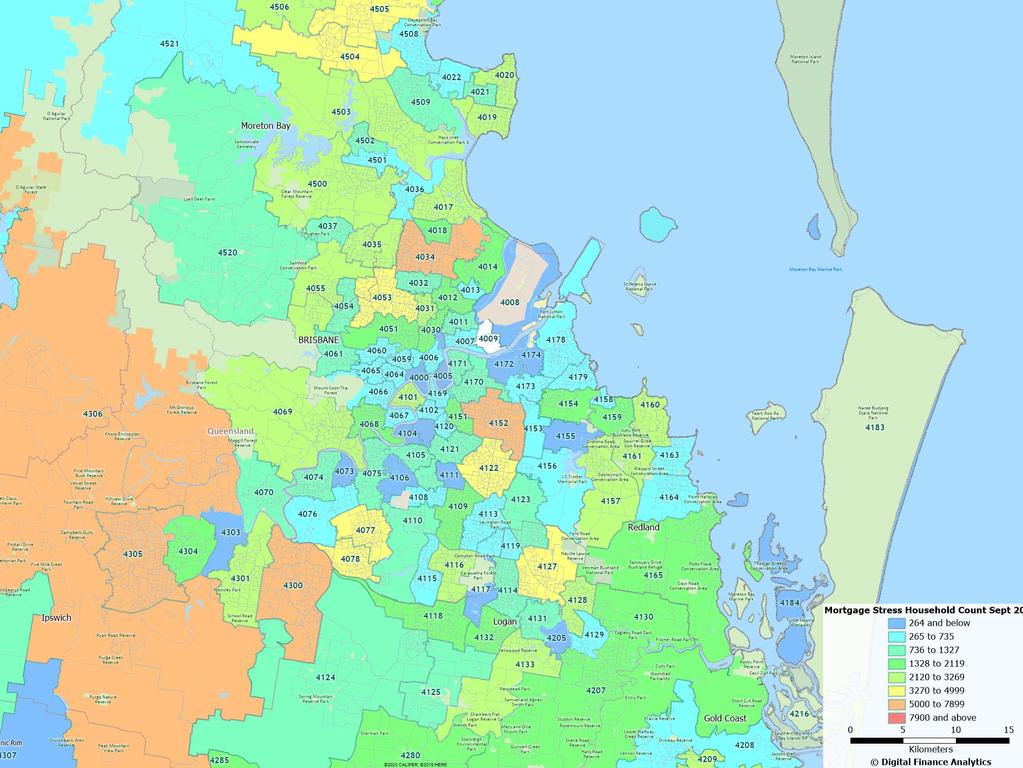

The DFA data showed certain postcodes were struggling significantly, with all mortgage holders in the area reportedly spending more than what they earned each month.

In some instances, this represented half the local population.

The southwestern Sydney region of Campbelltown and its surrounding suburbs had the highest count of mortgage holders in financial stress with more than 12,100 borrowing households going backwards financially out of the total population of 29,000. This represented 100 per cent of mortgage holders in the region.

The greater Liverpool region was the second worst affected, with more than 11,300 households in mortgage stress, close to 80 per cent of those with a mortgage.

The greater Toowoomba region in Queensland followed closely with more than 11,200 borrowing households in stress – about 73 per cent of mortgage holders in the region.

Mr North said high levels of housing stress would put downward pressure on property prices while potentially heightening the risk of social issues and an increase in crime.

PropTrack executive manager of economic research Cameron Kusher said survey-based analysis may not be the best way to measure mortgage stress and that mortgage arrears statistics published by the Australian Prudential Regulation Authority (APRA) were “still extremely low.”

“In saying that, no doubt the fact that interest rates have risen so quickly and so much sooner than anyone else was expecting is stretching some household budgets quite significantly,” he said.

“The expectation is that we will see a bit of an increase in mortgage arrears and mortgage stress will rise – and that’s a function of the fact that interest rates are rising the fastest pace they have since 1994.”

Comparison site Finder estimates 1.8 million Australians are currently struggling to meet higher loan repayments with close to one-third of people admitting to feeling worried about affording their loan following six months of rate hikes.

Finder head of consumer research Graham Cooke said Aussies with a $500,000 mortgage were paying almost $9,000 more a year in interest compared to just six months ago.

“Add to this the rising cost of living with groceries and energy bills also peaking, and we’ve reached a critical point where some people are having to make some really tough decisions to keep a roof over their head,” he said.

“Many people took out big loans when interest rates were at record lows and they potentially overstretched themselves.”

“Things could get a lot worse before they get better.”

He said those unable to refinance that were doing it tough financially should consider all the options available, such as moving in with family while renting out their homes in the short term or downsizing to a more affordable property.

“Increasing your earnings is obviously the best way to meet these rising costs, but if that’s not an option, downsizing into a more affordable home with a more manageable size debt could relieve some pressure and insulate borrowers against further rate rises,” he said.

MORE: Why Charles must now pay rent to Prince William

‘Feral rat’ — sledging match erupts in Block house

Crucial things to know after you buy a home

Originally published as Interest rates today: Australian mortgage payments ‘could double’ as home prices plummet